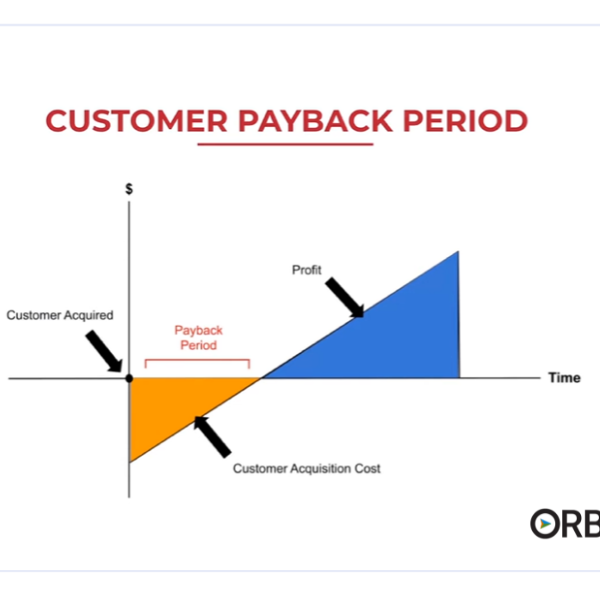

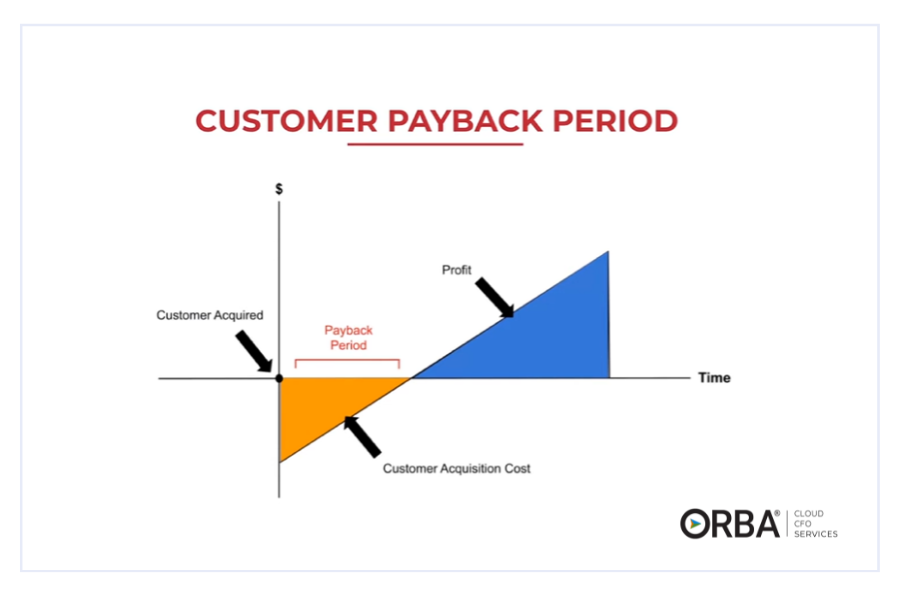

Many scaling businesses fail because they don’t put enough emphasis on the Payback Period (which we’ll get to soon).

Your Payback Period (PBP) is the length of time it takes to recover the cost of an investment.

A Quick Guide to Payback Period

Your customer payback period (PBP) tells you how long it takes for a customer to be earning you profit. In other words it’s your customer payback velocity.

Why do we care about payback period?

Often used by marketers in conjunction with customer acquisition cost (CAC), a short payback period suggests profitable growth.

Payback Period is used to evaluate risk and/or liquidity of an investment. Your payback period calculates the time it takes for an investment to generate enough cash flow to recover its initial cost. In other words, it measures the period of time it takes for you to break even (another useful KPI).

Typically, this metric is expressed in years or months depending on your risk tolerance and the size of the cash investment.

