No matter how you slice it, the increasing CPI has business owners doing a price increase dance. Growing freight prices, rising raw material costs, labor shortages, increasing wages are all strong indicators that inflation isn’t receding anytime soon.

So what’s a business owner to do?

Two things you can do as a business owner to prepare for inflation are: 1) monitor costs and secure pricing from suppliers (either over the short-term or the long-term) and; 2) raise your prices. Monitoring costs becomes easier to do when you’re properly tracking your supply chain KPIs. The second thing is to raise your prices.

In this article we review: how to forecast and prepare for inflation, accounting for inflation and how to raise your prices due to inflation.

How to prepare for inflation

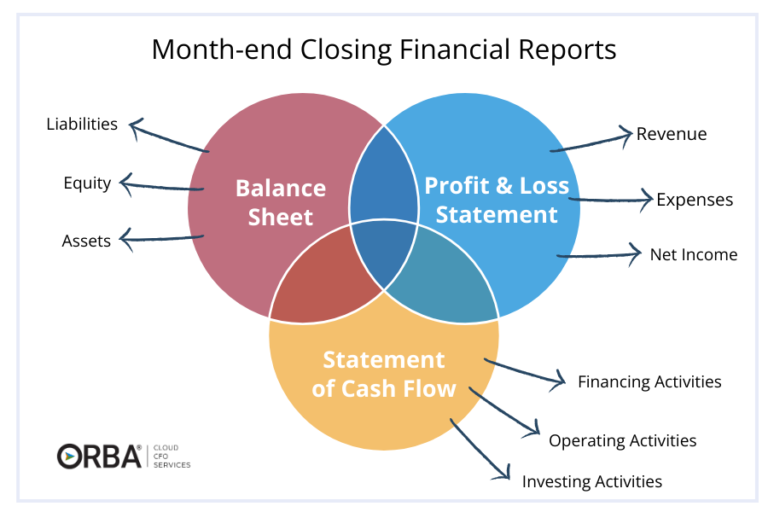

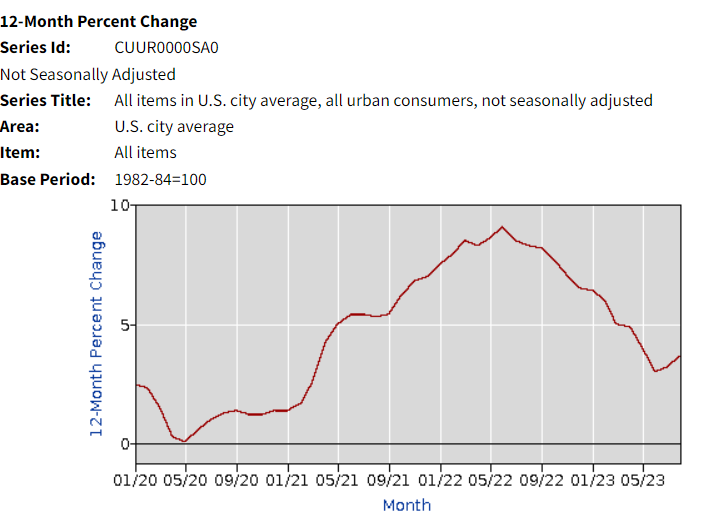

US inflation soared to a staggering 8.6% in May 2022, the highest upswing in 40 years – and isn’t looking to recede anytime soon. Every business owner, no matter the industry, should be asking how to prepare for inflation. Inflation drives up the cost of materials and labor, thereby increasing your cost of goods sold (COGS). You’ll see this reflected on your income statement. Profitability analysis is paramount to maintain financial health.

5 strategies to prepare your business for inflation:

- Update forecasts with assumed higher costs

- Examine your supply chain vulnerabilities. For example, increase in shipping freights, raw material costs etc.

- How are the prices of your cost of goods sold impacted?

- How is the cost of your labor impacted?

- How are your logistics impacted?

- Calculate any change in margins using the basket approach

- Compare the budget of last year to the current year (using the basket approach) for an inflation rate specific to your business. Factor in any of the above changes in margins

- Aim to have a consistent gross profit margin

- You ideally want to maintain a consistent gross profit margin. While costs of raw materials or products are always a big concern, you must also consider things like salary raises especially given current labor shortages.

