When setting your business goals, it’s not always easy knowing where to begin. If you have been in business long enough, you are already well aware that tracking key performance indicators (KPIs) should be a component of your business strategy. However, where we often see companies flailing in this process is by setting too many to track or by missing the mark when choosing the right KPIs to drive growth. So, I am sharing our easy step-by-step solution to choosing KPIs as your key to scaling your business.

The 7-Step Formula to Choose the Right KPIs to Drive Growth

Step 1. State your business goals over the course of your strategic plan

Your strategic plan is the optimal place to start. Set your targets over what is ideally a three- to five-year plan. Go about your planning with the end-goal in mind. Are you planning on growing your business to hold onto it long-term, or are you preparing to maximize and sell it within a set number of years?

A business that you hope to hold onto long-term should focus on cash flow and profits while growing slowly, concentrating on each year’s profits as you scale. Whereas, if you plan to exit within three to five years, you are going to focus entirely on growing your topline, which will likely be detrimental to your profits in the short-term. More revenue in those three to five years typically means selling the company for higher value.

Related Read: How to Increase Revenue

While it may seem peculiar to plan an exit at the onset, it will serve you well to determine the KPIs that support your long-term business objectives.

Step 2. Figure out a year-by-year plan of how you can achieve your desired outcomes

Use a top-down approach to break down how to achieve those goals, and a bottom-up approach to determine if it is realistic.

Start by working backwards from your target numbers (e.g. In the examples above, either cash flow and profits or revenue) using yearly and quarterly segments until you have drafted a year-by-year strategy. Once you have worked your plan back, re-examine it from ground zero to ensure it’s feasible. What kind of costs do you need to maintain? How many customers do you need?

It is important not to overreach. Which leads us to step three and four.

Step 3. Determine the KPIs that are most relevant to your business

Most people get hung up at this stage, finding it difficult to narrow down the correct KPIs for their business model. Though an outsourced CFO can help at this stage.

Related Read: “There Are Industry-Specific KPIs You Should Track in Order to Scale Your Business at the Right Time“

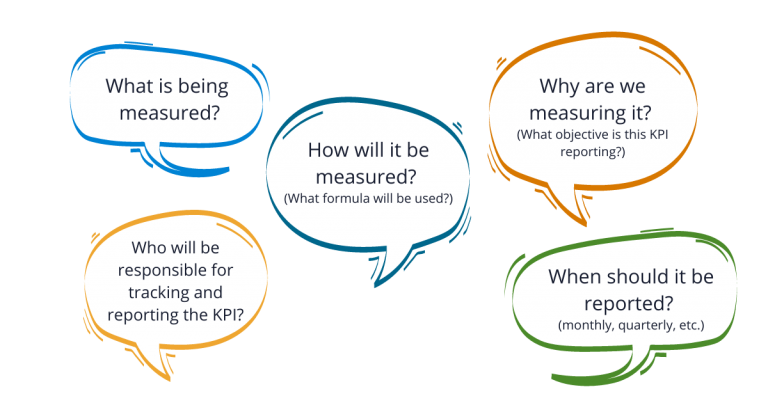

Use the What, Why, How, When, Who (WWHWW) questions to quickly assess which KPIs are most important for your business goals, again aiming for top-down goals with bottom-up drivers. These WWHWW questions should help you define the metrics that are most important to drive growth:

- What is being measured?

- Why are we measuring it? ( What objective is this KPI reporting?)

- How will it be measured? ( What formula will be used?)

- When should it be reported? (monthly, quarterly, etc.)

- Who will be responsible for tracking and reporting the KPI?

It may also depend on which department you’re involving. For your sales team you might focus on business development KPIs and your marketing and customer service team may be more focused on customer success KPIs while many of these overlap, remember to pay special attention to those that drive your goal.

Step 4. Narrow it down to the most important 3 KPIs for your business goals

Next, narrow it down to the three most important KPIs relevant to the targets set in your strategic plan. Because people can only concentrate on so many things at once, focus whole team to be working towards the same goals. It’s tempting to spread your attention on a number of metrics, but they might not all have immediate relevance on your growth and objectives. An alignment across the company will yield the best results.

Step 5. Assign the KPIs to various budget line items

Once you’ve completed step three and four, it should be straightforward to assign your three KPIs to various budget line items. Using this method, you can easily build accountability and appoint targets to relevant team members. Concentrate your attention on strategic costs and investments to focus on scaling instead of getting caught up in the details.

Step 6. Parlay the measurable drivers into actionable outcomes

As a cloud CFO team, we love analytics as much as anyone; however, the numbers mean nothing if you cannot put them to action. Metrics without context and correct application are useless. You need qualitative action to see quantitative outcomes. A few examples:

- If you’re a service-based business tracking gross profit, pay special attention to personnel hours involved in servicing each client.

- If you’re a SaaS company, and your key driver is sales channel profitability, closely monitor things like the number of sales calls and/or cold e-mails being made. Those sales salaries are direct costs to your B2B sales channel.

- An e-commerce company using ROI on advertising as a key growth driver should optimize web conversion rates and track associated costs-per-click to establish an average Customer Acquisition Cost (CAC).

Step 7. Review and revise as needed

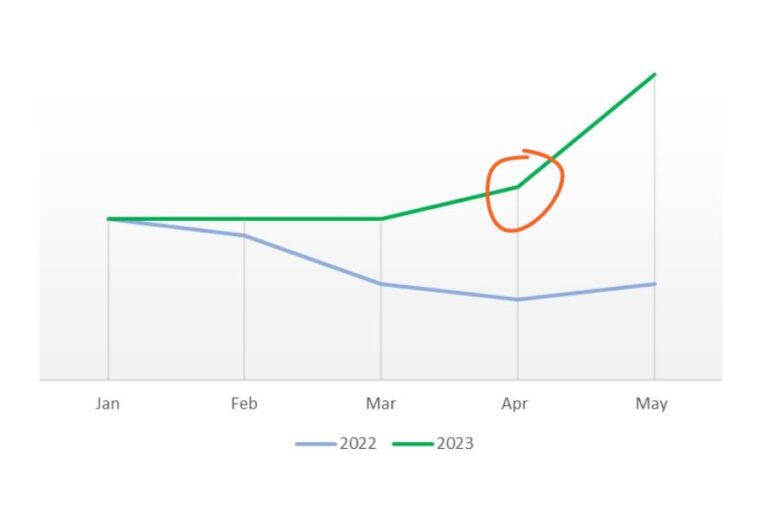

The best businesses adapt and change to the market economy they are existing in. In other words, for your KPIs to function optimally as growth drivers, you must be prepared to adapt and revise. Use budget variance analysis to stay on track towards your desired growth outcomes. The top three KPIs for a company with $1 million in revenue will likely not be the top three KPIs for a company with $10 million in revenue.

Choosing the right KPIs as growth drivers to meet your business goals doesn’t have to be difficult if you’re deliberate in your approach. Using the seven steps above, you will be on your way to a brighter (and hopefully bigger!) future. Still not sure how to determine which KPIs are right for your growth? Get in touch with us today.