With employee retention, inflation and a looming recession all front of mind for business owners, it can be tricky to balance the effect labor costs have on your bottom line. In the United States, WTW’s budget planning survey showed companies are projecting an average salary increase of 4.1% in 2023. But, even if your company is included in that estimate, there may be other ways to reduce labor costs.

Wait, I’m not going to tell you to start handing out pink slips.

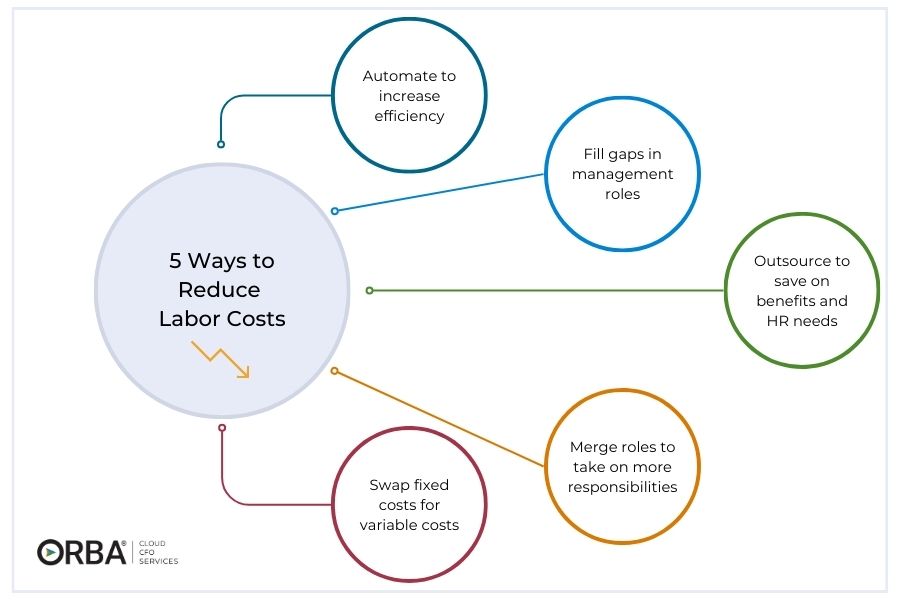

1). Automate

For example, if you have clerks on staff that spend time entering data for reporting purposes, scrutinize the usefulness of those reports and consider whether those reports could be automated. We’re not suggesting simply replacing people with tech; instead, increase efficiency within that team to create a capacity to scale. Pay the one-time implementation fee for that automation instead of hiring more staff and you’ve freed up time in your clerk’s day to take on more tasks.

2. Fill gaps in management roles

If there has been little turnover in your team, the supervision requirement of management roles should lessen each year. Look to fill those gaps with tasks like relationship management and lead generation that have a direct return on business development. In doing so, you’re optimizing one salary to reduce labor costs.

3). Outsource to reduce overhead costs

if you are planning to hire but wish to continue cutting your expenses, you might want to outsource certain staff roles to save on benefits and associated overhead costs. In addition our experience with clients is that outsourcing CFO duties allows management and executives to shift their focus back to core operations while also reducing HR time and cost.

4). Merge roles

Consider merging two roles to take on more responsibility for a raise. Cross-training can be a win-win for employees and employers to reduce labor costs. Merging roles offers professional development and keep jobs interesting. It’s a great strategy to improve employee retention. Plus, it increases the employee’s value and can assist with vacation or sick-time coverage. While technically still an increase to salary, compared to hiring a full-time employee, this is still a savings.

5). Swap fixed costs for variable costs.

To get creative with your cash flow, ask your controller where you can swap fixed costs for variable costs.

Reducing fixed salaries of your sales team by offering them a higher sales commission can be an attractive offer to your A-list salespeople. For service-based companies, you might employ contractors to swap fixed costs for variable costs.

