Taking the correct budget process steps play a crucial role in the success and growth of small businesses. It allows entrepreneurs and business owners to gain financial stability, make informed decisions, and set and track their financial goals. And surprisingly, many small businesses still don’t have a budget.

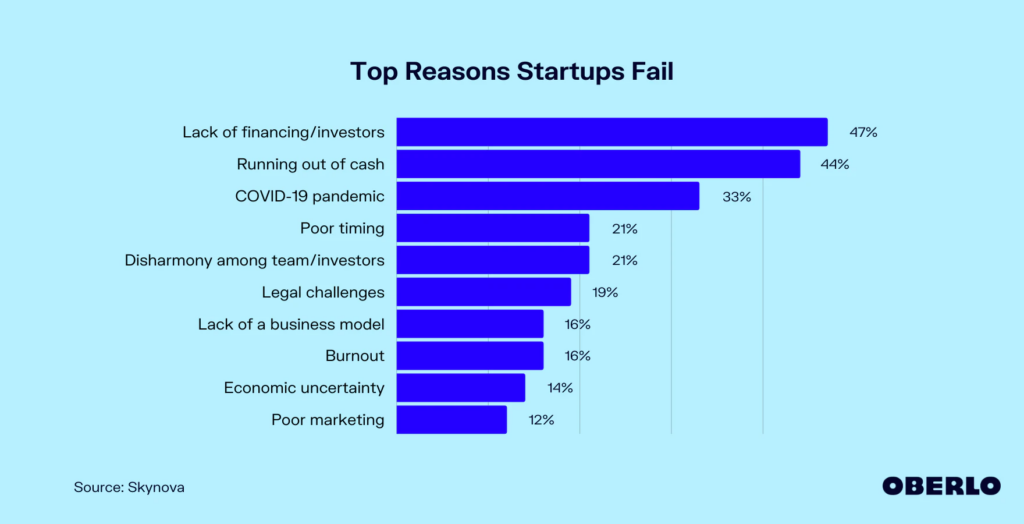

In fact, in 2018 Clutch reported that as many as 46% of small business did not have a budget (mind you this was surveying only about 355 businesses). As the Entrepreneur’s CFO, I don’t find this shocking but it is concerning.

There’s no doubt it’s tedious, but without the budget acting as your stake in the ground, it’s hard to know if you’re on target. Better yet, it puts you at risk of overspending on growth and restricting cash flow. And we all know running out of cash spells death for most companies. That’s why budgeting and forecasting for business owners is essential.

In this article, we will explore the importance of the budget process, provide step-by-step guidance on creating a budget, highlight common budgeting mistakes to avoid, discuss useful tools for budget planning, and share real-life client case examples to illustrate the impact of effective budgeting.

The Benefits of a Budget Process

Financial Stability and Control:

By creating a budget, small businesses gain better control over their finances with these six benefits:

- Ensure that income aligns with expenses

- Prevent overspending

- You know how and when to allocate resources

- Reduce unnecessary costs

- Identify areas for improvement

- Plan ahead for emergencies

Improved Decision-Making:

Here’s one of the #1 reasons I believe going through the budget process steps is important. The budget process drives discussion amongst your team. Budget discussions often uncover valuable insights that aid in decision-making. It gives you an opportunity to evaluate the financial feasibility of potential investments, new projects, or expansion plans. With a budget in place, businesses can make informed decisions that align with their financial goals, minimizing risk and maximizing profitability.

Key takeaway: You spend all day at your desk going over spreadsheets and reporting and it’s easy to forget your goals and your vision. You sit down with your team and it reminds you of what you’re trying to accomplish each and every day.

Goal Setting and Tracking:

Budgets serve as a roadmap to achieve your financial objectives. By setting clear benchmarks and tracking progress, small businesses can stay focused and motivated. Regularly monitoring the budget ensures you are on track and can make necessary adjustments to achieve your desired outcomes.

