You know what’s not ideal? An outdated, time-consuming AP process.

An efficient Accounts Payable (AP) process that saves your staff time and your business money.

Having a good AP process make sure your bills are paid on time, it strengthens your connections with vendors, and keeps you in line with regulations. It also forms the foundation for financial stability and growth. Effective AP operations smooth out the flow of funds, decrease the chances of fraud, and set your business up for smarter financial resource management.

Here’s how you can optimize your AP process to maximize these benefits and propel your business forward.

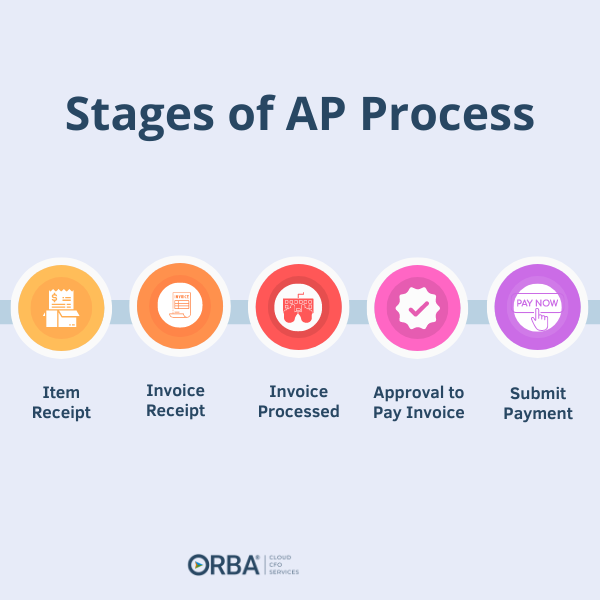

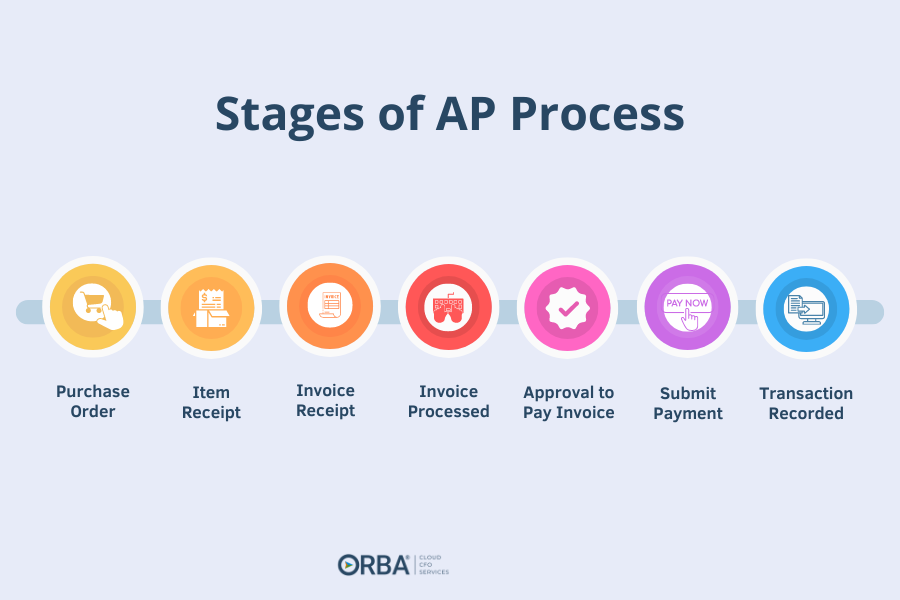

The 7 Stages of Your AP Process

Before we jump into process enhancements, a clear understanding of the AP process or cycle is essential. It’s typically divided into seven stages:

Stage 1: Purchase orders

First, the buyer (let’s say that’s you!), submits a purchase order (PO). Typically purchase orders include:

- the items ordered

- pricing

- volume

- terms

- delivery and billing addresses

Stage 2: Item Receipt

Next, if what you ordered was a physical item or goods, a person in your warehouse confirms the items received match the purchase order and inventory item receipt. Client Onboarding Manager, Vanessa Evanson recommends new clients use three-way matching in their AP process.