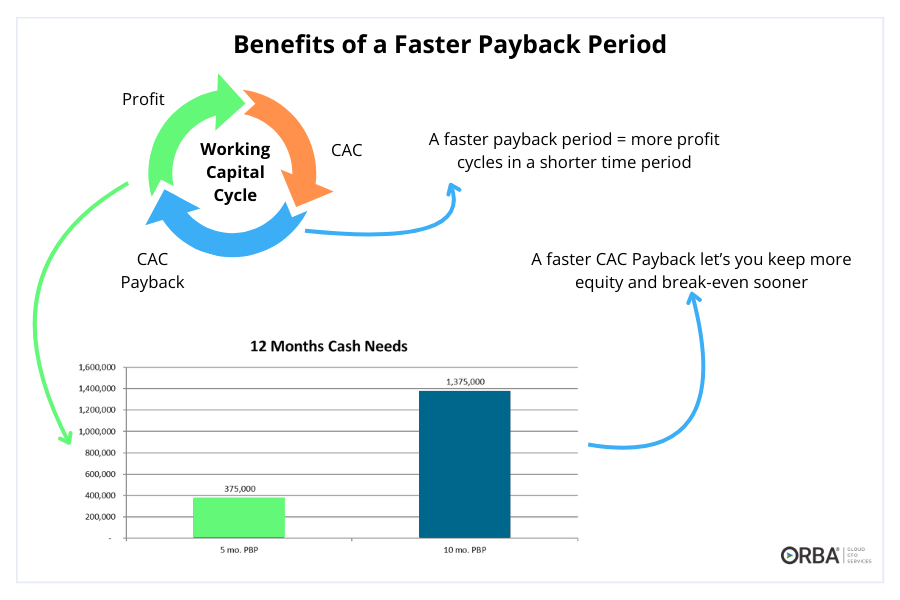

“A faster PBP means more profit cycles in a shorter time period (and less capital needed to fund growth).”

Generally, you are aiming for a shorter payback period as it means you’ve recovered your investment sooner and lowered your risk exposure.

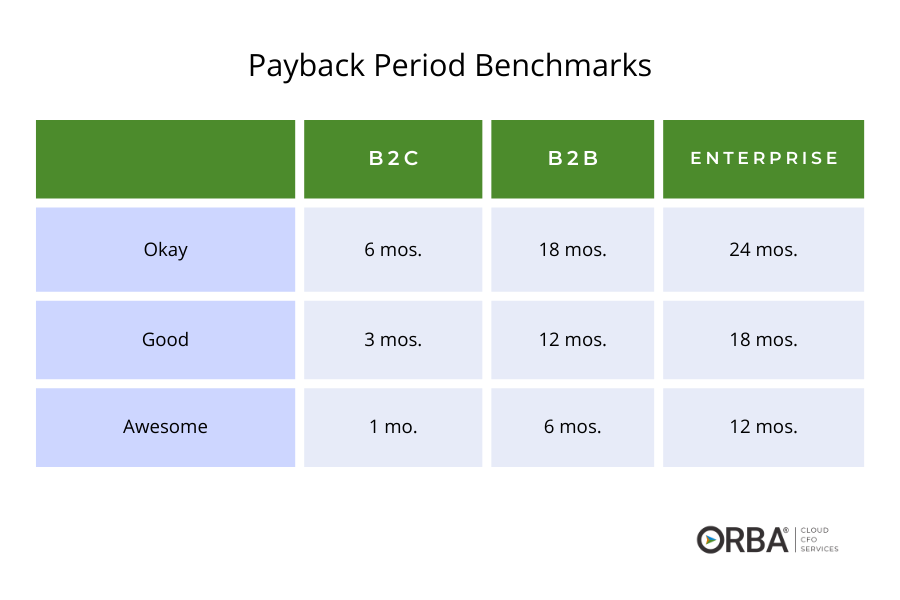

Cloud CFO Benchmarks: If you don’t have the capital to fund losses, your PBP should be short. A good payback period for smaller B2B and SaaS companies is 12 months or less. But, it’s ideal to be less than six months if you’re in hyper-growth mode (greater than 50% revenue growth per year). For a B2C company we’d recommend to aim for an even faster PBP: say three to six months.

That said, it can really vary by industry and company size. For example, using Meritech Capital’s PBP table, HubSpot’s payback period is 22.5 months while Bill.com’s (BILL) is 80 months. BILL can handle more risk exposure given the size of their company, though in our opinion, these PBP’s could be a lot better.