7 Budget Process Steps: An easy-to-follow guide

There are three main stages of budgeting for high growth companies: Creating, reviewing and revising. Creating a budget may seem daunting, but it doesn’t have to be. By following these seven steps, you can develop a comprehensive budget tailored to your small business:

Related read: Learn more about the 3 stages of budgeting and forecasting for high growth companies

1). Set Realistic Financial Goals:

Define your short-term and long-term financial objectives. These goals will serve as the foundation for your budget planning process. Review prior spending and determine whether it’s justified to maintain those expenses. Based on your financial goals, pinpoint where spending needs to increase.

2). Choose the Budget Type:

There are many different budget types, and going through these budget process steps will help narrow down which one is the right type for your business at its current stage of growth:

- Surplus

- Balanced (often the top choice of nonprofits)

- Zero-based

- Value proposition based

- Rolling budget: which can allow you to make operational adjustments for profitability before month-end.

- Incremental budget

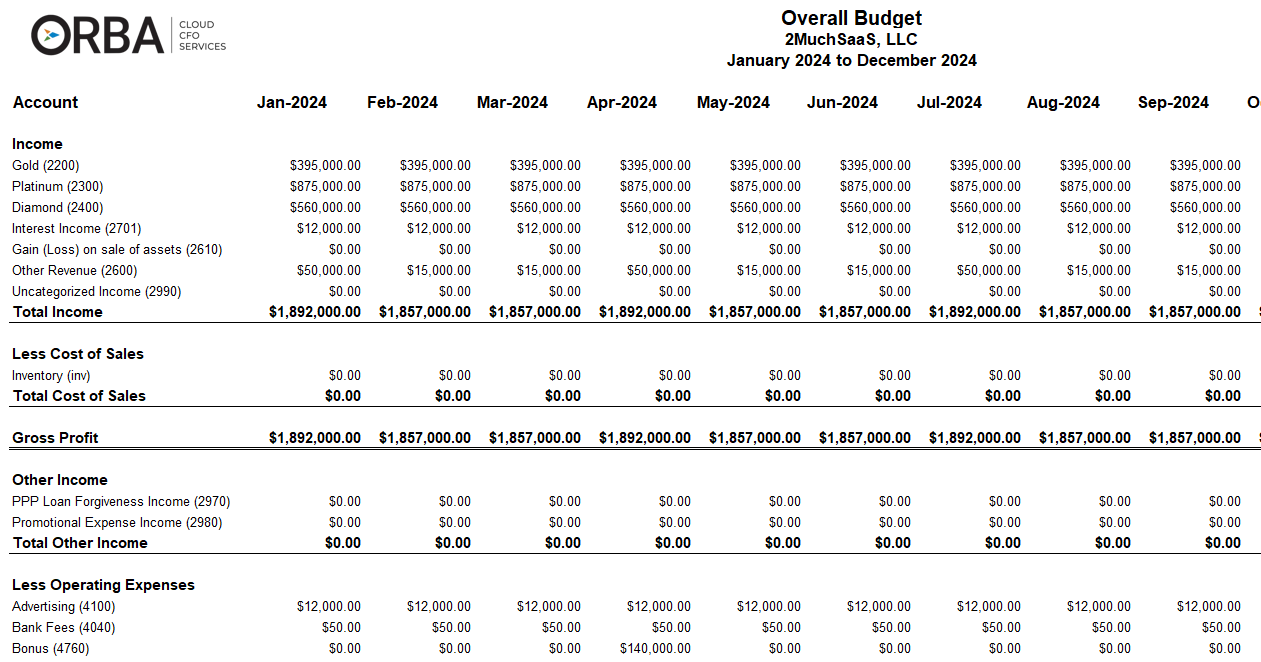

3). Project revenue:

When you’re projecting revenue for your budget include all expected income:

- Sales

- Interest

- Sale of assets

- Loans

Also consider your revenue drivers. Is your business:

- Subscription – similar

- Subscription – unique

- Project-based

- Commission-based

- Transaction-based

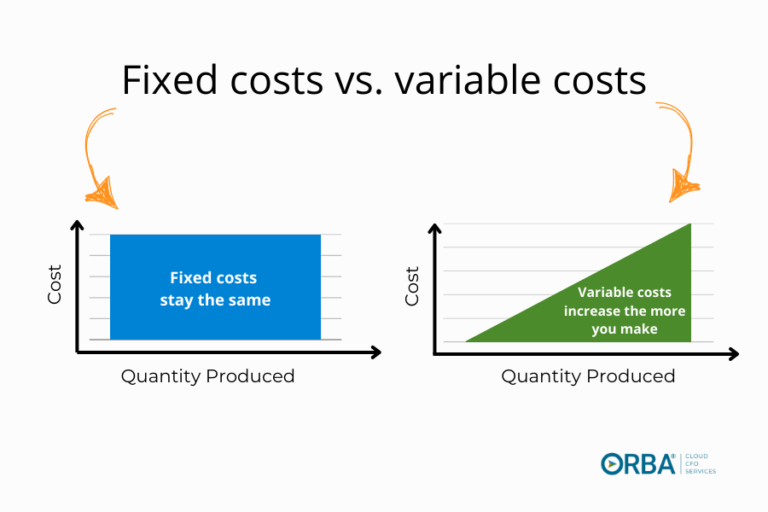

4). Include Fixed Costs:

Start by listing your fixed costs. These expenses remain relatively stable from month-over-month:

- Rent

- Salaries

Cloud CFO Tip: for any fixed costs, also apply a set percentage to prepare your business for inflation.

5). List Out Variable Expenses:

Identify and categorize your variable expenses, such as marketing costs, inventory purchases, and office supplies. Be thorough in capturing all potential expenditures. Smart business owners (and their outsourced accounting team) will categorize expenses into some version of the following:

- General & Admin

- Research & Development

- Sales and Marketing

- Operations

- Cost of Goods, etc.

6). Include Bigger CapEx Spends and Cash Flow Fluctuations:

Anticipate significant expenses, such as equipment upgrades or seasonal fluctuations in cash flow like employee bonuses. Allocate funds accordingly to ensure sufficient resources are available when needed. Determine whether there are certain departments that need to be trimmed in order for your budget to land at the benchmark you’ve set.

7). Prepare for Contingencies:

Unexpected expenses can arise at any time. Set aside a portion of your budget for emergency situations to safeguard your business’s financial stability.

Bonus: Monitoring and Adjusting the Budget:

You’re already onto something if you regularly review your budget and compare budget variances against projected amounts of revenue and expenses. Make necessary adjustments to keep your budget accurate and aligned with your business’s evolving needs.

Remember, this is your stake in the ground, but it quickly becomes irrelevant if you’re not monitoring it and running rolling forecasts.

Budget Template & Example

Common Mistakes in Budget Process Steps

1). Revenue plugs

Be cautious when estimating revenue. Ideally when you are budgeting revenue, you’re not just picking a number based on last year’s revenue. It’s important to be budgeting revenue based on a key driver. Base financial projections on realistic market conditions and historical data rather than unsupported numbers. I often recommend including three scenarios: average, awesome and anemic. Overestimating your revenue can lead to financial strain and misaligned expectations.

2). Neglecting the contingency budget

Unforeseen costs can arise at any time. It’s crucial to include a buffer in your budget to handle surprise CapEx for example.

Related Read: How to Create a CapEx Budget

3). Failing to check back in with your budget

Creating a budget is not a one-time task. And yet, the number of entrepreneurs I see that create a budget and then never look at it again… SMH. Regularly tracking, reviewing, and updating the budget is essential for its effectiveness. This ensures that your budget remains accurate, relevant, and aligned with your business’s evolving needs.