- Focus on flexing up your high-margin, high-demand products or services

- Hit pause on slower-moving inventory or frequent stockout products and aim to reduce inventory costs.

- Increase prices

- Analyze your product catalogue to understand which items contribute most to your bottom line. Some may need a design or price adjustment (and some may just be dead stock). The best SKUs or services combine high margins and high sales.

- To prepare business for inflation, take the specific rate of inflation for your business and increase your prices accordingly. (More on this below).

Worried about customers reactions to increased prices? Take a quick look at our guide on how to write a price increase letter for help.

How to forecast for inflation

With all the talk of inflation, stagflation and recession, now is the time to introduce rolling forecasts if you haven’t already. So when June 2022 ends, June 2023 is added on. Common forecasting periods are for 12, 18 and 24-months, but shorter is better. Ideally you want accurate cash flow forecasts for the next two quarters. This is something an outsourced CFO should be able to provide. Accounting for inflation requires an examination of all drivers impacted by these rising costs. For example:

Track gross and net profit margin by service or product line to monitor optimal performance.

To estimate the increased supplier prices look at historical gross and net profit margins using the basket approach:

- First, compare your profit margins from last year to this year. Note the percentage change for year-to-date (YTD).

- Next, look at your original budget for the year. Take your product cost and increase it by the percentage increase you found from last year to this year. That will give you an updated projection for profits for the year, assuming you don’t make any changes to your pricing.

- Increasing product costs are the primary concern; but you must also consider potential salary raises. These also impact your bottom line.

- Finally, calculate how much you wish to raise your revenue to get an acceptable net profit margin for the remainder of the year. This will show you how much you need to increase prices.

Related Read: 7 Tips to Build a Better Inventory Forecast

Once you are correctly tracking and forecasting the drivers affected by inflation, you can build in those cost increases in your pricing.

Raising your prices for inflation

Go ahead and raise your prices (because everyone else has)

Should you raise your prices? The easy answer is yes. Not only have your costs likely been affected by inflation, but your consumers and clients won’t be surprised.

Thankfully, because so many business owners are in the same boat, there will likely be less backlash from your customers because most people know it is warranted. Even expected.

Related Read: How to write a price increase letter due to inflation.

Every business is feeling the crunch of labor shortages and therefore increasing labor costs. So how can we compete?

Across all industries we’re seeing an increase in labor costs but they vary by industry. Specifically, we’ve seen higher-end inflation in the professional services sector. Further, I think the labor increases we’re seeing here are behind the curve.

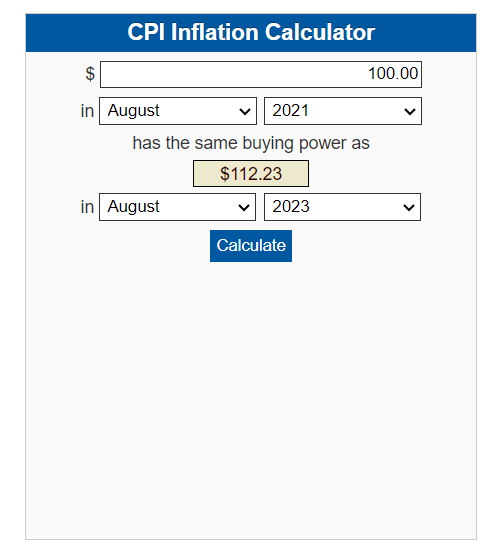

For example, if you look at the percentage increase from 2021 compared to 2023, then you might imagine that if employees aren’t seeing the same increase, they’re losing purchasing power. To get ahead of this within our own team we recently did a round of mid-year raises to proactively let our team know they’re valued. We were very transparent, “…this is what we’re doing to keep good people.”

While there are creative ways to reduce labor costs, it makes sense to offset your increased costs by adjusting your prices for inflation as well. A simplified way might be to take the consumer price index (CPI) rate increase and raise your prices by the same percentage increase. Without doing any further analysis, you could justify raising your prices for inflation by that amount. So, for example, if CPI is up by 3.7% from August 2022 to August 2023 and you haven’t raised your prices in the last 12 months, you could (in theory) , raise them by 3.7%.

