What is a growth barrier?

A growth barrier is any obstacle that stands in the way of your business development, expansion or ability to scale. These barriers may be internal or external. And here’s the beauty of defining that: any growth barrier that’s internal, you can fix.

If you find your small business is losing money, we recommend checking in with these growth barriers to make sure none of these are standing in the way of your business success.

5 growth barriers you can fix:

Once you identify the things standing in the way of business growth, any of the internal factors can be

1. Focusing on the Wrong Customer Metrics

You will often hear people talking about vanity metrics. And the truth is, there is SO much data out there that is possible to track, but it doesn’t mean you should. Instead, consider the metrics and customer success KPIs that will drive long-term growth. We’ll break it down into these 3 things:

- Key Drivers

- Actionable Ideas

- Why it matters

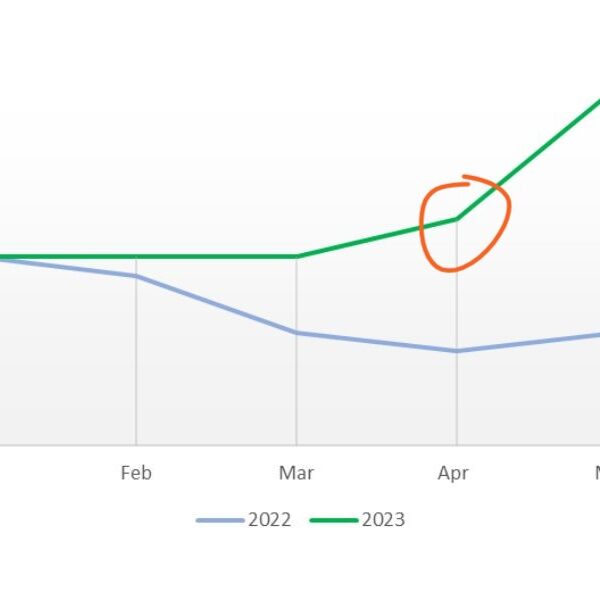

Here’s a great infographic from Orbit Media on how to rank your metrics from vanity to valuable:

So you can see, that measures like profit margin and net promoter score (NPS), for example, are critical but difficult to measure and improve. Let’s break it down further:

Key Driver

Net Promoter Score

Actionable Idea

Run simple surveys to understand how you can do better

Why it Matters

Companies that have high NPS grow their revenue twice as fast

2. Paying for Numbers, Not Quality

There is a tendency to target quantity over quality in customer acquisition.

Many marketers know that it’s better to extend the lifetime of your current customer base. And yet, many companies still spend a significant amount more on acquiring new customers. But this can be a barrier to growth. because it’s almost always better for your bottom line to retain one customer than it is to acquire a new one.

The numbers vary, and truthfully are based on some outdated studies (we’re talking 2014 or older). But Forbes still puts it at four to fives times more expensive to acquire new customers compared to retaining existing ones. And newer sources confirm that customer experience (CX) leaders outperform their industry peers in revenue growth.

Remember, your customer lifetime value (LTV) tells an important story about the value you offer customers and how valuable they are to your company. The magic ratio measures how that value compares to the cost to acquire them. To calculate your magic ratio you simply divide LTV by Customer Acquisition Cost (CAC).