4). Too much detail

Think key growth drivers for how many hires to support x-amount of growth, rather than each department gets a new stapler this year (regardless of how much Office Space puts value on them!)

Manager, Carolyn Koonce, recommends that clients “DO get detailed in their biggest drivers, which are usually income, COGS [cost of goods sold], and personnel expenses. Budget salary by person rather than a flat percentage across all positions. Think about if any positions will need to be added in throughout the year to sustain the growth you’re predicting. Then stay high-level on the less impactful things. Instead of listing out each supply need per department, include a general 10% increase and move on!”

Example: Let’s say the average salary for a salesperson is $82,500 and there are four positions available. Tally up your head counts to budget for benefits, equipment (we’re talking computers, monitors, printers, NOT staplers!), software as a service, training, and other expenses. Then multiply ($82,500 + personnel expenses) by the number of existing salespeople and any you anticipate hiring for the year ahead.

This approach avoids getting bogged down in details, while still obtaining valid results for comparison.

5). Not including relevant teams and departments

This kind of goes back to the idea of revenue plugs. Don’t forecast sales without speaking to the sales team, don’t budget professional services without checking in with your operations managers.

Tools for Budget Process

Spreadsheets

Many companies will use Microsoft Excel for budget planning. It allows for easy organization, calculation, and analysis of financial data.

Budgeting Apps and Accounting Software and Apps

There are numerous budgeting apps and software available that offer features specifically designed for small businesses. These tools automate calculations, provide visual representations of data, and offer convenient (although not always accurate) budget tracking. Many accounting software solutions, such as QuickBooks, Xero and NetSuite include budgeting features. These tools integrate budget planning with other financial management functions, streamlining your overall financial processes.

Here’s my CFO caveat though: while these budgeting (and forecasting) tools can automate certain functions of the budget process, there is no price tag on the value you can extract from drilling down into these variances as a team. It gives you direct insight into operations so you can adjust to meet your targets at year-end.

Case Studies in Budget Planning

Case Study: A budget planning mistake leads to business failure

In 2018, a small retail business expanded without comprehensive budget planning. They underestimated the costs associated with the expansion, leading to a significant financial strain. Consequently, the business had to close its doors within a year.

Key Takeaways:

- Without scenario planning (in this case the anemic version), you risk business failure.

- This case highlights the importance of thorough contingency budgeting and the potential consequences of neglecting this critical step.

Case Study: A successful budget process with an outsourced CFO

In 2022, one of our clients switched to weekly meetings with their outsourced CFO to track financial reporting, including budget variances and customer channel profitability.

Key Takeaways:

- By closely monitoring their budget and making data-driven decisions, they experienced a remarkable revenue growth of 120%.

- This case exemplifies the positive impact of rolling budgets and nimble decision-making.

Tips for making the most of the budget process

- Regularly Review and Update the Budget:

Review your budget on a consistent basis, ideally monthly. This ensures that it remains accurate and aligned with your business’s financial goals and market conditions. Look for budget variances as a precursor to adjusting your operations and adjust your budget as needed to reflect any changes in income, expenses, or business strategies.

- Involve Key Stakeholders in the Budgeting Process:

Engage relevant team members, such as department heads or managers, in your budget process steps. Their input can provide valuable insights and promote a sense of ownership and accountability for budget adherence.

- Seek Professional Advice When Needed:

Consider consulting with a financial advisor or an outsourced CFO to ensure your budget is comprehensive and aligned with your business’s long-term financial objectives. They can provide expert guidance on financial planning, risk management, and strategies for optimizing your budget.

The Bottom Line

Mastering budget planning is essential for small businesses to achieve financial stability, make informed decisions, and set and track your financial goals. By understanding the importance of budgeting, following these budget process steps, avoiding common mistakes, and learning from real-life case studies, you can create effective budgets that drive business growth. Start implementing these budgeting practices today with our outsourced CFO services.