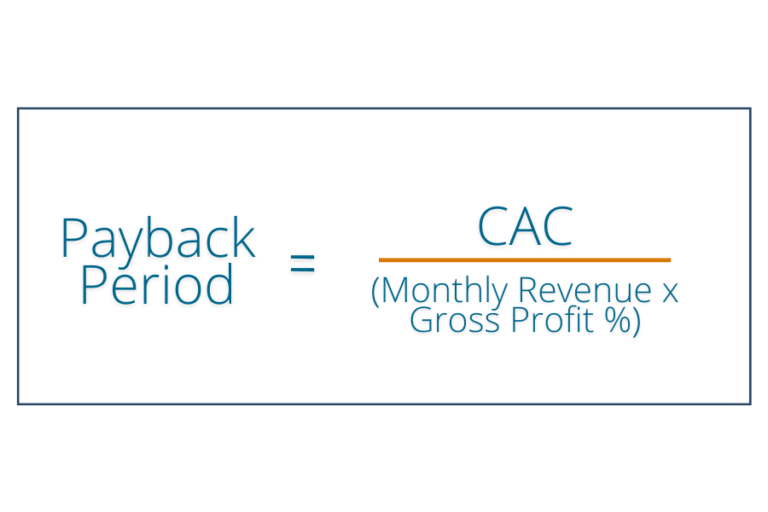

Payback Period Formula

To calculate payback period use the formula: payback period = Investment or cost of asset/(monthly revenue x gross profit %). So to find the payback period calculation per customer, use the following formula:

Cloud CFO Tip: Rather than defaulting to quarterly periods to calculate your customer payback, we recommend using a period equal to your average sales cycle (ie. one month) to give you a more accurate picture of how quickly you’re recovering your sales and marketing costs.

How to Calculate Payback Period

3 steps to calculate customer payback period:

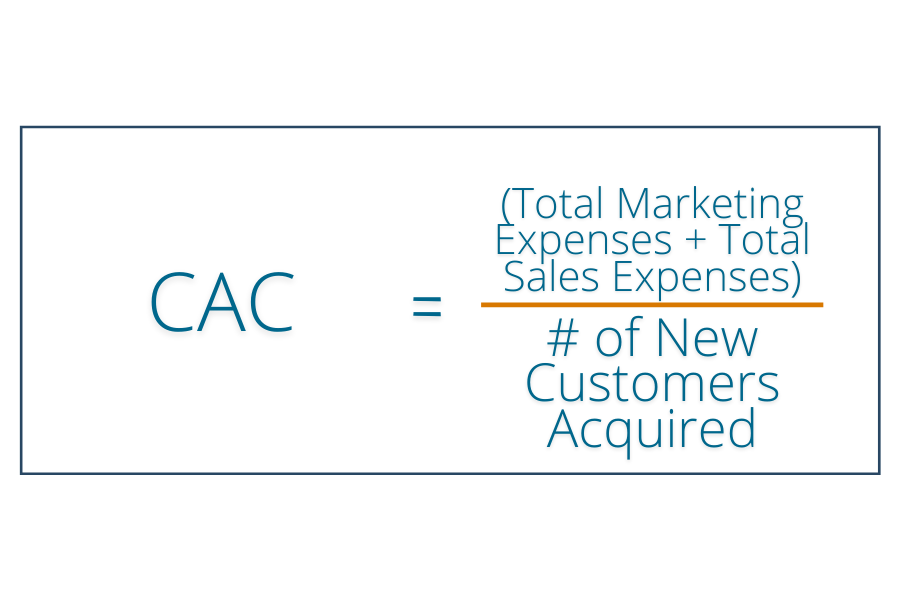

1). Find your customer acquisition cost

First, calculate your CAC using this formula: Customer Acquisition Cost = (Total marketing expenses + total sales expenses)/# of new customers acquired

Remember, your CAC includes more than the cost of ads.

While paid advertising may be obvious, it’s important to remember not to omit things like PR, Free Trial support and hosting, etc.