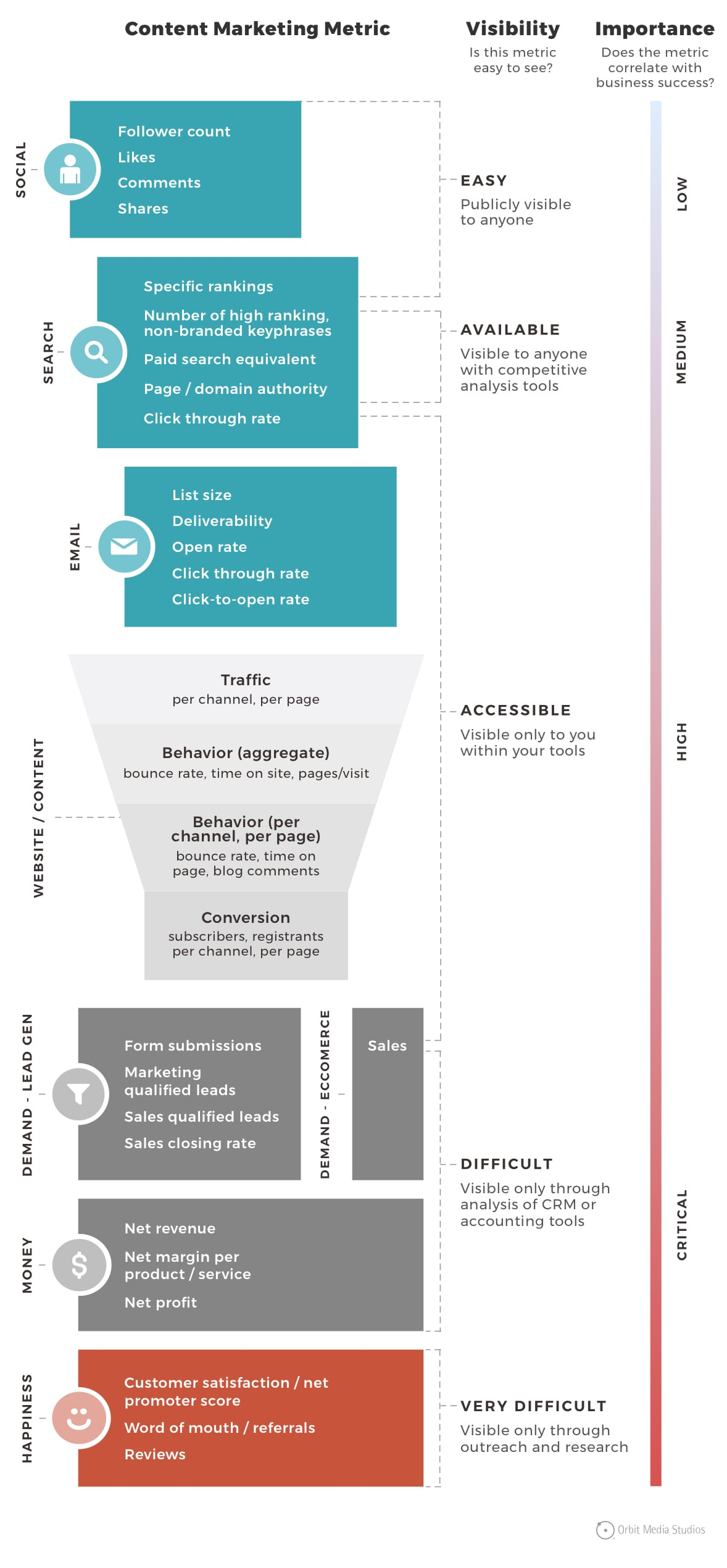

You can calculate a more accurate LTV by segmenting your customers by channel, customer type or location. This shows you which channels have the highest LTV and which are struggling. For instance, say your average CAC is $190 and your average LTV is $500. Your magic ratio is 2.63. Great, yes? But how do you know what customer to target? The overall average is simply a vanity metric and not all that helpful.

If you take the same numbers and plot them by customer tier, for example, you get a ton more insight:

In the above chart, you can see that your best bet is for sales to target the “Pro” tier as “Enterprise” has a lower magic ratio.

Key Driver

Customer Lifetime Value

Actionable Idea

Segment customers by channel, type or location to identify the best ones to target.

Why it Matters

It’s always cheaper to extend the lifetime of a customer than it is to acquire a new one.

3. Overstaffing & Underutilizing Staff

Hiring quickly over hiring correctly can lead to a mismatch between demand vs. overstaffing ultimately resulting in a barrier to growth.

Here’s a great example: After performing some financial clean up for a newer client, we noticed some staff were underutilized. When the employees were working directly on a job, their salary cost was moved into COGS. Anytime the same staff sat idle we moved their salary costs into an account in overhead titled “underutilized employee salary”. We quickly realized they were accumulating $20,000 in unused salary costs every month. In a people business, you might expect a one-off month where employees aren’t fully utilized; but, if it’s a consistent issue then you’re not staffed properly.

Instead look to outsource, use contractors or rely on overtime to lower fixed costs. In addition, for salaried employees you can fill gaps with tasks like relationship management and lead generation that have a direct return on business development. In doing so, you’re optimizing one salary to reduce labor costs.

