Capital expenditure, or CapEx, is a critical aspect of any business’s financial planning. For entrepreneurs, CEOs, COOs, and small business owners, understanding how to budget capital expenses effectively can be the difference between sustained growth and financial instability. In this blog post, we’ll explore the fundamentals of CapEx, how to calculate it, and provide a step-by-step guide on crafting a robust CapEx budget. By the end, you’ll have the insights needed to make informed decisions that drive your business forward.

What is Capital Expenditure (CapEx)?

Capital expenditures (CapEx) are funds used by a business to acquire, upgrade, and maintain physical assets such as property, industrial buildings or equipment. This type of spending is crucial as it impacts the long-term performance and capacity of a business.

CapEx is not just about buying new assets. It also includes making significant improvements to existing ones. For example, upgrading machinery in a manufacturing plant or renovating office space to improve productivity.

Understanding CapEx is essential because it represents a major investment of resources. These investments are usually substantial and can affect a company’s cash flow and financial health. Unlike operating expenses (OpEx), which cover day-to-day operational costs, CapEx investments are expected to generate benefits over a longer period.

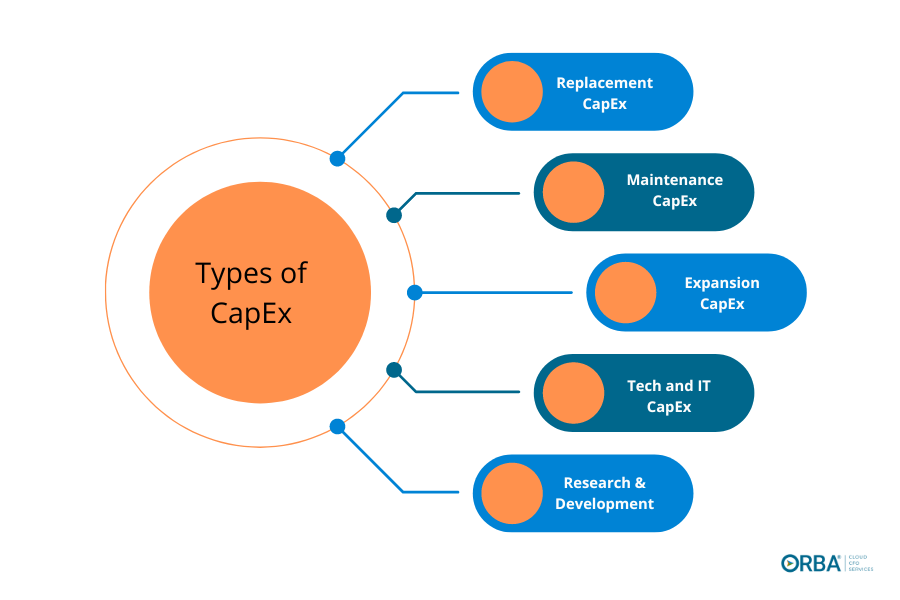

Types of Capital Expenditures

There are a number of capital expenditures you may need to budget for:

- Replacement CapEx

- Example: a manufacturing company that needs to replace machinery

- Maintenance CapEx

- Example: an oil & gas company that needs to maintain drills, wells and equipment

- Expansion CapEx

- Example: a retail business that plans to open a new location

- Tech and IT

- Example: a telecom company that needs to upgrade data centers

- Research and Development (R&D)

- Example: a health & wellness business that needs to hire specialists to develop a product

How to Calculate CapEx

To manage CapEx effectively, you need to know how to calculate it accurately. The basic formula for calculating CapEx is:

CapEx = Change in Fixed Assets + Depreciation Expense

First, identify the change in fixed assets from one accounting period to the next. This change can be found on the company’s balance sheet. For instance, if your fixed assets increased from $500,000 to $600,000, the change is $100,000.

Next, add the depreciation expense, which is a non-cash expense representing the wear and tear on assets. If the depreciation expense for the period is $50,000, then your CapEx is calculated: $100,000 + $50,000 = $150,000 CapEx.

This formula provides a snapshot of the funds invested in maintaining and improving the company’s asset base.