“To prevent fraud, I recommend using three-way matching in the AP process.“

Vanessa Evanson, Client Onboarding Manager

Three-Way Matching

Three-way matching involves cross-referencing the invoice with its PO, and delivery receipt (or inventory item receipt) and the invoice to make sure the quoted amount and the number of items delivered match:

- PO: Check the PO for number of items, volume and pricing

- Delivery receipt: The inventory/warehouse department matches the number of items delivered with the PO

- Invoice: Check to make sure your supplier’s invoice matches the quantity on the PO and the delivery receipt. If only part of the order was received, is the supplier charging the correct amount?

Evanson elaborates, “the person reviewing the delivery receipt is normally someone outside of your finance department. Alternatively, if you rely heavily on services, the person on your team using the service can confirm the invoice matches the services rendered. Having all three steps prevents fraudulent billing.”

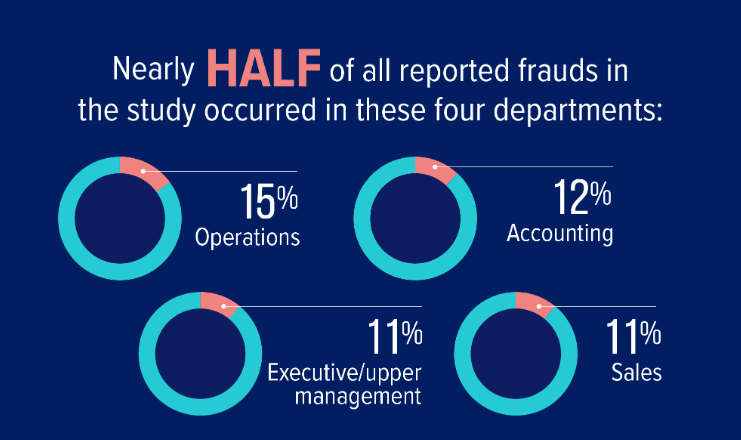

With 12% of fraud cases happening in the accounting department according to the Association of Certified Fraud Examiners, upping your internal controls in your accounts payable department is an important preventative measure.

Stage 3: Invoice Receipt

Your vendor will then render services or provide the products and issue you an invoice. The invoice should be reviewed to make sure the goods received or services rendered match the invoice items listed. This is especially important if you receive invoices for multiple purchase orders.

Stage 4: Invoice processing

Invoices are reviewed, coded and entered into your accounting system during this stage. Chart of Accounts codes are commonly used to link expenses to general ledger accounts, like an expense account. This makes it easier for the accounting team to update your general ledger, the final step in the AP process. It’s also advisable to include the invoice number for tracking purposes. This step of the AP process can be owned by your outsourced bookkeeping team.

Upon receipt of the invoice, the amount transitions to accounts payable and reflects on the balance sheet. Invoices should be matched with accounting transactions that have increased the accounts payable balance.

| Date | Debit | Credit | Account | Invoice # | CoA Code |

|---|---|---|---|---|---|

| 3/14/24 | $5,295 | Inventory | Inv-231 | 6560 | |

| 3/14/24 | $5,295 | Accounts Payable | Inv-231 | 6560 |

Your outsourced bookkeeping service will flag any discrepancies at this stage. If there are none, then the invoice will be marked ready for approval.

