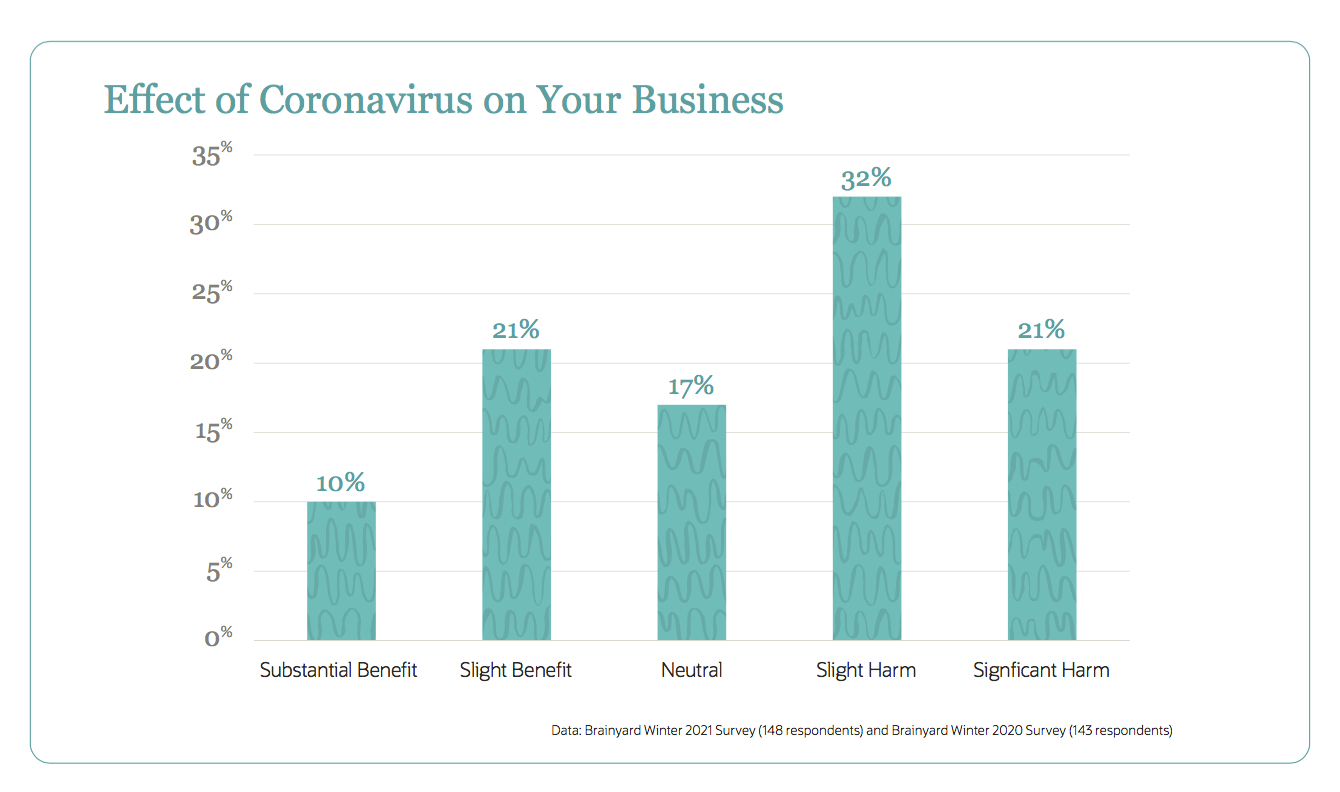

In their recent survey of business leaders, NetSuite found that over 50% of business owners were harmed by the impact of COVID-19. In these instances it becomes imperative to get creative to increase your cash flow.

Does the COVID crisis have you strapped for cash?

In this quickly-changing COVID landscape, the restrictions to your cash flow come hard and fast. In a crisis, restricted cash flow can be a double-edged sword. To stay afloat, a business must improve liquidity for fluctuating priorities. So while inevitably many will focus solely on cutting costs, there are a few other ways to get creative with cash flow in a crisis.

Here are a few creative ways you can come up with some cash in a crunch:

1. Worry less about margin, more about cash.

This goes against everything you’ve always been told up until now- but, in this current climate, now is not the time to worry about your markup on inventory. You need cash in the door and quickly? Forget about offering discounts that still make you a margin. Just sell off as much inventory you can even if you’re technically taking a loss. The more you sell, the more cash in your hands.

Note: this is the case when you are trying to get cash in hand, and fast. Now that inflation has spiked the CPI, we recommend raising your prices to meet your margins. Track your supply chain KPIs to stay on top of when to sell off or when to raise prices to optimize both your inventory and cash flow. Worried about how customers will handle the increase? Use this price increase letter template.