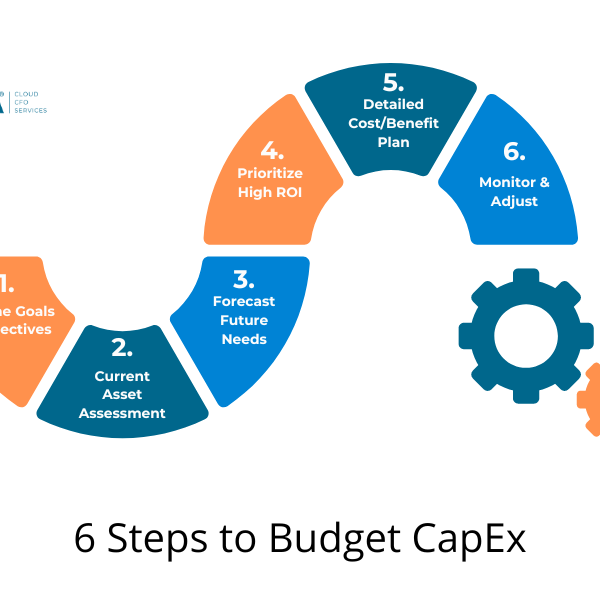

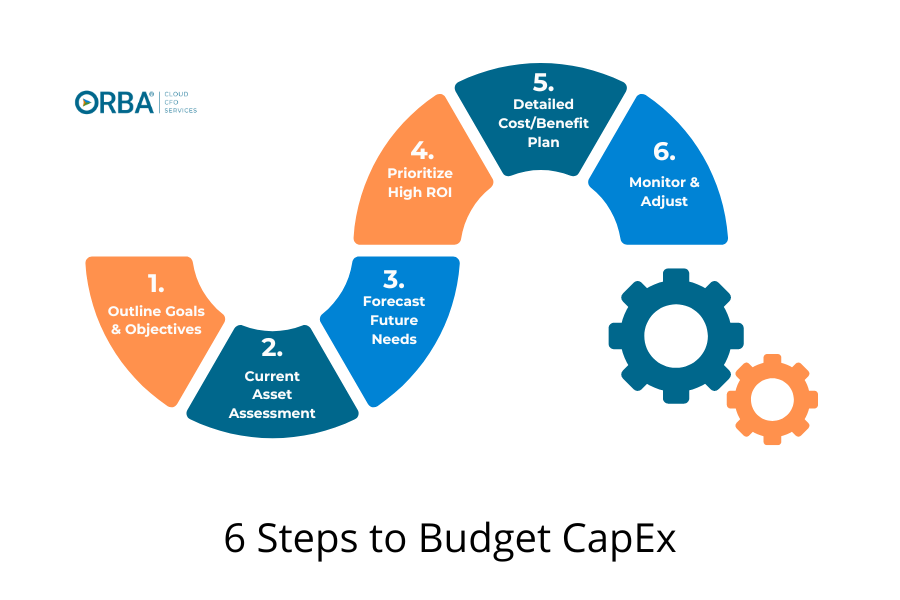

How to Create a Capital Expense Budget

1. Identify Business Goals and Objectives

Before you can start budgeting, it’s vital to outline your business goals and objectives. Are you looking to expand your operations, improve efficiency, or enter a new market? Understanding your strategic priorities will help you make informed decisions about where to allocate your CapEx funds. Consider the lifespan of equipment and implement a maintenance strategy to extend its life and reduce CapEx.

2. Assess Current Assets

Conduct a thorough assessment of your current assets. Identify which assets are performing well and which ones need upgrades or replacements. For example, if you have outdated machinery that frequently breaks down, it might be time to invest in new equipment.

Cloud CFO Tip: You might consider looking at your net present value (NPV), or the difference between the current value of cash inflows and cash outflows. This helps account for the value and rate of return for projects within a set period of time.

3. Forecast Future Needs

Project your future needs based on your business goals. If you plan to increase production, consider the additional machinery or space you will require. Use historical data and market trends to make realistic forecasts. Without a benchmark, it will be difficult to determine the cost efficacy of their capex.

Consider upgrading for automation and build in that contingency. Sudden equipment failures can cause unexpected expenses that can disrupt budget planning. Scenario planning and sensitivity analysis can help understand how changes to CapEx may impact supply chains and mergers and acquisitions.

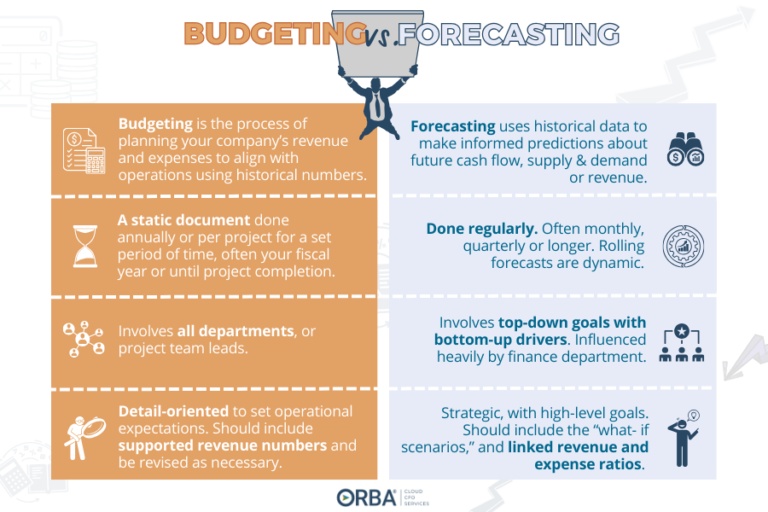

Related Read: A business owner’s guide to budgeting and forecasting

4. Prioritize Investments

Once you have a list of potential investments, prioritize them based on their expected return on investment (ROI) and alignment with your business goals. High-priority projects should be those that offer the most significant benefits and align closely with your strategic objectives.