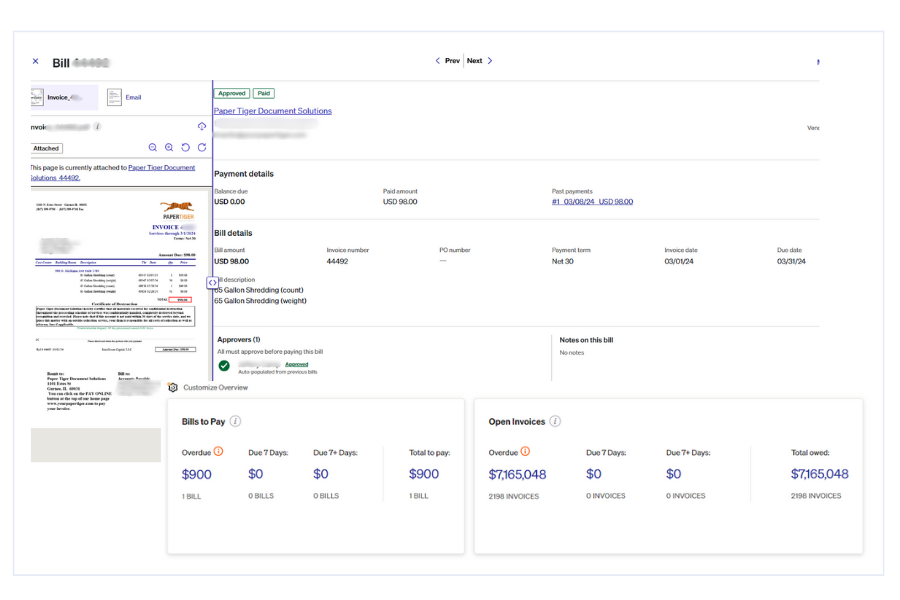

Stage 5: Invoice approval

Next, the invoice will need to be approved to be paid. Delays in this stage can cause late payment penalties and sour relationships with your vendors, so AP process automation can be a time and money-saver.

Automation Tools

Leverage automation tools within your accounting software to route invoices to the right approvers and even set up automated approval for low-value invoices, expediting the process.

Approval Hierarchies

Create clear approval hierarchies with predesignated approvers for different invoice amounts. This ensures that there’s no bottleneck in the approval process and reduces the likelihood of unauthorized spending.

Stage 6: Payment execution and reporting

Once the invoice has been approved for payment, the AP team should execute payment (this can be using ACH, check, or credit cards) and then record the transaction in your accounting system. This can be automated to optimize cash flow. (More on this below!)

Stage 7: Transaction reporting

Next, your bookkeeping service should record the transaction using the codes noted above.

| Date | Debit | Credit | Account | Invoice # | CoA Code |

|---|---|---|---|---|---|

| 4/11/24 | $5,295 | Accounts Payable | Inv-231 | 6560 | |

| 4/11/24 | $5,295 | Checking Account | Inv-231 | 6560 |

Your AP balance gets zeroed out. And you’re left with an increase in inventory and a decrease in cash. Understanding these stages is critical as any inefficiencies can cascade into significant financial issues for your business.

How to Streamline Your AP Process

Now, let’s break down optimizing your AP process into actionable steps that you can implement today.

Step 1: Centralize Your AP Function

Centralizing your AP function consolidates control and facilitates better management. Consider having a dedicated AP team. The AP process is also an easy part of your accounting cycle to outsource.

Role Specialization

Assign specific roles within the AP team for invoice processing, approvals, and payments. Ensure each team member is clear about their responsibilities and objectives.

Vendor Portals

Implement self-service vendor portals where suppliers can track the status of their invoices, significantly reducing the volume of status inquiries to your team.

Step 2: Go Digital

The era of paper-based invoices is, at this point, far behind us. Deloitte reports that 35% of businesses state high processing costs associated with traditional payment methods. Further, multiple sources put the cost of AP processing at anywhere from $8 to $12 per invoice. That’s not chump-change when you have multiple suppliers you pay each week!

It costs anywhere from $8 to $12 to process each invoice using traditional payment methods.

Instead, leverage technology to receive and process bills faster, gain real-time financial insights, and reduce manual errors in data entry.

Cloud-Based Solutions

Adopt cloud-based AP solutions for scalability, accessibility, and real-time collaboration. These platforms often come with the latest updates in security and functionality. The Spendlightenment Survey of Finance Professionals found a lack of transparency into AP with only 13% knowing about purchases before they are made and a further 66% of respondents saying the lack of control and visibility has a negative impact on growth.

66% of finance professionals say lack of control and visibility over AP has a negative impact on their growth.

Imagine feeling uncomfortable with the way you were spending money, and then on top of that, also not knowing who was spending it and when!

Integration with ERP Systems

Ensure your AP processes are fully integrated within your enterprise resource planning (ERP) system to maintain a cohesive financial infrastructure. Remember, anything to reduce that $12 per invoice processing spend!

Digital Invoicing Systems

Invest in a reliable digital invoicing solution that integrates with your accounting software. Look for platforms that offer OCR (Optical Character Recognition) technology to automatically capture and input invoice data.

Electronic Payments

Adopt electronic payment methods like ACH transfers, virtual credit cards, or payment platforms. These options usually offer cost savings, security benefits, and faster processing times compared to traditional checks.

Two of the cloud AP tools we often use include:

BILL vs. Ramp

BILL is a great sidekick for SMBs invoicing needs, perfect for those not diving into global vendor waters. Meanwhile, Ramp shines when we’re talking about spend management features, especially its corporate card offerings.

