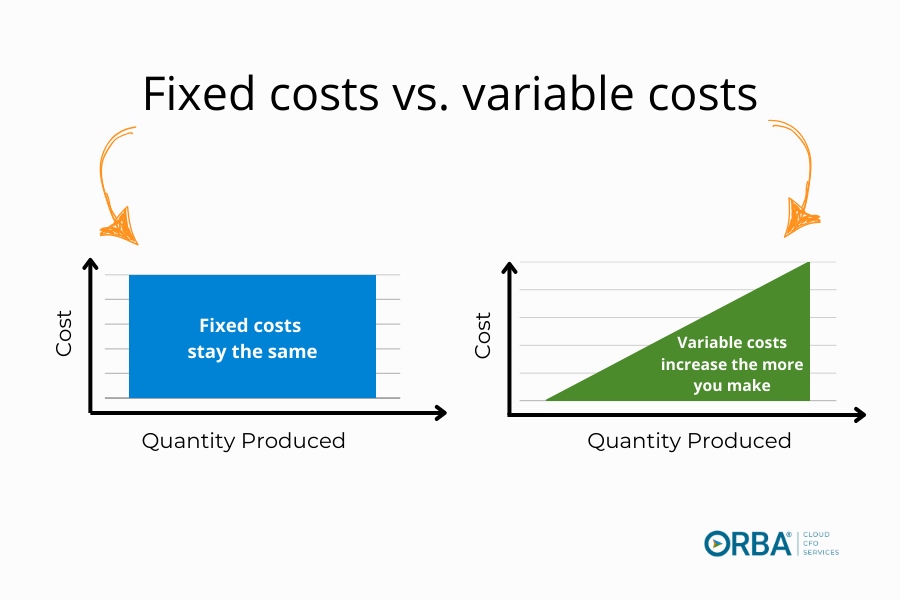

You will have undoubtedly noticed that on your profit & loss statement, your expenses fall into two distinct categories:

- Fixed costs (or expenses)

- Variable costs (or expenses)

What exactly are fixed costs vs. variable costs? And how does it affect your budget process and cash flow?

What Are Fixed Costs?

Fixed costs are expenses that generally stay the same over time, even if those costs increase or decrease now and then, they are not contingent on the number of products or services your company sells. The key differentiator from fixed costs vs. variable costs is that fixed costs do not change with production levels.

Examples of fixed costs

Here are a few examples of fixed costs:

- Rent

- Insurance premiums

- Wages for full-time employees with salaried positions

- Lease payments for equipment or property

- Premiums for business insurance,such as property or health insurance

- Fixed payments for building maintenance or other services

- Subscriptions that are paid monthly or on another regular cadence

- Depreciation on capital assets such as equipment and vehicles

- Annual fees for licensing or permits.

What Are Variable Costs?

Variable costs are business expenses that can change and fluctuate with production levels. If your business produces more products or services, variable costs will increase. If you produce less, variable costs decrease.

Examples of variable costs

Here are some common examples of variable costs you may see:

- Raw materials

- Packaging costs

- Commission

- Shipping costs

- Contractor wages

- Wages for part-time staff that vary based on how busy you are

- Marketing expenses during busy seasons

Key Differences Between Fixed and Variable Costs

Fixed Costs

- remain the same, regardless of increased production or increased sales

- can limit a company’s flexibility because they must be paid regardless of revenue fluctuations

- can affect profitability during periods with low sales

- higher production volumes lower fixed costs per unit

Variable Costs

- fluctuate depending on production and increased sales

- offer more flexibility as businesses incur these expenses only when they are actively producing or selling

- higher production volumes may increase variable costs.

Understanding this distinction is crucial for effective financial planning and strategic decision-making. It allows business owners and COOs to better balance cost management with growth.

Why Tracking Costs Matters for COOs and Small Business Owners

Accurate cost tracking is critical for COOs and small business owners to make informed decisions about their operations.

Understanding both fixed and variable costs allows businesses to identify opportunities for cost savings and improve profit margins. You can use cost analysis to set competitive pricing, forecast cash flow, and avoid financial pitfalls.

Developing a clear picture of cost structures not only aids in budgeting but also empowers leaders to build resilient and adaptable business strategies.

Tips for Optimizing Fixed and Variable Costs

Here’s an example of how swapping fixed expenses for variable expenses can help your cash flow:

Swap fixed costs for variable costs.

To get creative with your cash flow, ask your controller where you can swap fixed costs for variable costs.

Reducing fixed salaries of your sales team by offering them a higher sales commission can be an attractive offer to your A-list salespeople. For service-based companies, you might employ contractors to swap fixed costs for variable costs.

Here’s a great example: After performing some financial clean up for a newer client, we noticed some staff were underutilized. When the employees were working directly on a job, their salary cost was moved into COGS. Anytime the same staff sat idle we moved their salary costs into an account in overhead titled “underutilized employee salary”. We quickly realized they were accumulating $20,000 in unused salary costs every month.

In a people business, you might expect a one-off month where employees aren’t fully utilized; but if it’s a consistent issue then you’re not staffed properly.

That’s money you’re tossing out the window (or in this case into people’s pockets, without any return at least).

What to do if you have underutilized employees?

Option 1: Use contractors

Instead, in a case like this, hire staff to cover 50-75% of your expected workload- or whatever you can consistently maintain. Then utilize contractors to make up the remaining percentage if you get more work, i.e., revenue. You’ll sleep better at night. Contractors are available to hire if needed and you don’t have to let people go if the work isn’t there. While you’re giving up some gross profit margin on the incremental work in those higher-revenue months when you need to flex up; when you have a bad month, you’re not stuck paying fixed salaries for staff simply because you don’t want to let them go.

In this example, swapping fixed salaries for variable ones reduced labor costs by $240,000 per year!

Option 2: Pay overtime

Contrary to what some think, one money-saving option is to again hire staff for less than 100% of your workload, then pay overtime to your current team instead of hiring subcontractors when you flex up. It’s a win-win, they make more money, and you still pay less than you would contracting out. In general, overtime is a useful solution across industries not just those that use contractors.

If your controller isn’t providing you with these insights you may want to consider looking for a new one.

Fixed vs .Variable Costs and your Break Even Point

One important metric that fixed costs and variable costs are directly related to if your break-even point. The break-even sales point formula is:

Break-Even Sales Point = Fixed Costs / (Sales Price per Unit – Variable Costs per Unit)

So, to find your break-even sales point you take your fixed costs and divide them by the contributing margin or the sales price per unit minus your variable costs per unit. This underscores the importance of ensuring you have a good handle on the difference between your fixed costs and variable costs.

The Bottom Line

After digging into fixed costs vs. variable costs you can see why it’s important to create strategies and monitor these costs to optimize cash flow and maintain profit margins.

By regularly evaluating cost structures, businesses can identify untapped efficiencies and make decisions to foster long-term growth. Think of cost management as more than just numbers; it can empower your business to be flexible, competitive, and resilient. The question isn’t whether fixed and variable costs matter—it’s how you’ll leverage them to unlock your business’s full potential.