Included in CAC

- Paid advertising

- PR

- Sales people base & commission

- Sales manager compensation

- Free trial and freemium user support and hosting

- Affiliate fees

- Cost to create content for SEO/social media strategy

Not included in CAC

- Account management

- Hosting

- Training on new releases

- Customer service

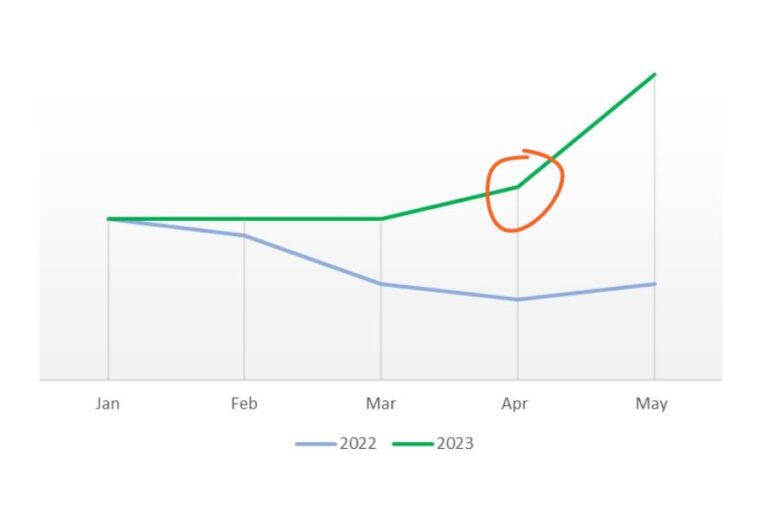

Many marketers and business owners only focus on how to lower customer acquisition cost (CAC), this can be misleading. For example, ABC Office Supplies has a $100 CAC and OfficePlus has a $500 CAC for a similar product. You’d think ABC Office Supplies is going to come out on top right?

Nope.

ABC Office Supplies takes 2 years to recoup that $100, while OfficePlus gets their $500 paid back in just three months with an additional $750 in revenue. If you understand the time value of money, you will know that the opportunity cost of having a longer payback period puts OfficePlus at a disadvantage.

That’s why we recommend taking into account a few of the customer success KPIs like CAC:LTV and Payback Period to really focus on revenue growth.

2). Find your monthly revenue

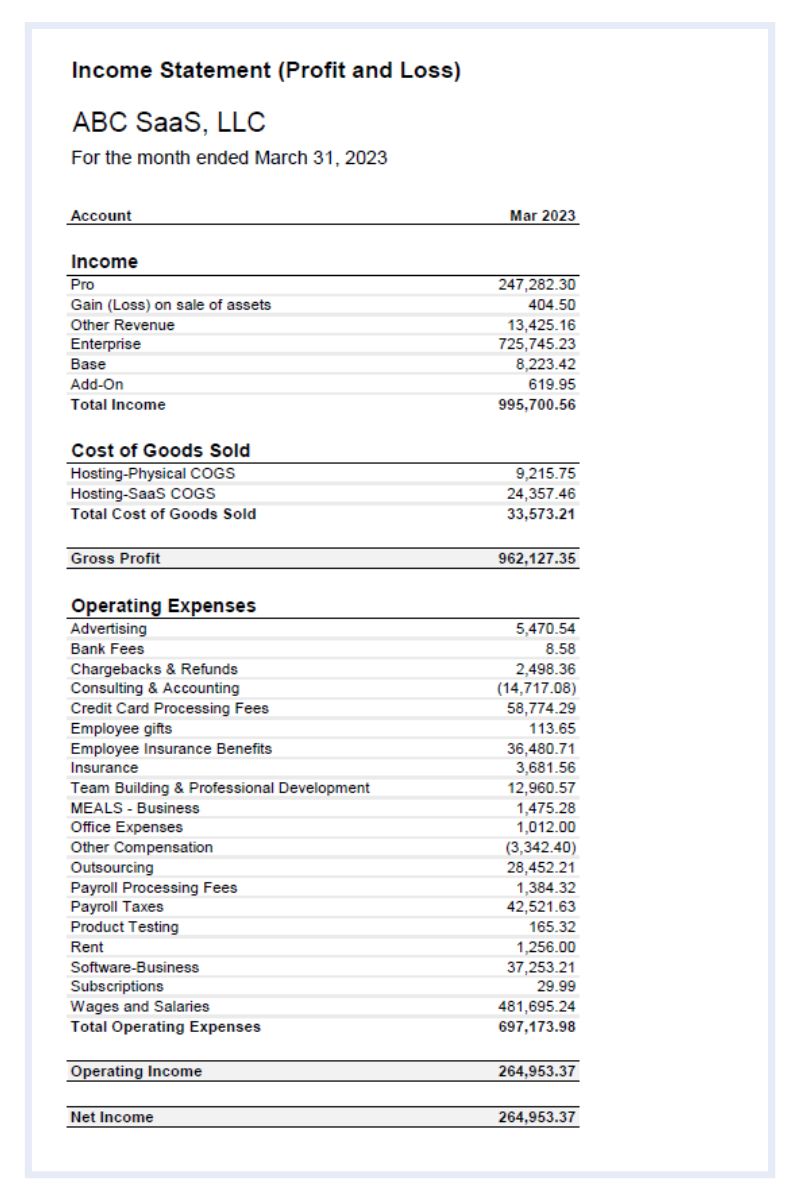

Next up, to calculate payback period you’ll need to find your total monthly revenue: found on your income statement or profit and loss (P&L).