Step 3: Set Up Recurring Payments

For predictable expenses, set up recurring payments to vendors. This not only saves time for your team but also provides clarity and predictability for vendors, promoting good relations.

SOPs for Recurring Payments

Develop standard operating procedures (SOPs) for the management of recurring payments. Regularly review these to ensure they remain accurate and up-to-date with any changes in vendor agreements.

Automated Notifications

Utilize your banking or accounting system to send automated notifications to vendors prior to payment, confirming the transaction. This adds an extra layer of transparency and instills trust.

Step 4: Conduct Regular Vendor Outreach

Communicating with your vendors builds strong partnerships. Regular outreach can help in monitoring service quality, discussing potential disputes, and aligning on mutual benefits.

Vendor Service Level Agreements (SLAs)

Work with vendors to establish SLAs that clearly articulate service expectations, invoice submission formats, and payment terms. This can reduce invoice discrepancies and streamline the approval process.

Early Payment Discounts

Negotiate early payment discounts (e.g., 2%, Net 10 days) with vendors to incentivize timely payments. While the discount may seem negligible at first, this can lead to considerable cost savings over time.

Step 5: Continuous Education and Improvement

Enhancing your AP process is a continual effort, not a one-time fix. Encourage a culture of continuous learning within your AP team. Staying updated on the latest industry trends, best practices, and software updates is key to remaining competitive.

Employee Development

Invest in your team’s professional development by providing access to relevant courses, certifications, and workshops.

Benchmarking

Regularly benchmark your AP process against industry standards and peer organizations to ensure you’re not falling behind the curve.

Step 6: Audit and Optimize

Regularly audit your AP process to identify bottlenecks and opportunities for improvement. Continuous optimization is key to maintaining an efficient process as your business evolves.

Data Analytics and Reporting

Leverage data analytics tools to track AP KPIs such as the average time to process an invoice, the number of invoices per processor, and the ratio of on-time payments.

Process Automation

Look for repetitive tasks that can be automated, such as invoice data entry, payment scheduling, and reporting. Freeing your team from these manual tasks allows them to focus on more strategic activities.

Troubleshooting the AP Process

Some issues that might arise during the accounts payable process may include:

- Outdated processes: by using an AP cloud tool you can limit the outdated paper trail that makes transactions difficult to track

- Double entry: with automation, you can limit human error like double data-entry

- Late payments: one of the highlights from an accounting perspective, of automating your AP process, is that you can schedule payments to optimize cash flow and avoid late payments (or take advantage of early-payment discounts). Your outsourced accounting services can help determine the best schedule to pay your invoices.

- Account discrepancies: Ensure your payment goes to the right person— the faster they cash their check, the closer your book balance is to your actual bank balance. And the faster you can report issues to your bank like checks going to the wrong person, the more likely you are to recoup losses in the case of mail fraud.

“I wish people paid more attention to the legitimacy of uncashed checks. My recommendation is to review the transactions that are left over in the register after you’ve completed the reconciliation. This is the easiest way to identify if you have a duplicate transaction that needs to be removed.”

Carolyn Koonce, Manager

Level Up the Accounts Payable Process

If you want to really dial in your AP process remember to include a security plan and to loop in your CFO. And remember that with an outsourced bookkeeping service, they will take care of all those pieces on your behalf.

Focus on Compliance and Security

Compliance with regulatory requirements and maintaining the security of financial data are paramount. A breach can lead to financial loss, penalties, and a loss of business reputation.

Training and Policies

Regularly update your team on compliance best practices and ensure that AP policies are aligned with current regulations.

Secure Payments

Implement dual control on larger payments, utilize secure payment networks, and conduct periodic security audits to protect against fraud and cyber threats.

Partner with a Fractional CFO

For businesses aiming to optimize their AP processes while not ready to commit to a full-time CFO, contracting fractional CFO services could be an ideal solution.

Expert Guidance

A Fractional CFO provides expert financial guidance and strategy to enhance your AP operations without the overhead of a full-time executive. Want to understand exactly the best timing to pay your invoices in order to optimize your cash flow? A fractional CFO can advise.

They can step in during periods of change or growth, offering the analysis and insight needed to make strategic decisions that will impact the AP process positively.

An efficient AP process is about more than just avoiding late fees—it’s fundamental to building a solid financial foundation that can support business growth and agility. By implementing these strategies, you can transform your AP operations into a well-oiled machine that drives success and stability for your business.