Cloud CFO Tip: Using the internal rate of return (IRR), can help you determine the annual rate of growth the CapEx project is expected to generate.

5. Develop a Detailed Plan

Create a detailed plan outlining each investment, its cost, and the expected benefits. Include timelines for implementation and any potential risks. A well-documented plan will help you secure funding and ensure that all stakeholders are on the same page.

Cloud CFO Tip: Remember to identify the absolute lowest-cost design capable of meeting the project objectives. Once the minimum is set you can look at how much wiggle room you have to include other features and wish list items.

6. Monitor and Adjust

Regularly monitor the budget variances of your CapEx projects and compare actual spending to your budget. Be prepared to make adjustments as needed. Market conditions and business needs can change, and your budget should be flexible enough to accommodate these changes.

Cloud CFO Tip: Use the payback period to analyze the time required for your CapEx investment to generate the revenue needed to cover the amount you invested in the project.

Example Case Study

Consider a mid-sized manufacturing company, ABC Office Supplies, looking to expand its production capabilities. The CEO, Jane, identified that the current machinery is outdated and frequently breaks down, leading to production delays and increased maintenance costs.

Step 1

Jane’s goal is to increase production by 20% within the next year to meet growing customer demand.

Step 2

The company conducts an assessment and finds that the existing machinery is over 10 years old and not as efficient as newer models.

Step 3

Jane projects that to achieve the desired production increase, Acme Corp will need to invest in two new state-of-the-art machines.

Step 4

After evaluating the potential ROI, Jane prioritizes the purchase of the new machinery as it directly impacts production capacity and efficiency.

Step 5

Jane creates a detailed plan that includes the cost of the new machines ($500,000), installation timelines, and expected benefits such as reduced maintenance costs and increased production speed.

Step 6

Over the next few months, Jane monitors the installation process and ensures that the project stays within budget. She also tracks the performance of the new machines to confirm that they deliver the expected benefits.

CapEx Budget Pitfalls

Where does CapEx budgeting go wrong? With sloppy execution and poor planning that costs you money and time. This is also when the you start to see failed deliverables.

Proper planning and budgeting for CapEx recognizes things that often go overlooked in the CapEx budget process. Things like:

- disposal costs

- consumables

- small parts

- rental costs

- delivery charges and/or expedite charges

- permits

- supply chain delays

CapEx FAQ

What is CapEx?

Capital Expenditure (CapEx) refers to the funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment. It is a crucial aspect of making long-term investments for growth and sustainability.

How does CapEx differ from OpEx?

While CapEx involves significant investments in physical assets aimed at long-term benefits, Operating Expense (OpEx) focuses on the ongoing costs of running a business, such as salaries, rent, and utilities. CapEx is usually a one-time expenditure, whereas OpEx is recurrent.

Why is CapEx important for growth?

Investing in CapEx allows companies to improve their operational efficiencies, expand production capacities, and enhance product quality. Such investments can lead to increased profits and a stronger competitive advantage in the market.

How should companies evaluate CapEx projects?

Companies should assess CapEx projects through a cost-benefit analysis, considering drivers such as:

- Return on Investment (ROI)

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Payback period (PBP)

along with the alignment with strategic business goals. This evaluation helps in determining which projects are worth pursuing.

What are some common challenges in managing CapEx?

Challenges may include

- budgeting constraints

- unexpected costs

- project delays

Effective planning, continuous monitoring, and adaptive strategies can help mitigate these challenges and ensure successful CapEx management.

The Bottom Line

Budgeting for CapEx is a crucial task that demands a strategic approach. By understanding what CapEx is and how to calculate it, you can make informed decisions that align with your business goals. Following a step-by-step process ensures that your investments will deliver the desired outcomes, driving growth and efficiency.

Remember, a well-planned CapEx budget not only supports your current operations but also sets the stage for future success. If you’re ready to take your business to the next level, start by mastering your CapEx budgeting today.

Feel free to reach out to our team of outsourced CFOs for personalized advice on optimizing your CapEx strategy. Let’s build a brighter future for your business together.