Accounts Receivable AR automation is step one to improve your accounts receivable (AR) process. Because AR is considered to be assets converted to cash, optimizing your AR directly affects your cash flow.

Why should you care? Lenders and investors all look closely at your AR when making decisions about whether to fund your company.

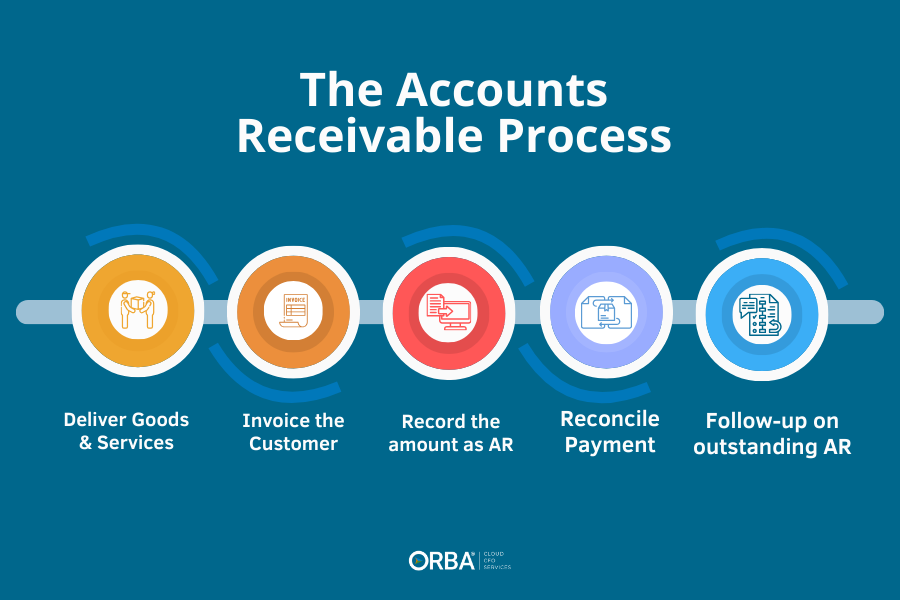

A Quick Review of the AR Process

- Deliver Goods or Services to Clients

- Invoice the Customer

- Record the Invoiced Amount as an Account Receivable

- Process and Reconcile Accounts Receivable Payments

- Follow Up on Outstanding Payments

Managing accounts receivable (AR) is essential for maintaining a smooth cash flow in your business. It all starts with credit approval and sales orders, leading to the timely delivery of goods and services. Next, you generate and send out invoices that clearly outline the amount due, payment terms, due dates, and payment methods.

Once the invoice is delivered, your finance team records it as an account receivable, boosting your AR balance on the balance sheet. Regular monitoring and tracking of these receivables are crucial for business health. When a customer makes a payment that matches the invoice, it reduces the AR balance and updates your cash position. But if payments lag, proactive collection efforts kick in.

Benefits of AR Automation

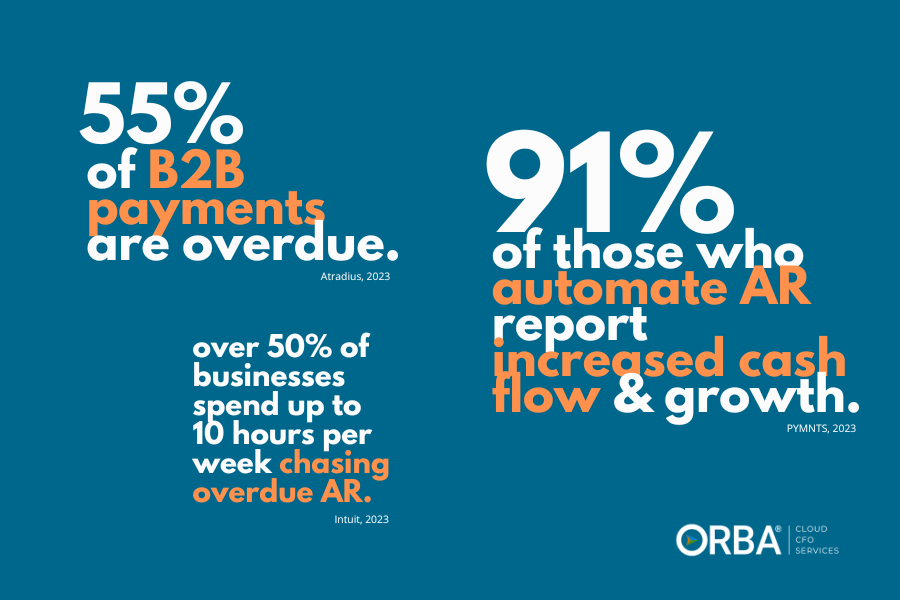

With 55% of B2B businesses reporting payments overdue and 91% of those who use AR automation reporting increased cash flow, the numbers speak for themselves. Automating accounts receivable is good for business.