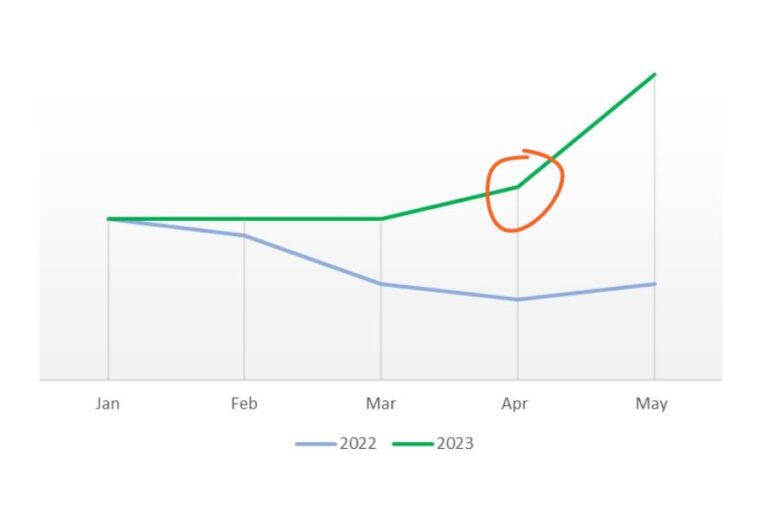

Here’s a great example: After performing some financial clean up for a newer client, we noticed some staff were underutilized. When the employees were working directly on a job, their salary cost was moved into COGS. Anytime the same staff sat idle we moved their salary costs into an account in overhead titled “underutilized employee salary”. We quickly realized they were accumulating $20,000 in unused salary costs every month. In a people business, you might expect a one-off month where employees aren’t fully utilized; but, if it’s a consistent issue then you’re not staffed properly.

That’s money you’re tossing out the window (or into people’s pockets, without any return at least).

What to do if you have underutilized employees?

Option 1: Use contractors

Instead, in a case like this, hire staff to cover 50-75% of your expected workload- or whatever you can consistently maintain. Then utilize contractors to make up the remaining percentage if you get more work, i.e., revenue. Trust me, you’ll sleep better at night. Contractors are available to hire if needed and you don’t have to let people go if the work isn’t there. While you’re giving up some gross profit margin on the incremental work in those higher-revenue months when you need to flex up; when you have a bad month, you’re not stuck paying fixed salaries for staff simply because you don’t want to let them go.

In this example, swapping fixed salaries for variable ones reduced labor costs by $240,000 per year!

Option 2: Pay overtime

Contrary to what some think, one money-saving option is to pay overtime to your current team instead of hiring subcontractors when you flex up. It’s a win-win, they make more more money and you still pay less than you would contracting out. In general, overtime is a useful solution across industries not just those that use contractors.

The Bottom Line

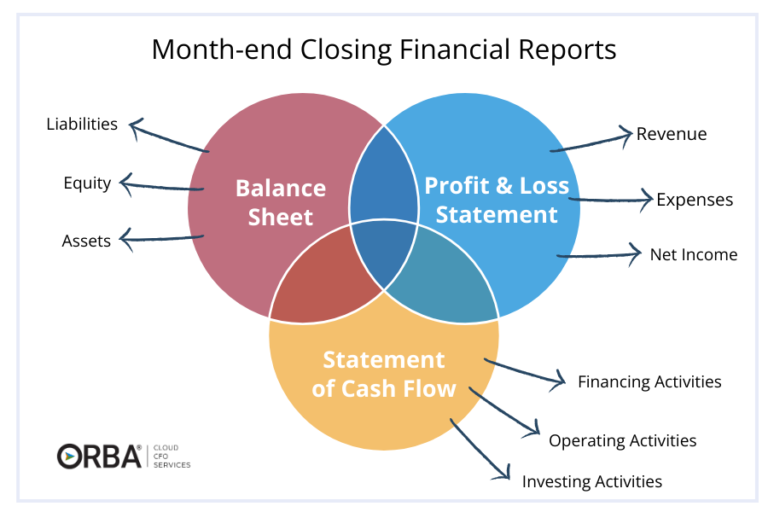

Ultimately, there are a number of ways that you can reduce your labor costs without massive layoffs. Having a fractional CFO or hiring outsourced controller services can give you the financial reporting you need to identify areas where you could swap costs or tighten up. Get in touch to talk to one of our experts!