With Forbes reporting a massive decline in retail sales, industrial production and manufacturing, it should really be no surprise that Bloomberg declared there is a 100% chance chance of a recession in the next 12 months.

Our cloud CFO team has always advocated dynamic budgets. Budgets that are more adaptive to market trends are budgets that force teams to come together to plan and forecast. This approach yields strategic conversation. I recently wrote about how a zero-based budget can help reduce spending when you’re facing a cash flow crisis. So how do you make those adjustments to your budget while being chased by a looming recession?

To begin to adjust your budget in a recession you have to rethink your budget period.

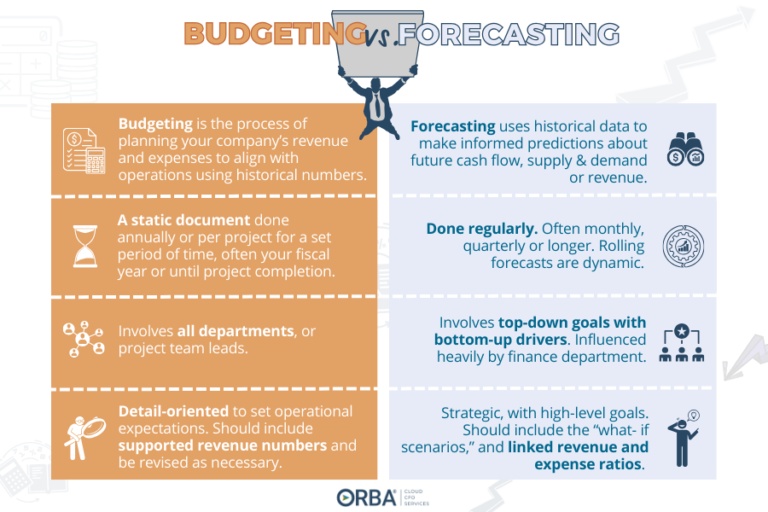

The current economic downturn may warrant you adjusting your normal budgeting period. To adjust your budget in a recession you may want to amend your “budget period” from a year to quarterly or from quarterly to monthly to tighten your control over any expenses carried over.

Toss out the idea of looking at your previous periods like you might with traditional budgeting. This method assumes all your expenses were necessary. In this climate many businesses are being forced to quickly redefine “necessary.” Complicated phone systems are being replaced by Zoom memberships and photocopiers are being traded for Dropbox. Printing costs have plummeted while IT requests have gone up as everyone tries to navigate remote access. So why not replace your traditional budget for a zero-based budget?

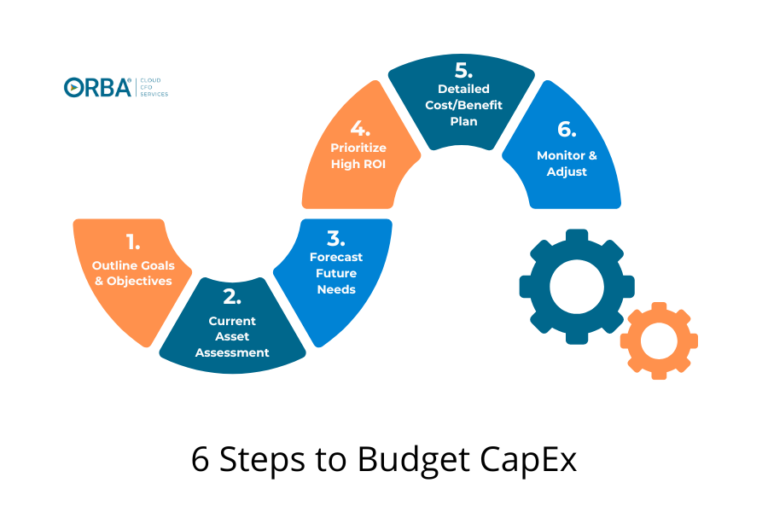

Steps to build your zero-based budget.

- Have your sales manager provide a three to six months forecast for revenue. Then cut that number in half. (Sales people are “optimistic” and these are unparalleled times.)

- Next loop your management team in. Have all your department managers involved list out non-negotiable expenses.

- Think from a cost-management approach. Determine where you can adjust operations or spending to achieve your goal. Right now may be a good time to shop around for price-matching and discounts to lower your COGS. Look for redundancies that could be fixed.

- Only approve spending that shows a return on investment (ROI) in the next period or two. Look for a short-term impact over chasing long-term ventures. For example, reallocating print advertising budgets to targeted online campaigns allows you to measure ROI.

- Prioritize the strategies you plan to roll out.

- Next, with the help of your managers, link incentives to key targets. Incentives will align your team to be working towards the same goal of either cutting costs or increasing revenue to meet your budget.

Related read: In this post on zero-based budgeting for profitability we discuss tips for encouraging employee engagement in a cost-management environment.

When zero-based budgeting just isn’t right for you.

Not all companies can thrive in a cost-reduction approach. Businesses that have a large R&D team or have high customer service needs may find those departments have trouble justifying their ROI on budget requests.

If this is the case, you may simply want to employ a cash budget in the short-term to help you manage the recession. Put simply, you will want to list out all cash inflows and outflows expected in a fixed (aka short) period of time. Given that we are still in a point of uncertainty in this global pandemic, try to employ projections based on modeling available. This is an inexact approach; however, it will give you a better idea of what your cash flow may look like in the upcoming period and help you strategize accordingly. No matter how you slice it, running a business in the face of an impending recession is a daunting task. Whether you’re considering adjusting to a zero-based budget or a cash budget based on modeling, you’re looking at a time-intensive process. However, the time you invest now will better prepare your business for the uncertainty ahead.