- Efficiency: AR automation speeds up the manual AR process of invoicing and collection.

- Cost Reduction: By automating AR, you reduce labor costs and can retool staff to more strategic tasks.

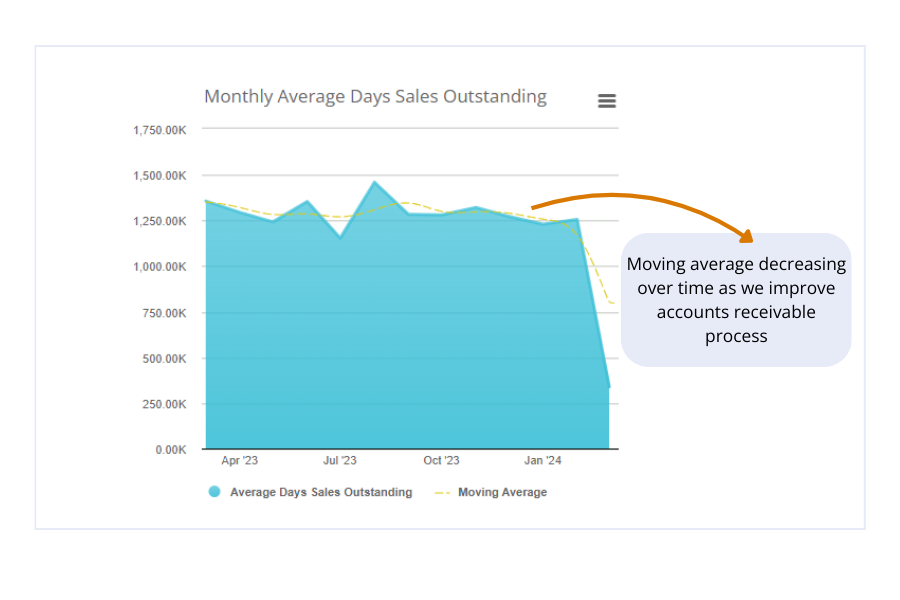

- Cash Flow: One the first measures to check in with after automating accounts receivable is your DSO, as it directly affects your cash conversion cycle.

- Data Accuracy: As with any automation, you reduce the chance of manual data-entry error.

- Customer Experience: With customer portals, more payment options and faster invoicing you improve your CX, which is huge for customer retention (and timely payments!)

“Automated invoicing slashed delays in sending bills, ensuring we got paid on time. This is really important [for] cash flow because it secures a more consistent and predictable inflow of funds. We have seen our DSO drop by 15%, which means more rapid collection of receivables.“

Kenan Acikelli, Workhy

AR Automation Measures

To track improved accounts receivable performance with AR Automation, you can pay special attention to these two measures:

Days Sales Outstanding (DSO)

A lower DSO means that a company is collecting its receivables more quickly as it speeds up your cash conversion cycle.

Ways to improve your DSO include:

- setting clear payment terms with customers

- sending invoices immediately after sales are made

- offering early payment incentives

- following up promptly on overdue payments.

Additionally, implementing a robust credit management system can help prevent extending credit to your customers who have a history of late payments.

Sr. Staff Accountant, Connor Lucas says, “one of the best ways to reduce your DSO is by invoicing more regularly and sending reminder emails when invoices are overdue to improve the collection process and cash flow. All of this can be accomplished with AR automation.”

AR Turnover

Accounts Receivable (AR) Turnover is a financial ratio that measures the efficiency of a company in collecting its accounts receivables. The AR turnover ratio is calculated by dividing the net credit sales by average accounts receivable during a particular period. The result of this calculation shows how many times the company collected its average AR balance during the given period.

A high accounts receivable turnover indicates that the company has an effective collection process and is able to convert its credit sales into cash quickly. On the other hand, a low turnover may indicate issues with collecting payments from customers or giving too much leniency on credit terms.

This ratio is important for both companies and investors as it gives insights into the liquidity and cash flow management.