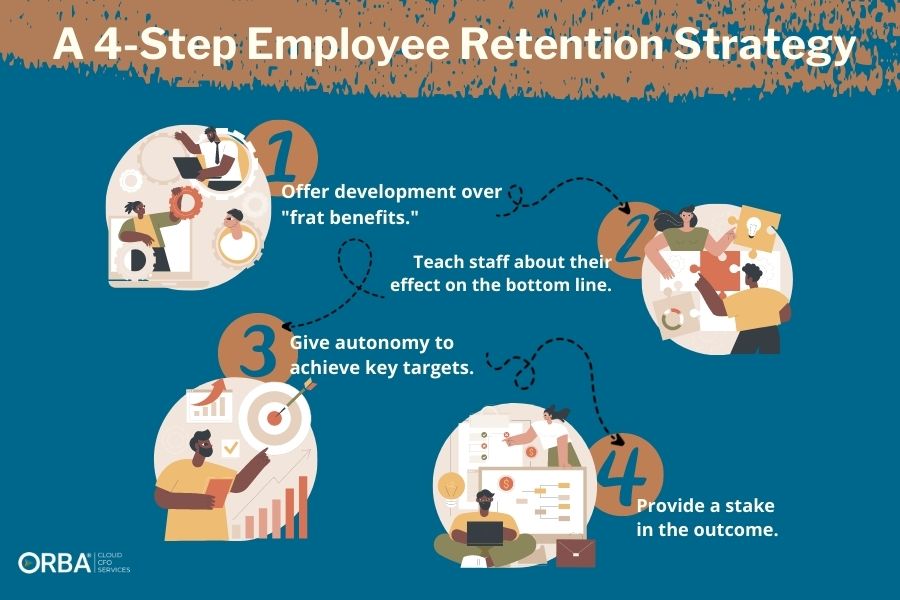

Additionally, to increase employee retention, spend time crafting comprehensive job descriptions and vetting candidates thoroughly to ensure a seamless alignment with company culture and objectives. Continuous training and skill development programs are essential to adapt to evolving market demands and ensuring your employees are equipped to drive sustained growth.

The above, tandem with employee retention strategies, will also save your business time and money.

4. Forgetting to Include a Failure Buffer in Your Budget

Sh*t happens.

Unexpected expenses can arise at any time. Set aside a portion of your budget for emergency situations to safeguard your business’s financial stability. Preparing for contingencies will help you avoid this growth barrier.

Aim to balance risk-taking and cautious financial planning. On one hand, taking calculated risks can lead to significant rewards and growth, such as investing in the stock market or starting a new business venture. However, it is equally important to engage in cautious financial planning, which involves setting clear financial goals, building an emergency fund, and ensuring adequate insurance coverage. By striking a balance between these two approaches, individuals and businesses can capitalize on opportunities for growth while protecting themselves against potential financial setbacks.

5. Going Too Big (Growing Your Business Broke)

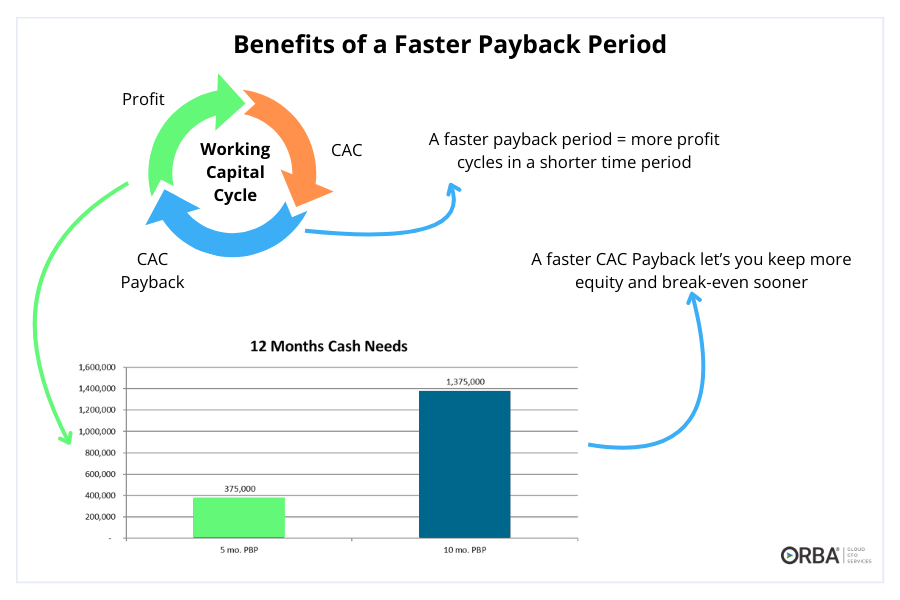

Many scaling businesses fail because they don’t put enough emphasis on the Payback Period (PBP).

Payback Period is used to evaluate risk and/or liquidity of an investment. Your payback period calculates the time it takes for an investment to generate enough cash flow to recover its initial cost. In other words, it measures the period of time it takes for you to break even (another useful KPI).

Typically, this metric is expressed in years or months depending on your risk tolerance and the size of the cash investment.

“A faster PBP means more profit cycles in a shorter time period (and less capital needed to fund growth).”

Generally, you are aiming for a shorter payback period as it means you’ve recovered your investment sooner and lowered your risk exposure.

A good payback period for smaller B2B and SaaS companies is 12 months or less. But, it’s ideal to be less than six months if you’re in hyper-growth mode (greater than 50% revenue growth per year). For a B2C company we’d recommend to aim for an even faster PBP: say three to six months. Check out our PBP benchmarks here.

Key Metric

Payback period (PBP)

Actionable Idea

You can shorten your payback period by pulling on the correct CAC and LTV levers.

Why it Matters

Ultimately if you’re not tracking this metric you could grow your business broke!

The Bottom Line

This is a non-exhaustive list of the growth barriers you might face when trying to scale your business. But, by taking the actions noted above, you can instead see your bottom line grow. Need help setting these actions into motion? Get in touch to see how our fractional CFO services can help.