Accounting for Inflation

CPI is up by 3.7%, so I just raise my prices 3.7% right?

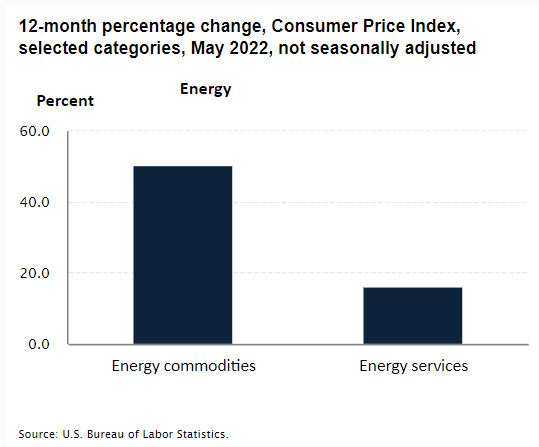

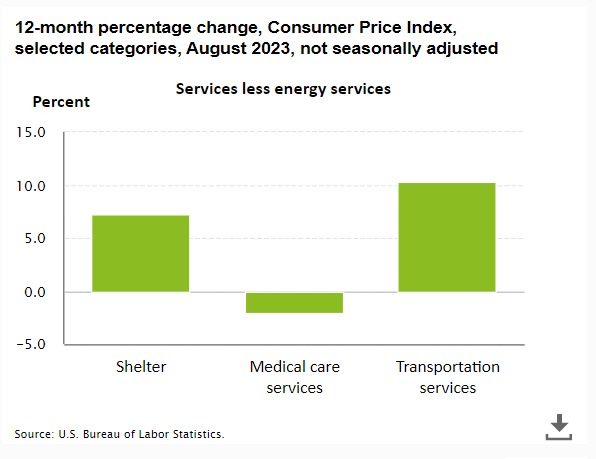

While that is a quick way to make a rough estimate for a price increase due to inflation, inflation can vary wildly from industry to industry or even product to product. For example, gas and fuel have increased by 40% or more in the last two years, which in turn drives up the cost of freight. The overall CPI increase makes for a great headline but the devil is in the details.

And most recently, comparing August 2022 to August 2023, you can see that energy costs have dipped while food and other items have continued to rise in cost. Depending on your industry or segment, you could be affected very differently than the headline CPI. The 12-month percent change from 2020 to 2023 is holding a lasting effect on both business executives and their consumers.

Any of our clients with ecommerce accounting needs that get raw materials or products from overseas know firsthand how much that 500% increase in ocean freight expenses affected their landed cost per unit back in 2022. Not to mention the shipping delays that are stacked on top. These factors force a business to raise prices in order to simply maintain profit margins.

So any business that relies on overseas suppliers, costs significantly increased far above the biggest average increase of 8.5% CPI. This has caused many companies to face a two-pronged effect of inflation:

- It is now taking longer than before to ship via marine transport, which is affecting fulfillment and inventory turnover; and

- Many have had to resort to shipping by air – increasing expenses further – in order to speed up their orders.

Related Read: The Supply Chain KPIs You Need To Know

A business experiencing the above cost increases would need a more granular method of accounting for inflation. The basket approach would provide them a solid strategy to calculate how inflation is affecting their profit margins.

Example: Take a few bills from suppliers from a year ago and look at the freight costs, compare it to your current bills and use the percentage change to determine a price increase that is more specific to your business than the general CPI.

To seize this opportunity to raise your prices don’t overlook the importance of forecasting for inflation.

Still not sure exactly how to prepare for inflation? Our ecommerce accounting services provides regular reporting if you opt into our core pricing package.

While the Federal Reserve Bank suggests that this period of inflation is transitional, mid-size companies are no doubt feeling especially pinched. With supply chain rates increasing, but having little experience in how to adjust their pricing without losing customers, it’s no wonder business owners are feeling panicked by inflation.

If this sounds familiar, we are here to help. Get in touch to learn more about how business owners can prepare for inflation using our outsourced controller services.