Ways to improve your AR turnover include:

- Automated invoice delivery

- Reminders before the payment terms come due

- Offering multiple payment options

- Easy access through customer portals

How to Streamline Your AR Process in NetSuite

Managing ARs manually can be a real headache—time-consuming and susceptible to human error. This is where automation shines. By automating your AR process, you can streamline nearly every step, freeing up your team to focus on more strategic tasks.

Take NetSuite, for example. It seamlessly converts sales orders into invoices as soon as they’re fulfilled and can deliver billing statements via mail or email. It handles VAT, sales, and other taxes automatically, updating your general ledger without the risk of manual entry errors.

Plus, NetSuite lets you combine multiple orders into one billing cycle and a single, streamlined invoice, making it easier for your customers to manage their payments.

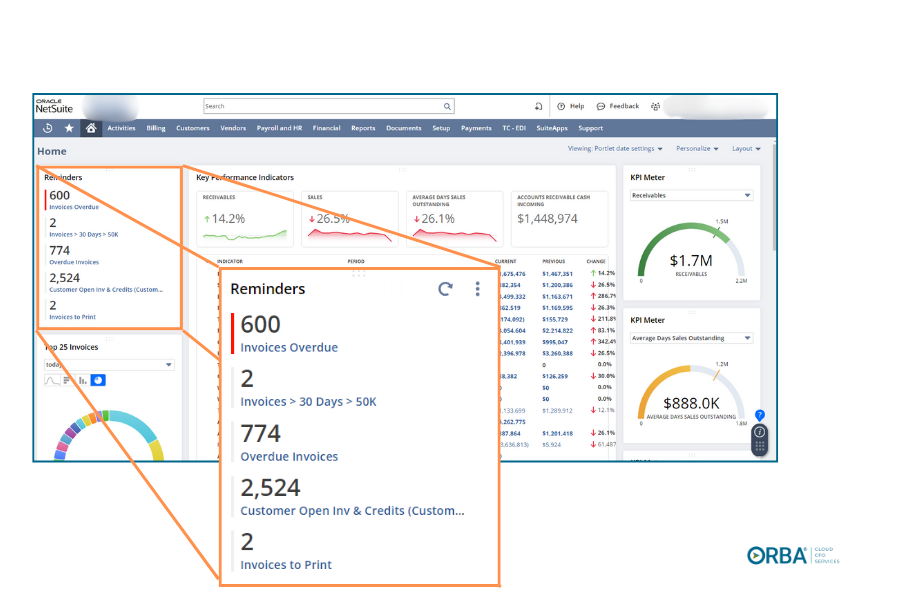

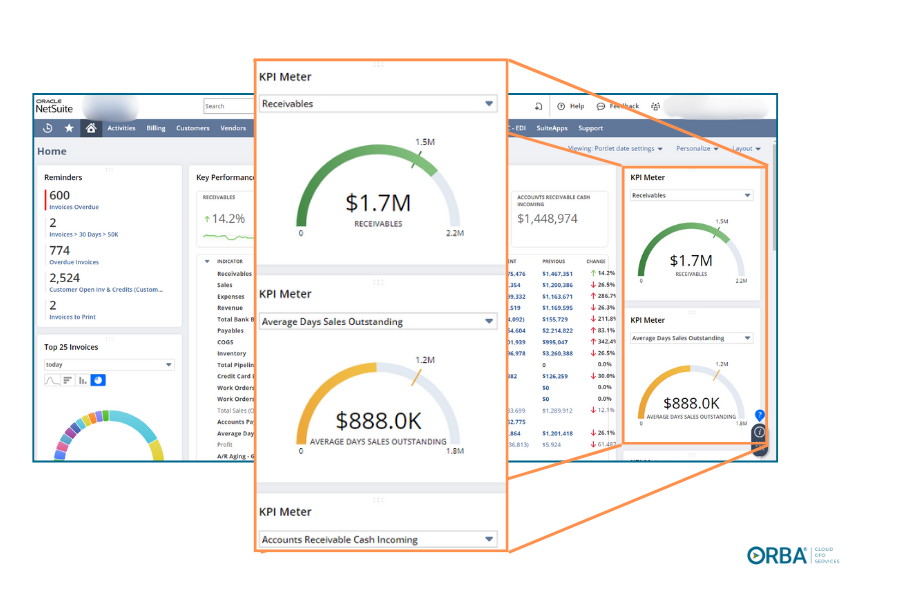

AR automation using NetSuite enables businesses to create and send invoices, set credit and payment terms and better manage collections. This NetSuite feature shortens the credit-to-cash cycle through real-time visibility throughout your AR process.