3). Find your gross profit %

Finally, find your gross profit percentage.

Your gross profit percentage measures gross profit as a percentage of total revenue. It can also be known as gross margin on sales, gross profit margin (GPM), or gross margin percentage.

Find your gross profit using this formula: Gross profit = (Revenue – COGS)/Revenue x 100

So, using the income statement example above, the gross profit % of this SaaS would be ($995,700.56 – 33,573.21)/995700.56 = 0.966 x 100 = 96.6%.

Some of examples of COGS by industry include:

SaaS

- Web hosting

- Software

- Server fees

- Research & development expenses (salaries, technology, equipment)

- Customer support (if necessary for revenue retention)

Manufacturing

- Raw materials cost

- Labor

- Factory overhead

- Equipment depreciation

Services

- Labor costs like wages

- Materials and supplies directly related to offering the service

How to Shorten your Payback Period

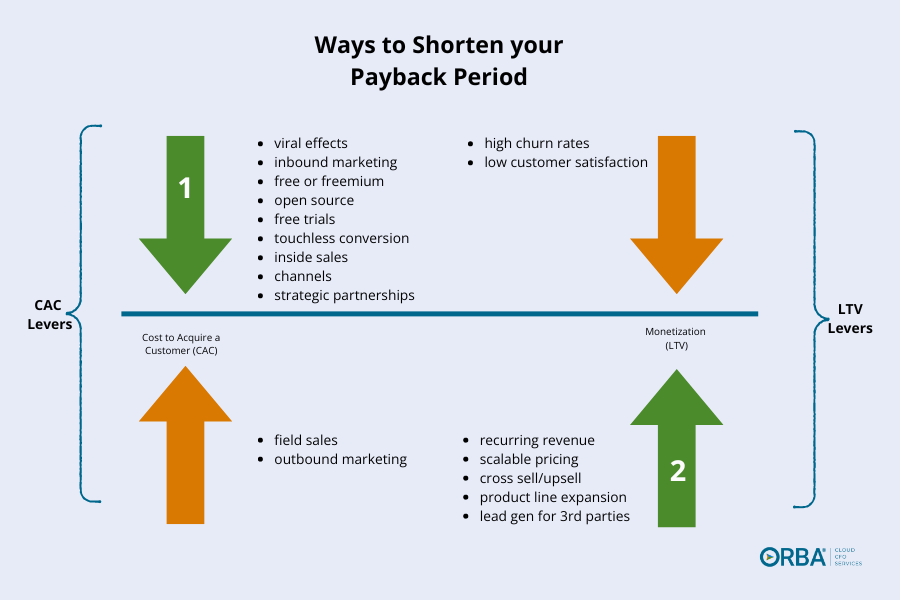

There are a number of ways you can shorten your payback period by pulling on the correct CAC and LTV levers:

3 ways to shorten your payback period include:

1.Reduce the CAC (so focus on improving the list of items next to the green CAC arrow #1 above)

2.Increase the monthly profit margin for the customer (focus on those items listed next to the green LTV arrow #2)

3.Accelerate customer payments (e.g. annual subscription paid upfront)

Payback Period vs Discounted Payback Period

While payback period is easy to understand it does have a couple of drawbacks when you’re using it to judge an investment:

- Future value of cash over time is ignored.

- When calculating payback period, generally you are also ignoring any future cash inflow after the initial investment has been recovered.

If you want to account for future cash flow, you will want to use the capital budgeting formula called discounted payback period. Your discounted payback period is the amount of time it takes to reach the break even point on an investment by discounting future cash flows to adjust for the time value of money.

Calculating discounted payback period is a key metric in understanding your true return on investment, and will help you make critical potential investment decisions.

Need help understanding how to calculate your payback period correctly? That’s what we’re here for. Get in touch to learn more about how we can help.

Key Takeaways

- Payback Period (PBP) is an important measure that tells you how long it takes your company to recover the cost of an investment (like acquiring one customer).

- A faster PBP means more profit cycles in the same time period.

- When calculating PBP, include all related costs for CAC and COGS.

- Pull on the CAC and LTV levers to shorten your payback period.

- When using PBP to judge an investment remember that it does not account for discounted cash flow.

Learn more about how tracking the right KPIs with our fractional CFO services can help your business grow.