2. Offer special discounting.

This goes hand-in-hand with number one, but by offering exceptional discounts you can drive sales you might not have otherwise. One way to increase cash flow is using referral programs that offer ways to actually increase sales. More people referred = more people buying your product or service = more cash. In fact, according to Andrew Roth, a McKinsey partner in digital ventures, 20-30% of all new customers are driven by referral programs.

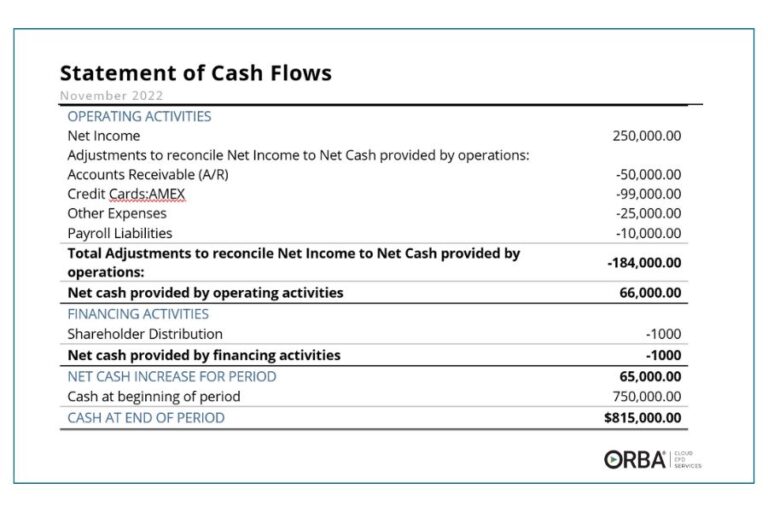

3. Get on top of all your accounts receivable.

If you’re not already, get on top of any outstanding receivables. To improve your accounts receivable process consider offering early-pay discounts to increase cash flow.

If you’re really in a cash crunch you could investigate options for factoring your invoices; however, factoring is hard on your bottom line and controversial. You will want to be careful which company you employ. Some are more transparent than others. Look for companies that offer more flexible contracts with a policy open to selective invoices or companies that offer solid discount and advance rates. Ramp Flex is a popular option for businesses in the ecommerce, construction and manufacturing industries with long cash conversion cycles.

4. Offer recurring or subscription services.

Many individuals and companies will be looking to limit their own cash outflow for the foreseeable future. Look to pivot how you offer your products and services to meet that demand. Is there a way you could offer your product in a subscription format? It will be more attractive to your customers and it will also allow you to plan ahead with recurring cash.

5. Apply for a rainy day loan.

Ditch your line of credit and build your rainy day fund. In our last blog, we discussed the unique opportunity that exists with low-interest rates. If you have a solid P&L and balance sheet without too much existing debt, take out a fixed-term loan to get some cash up front. It can either help you survive or better yet, help you double-down.

Related Read: That said, if you are going to apply for a business line of credit, read these tips first on how to get your financial reports and calculate your borrowing base.

6. If you are going to cut costs, make sure those cuts are both effective and strategic.

Begin mitigating risk and streamlining your spending with a zero-based budgeting approach.

Where possible, swap fixed costs for variable costs. For example, reducing fixed salaries of your sales team by offering them a higher sales commission can be an attractive offer to your A-list salespeople.

Note that your management philosophy becomes important as soon as you begin using words like cost reduction. Nobody wants to jump to this, but if cutting costs results in discussions about layoffs, communicate with your remaining team to make sure they understand you’re aiming to let your “C players” go to build a stronger, more efficient team. Do whatever you can to maintain a positive work environment.

Investigate options for cutting costs that won’t impact your business. Look into whether you can defer rent or mortgage payments. Talk to your landlord or bank about special options available in this crisis.

7. Have your accounting team look into all government aid or tax credits available to your business.

If they’re not already, your finance team should be investigating every option available to your business within the recently passed CARES act and stimulus package. That isn’t limited to the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL). There are other resources available in the stimulus package, like the Emergency Paid Sick Leave benefits or Employee Retention Credit that could help your business stay afloat. That said, we are advising all of our clients to go after the PPP loan first- with its 1% interest rate, 2-year term, and a sizable chunk being forgivable there is little downside to applying. Important to note that it’s first come, first served, so act quickly.

Read our resources on the Paycheck Protection Program and its updated program rules.

In a financial crisis, smart business owners should shift their focus to their balance sheet to uncover where to make adjustments to payables, receivables and inventory in order to free up as much cash as they can. Get in touch to learn more about cost-cutting, zero-based budgeting or how to apply for the PPP.