Embrace automation and watch your AR process transform into a well-oiled machine!

NetSuite AR Automation

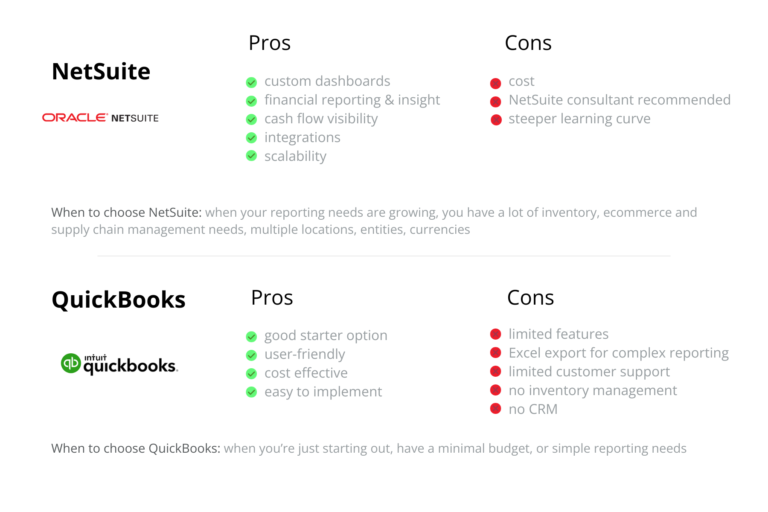

One of the best ERPs we recommend to clients for AR automation is NetSuite. Features included in NetSuite Accounts Receivable include:

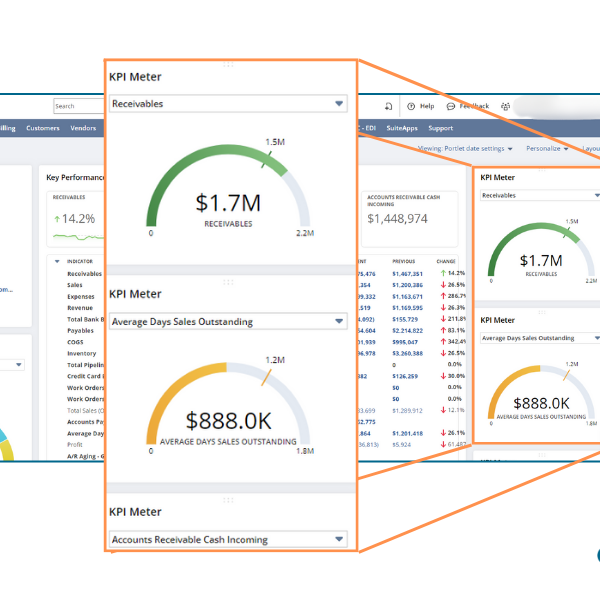

- Custom Dashboards: for AR roles to accelerate collections and improve Days Sales Outstanding (DSO)

- Customer Management: maintains customer data, contacts, transaction history, purchased items, open invoices and credit worthiness. Includes a customer portal to view invoices, make payments and check account status.

- AR Automation: Automatically convert sales orders to invoices and customize invoices to meet customers’ unique billing needs, whether by mail, email, fax or electronically. Easily calculate VAT, sales and other taxes.

- Invoice Consolidation: Streamline the billing process with consolidated invoices which increases customer convenience while shortening DSO

- Payment Flexibility: Accept payments via cash, credit card, check, bank transfer, electronic funds transfer (EFT) or another electronic format. Automatically match customer payments to open invoices.

- Dunning and Collections: With NetSuite AR automation, companies can automatically send reminders in multiple languages and currencies before or after payment is due with customized communication.

- AR Reporting: Get AR aging reports, cash forecasting, and customizable reporting.

Need help getting AR automation set up in NetSuite? Our NetSuite accountants can help.

The Bottom Line

- Optimizing accounts receivable will have a direct effect on your cash flow and is important for impressing lenders and investors

- In addition to improving cash flow, AR automation helps improve efficiency, data accuracy, customer experience and reduces costs

- Two measures of AR automation performance are: DSO and Accounts Receivable Turnover

- One of the best tools for AR automation is NetSuite

Need help getting set up with NetSuite to optimize your accounts receivable cycle? Learn more about our NetSuite pricing here.