The secret to cash flow awesomeness? Cash flow analysis.

Imagine walking into a store without really knowing whether your card would be declined. Cue the anxiety right?

Now imagine owning a business and not knowing how much cash you had and whether you could pay next months bills, taxes and payroll. Somehow, we continue to meet new clients that aren’t regularly performing cash flow analysis.

Cash flow analysis examines your company’s cash inflows and outflows during a specific period. Cash flow KPIs are the indicators you can measure to perform that cash flow analysis.

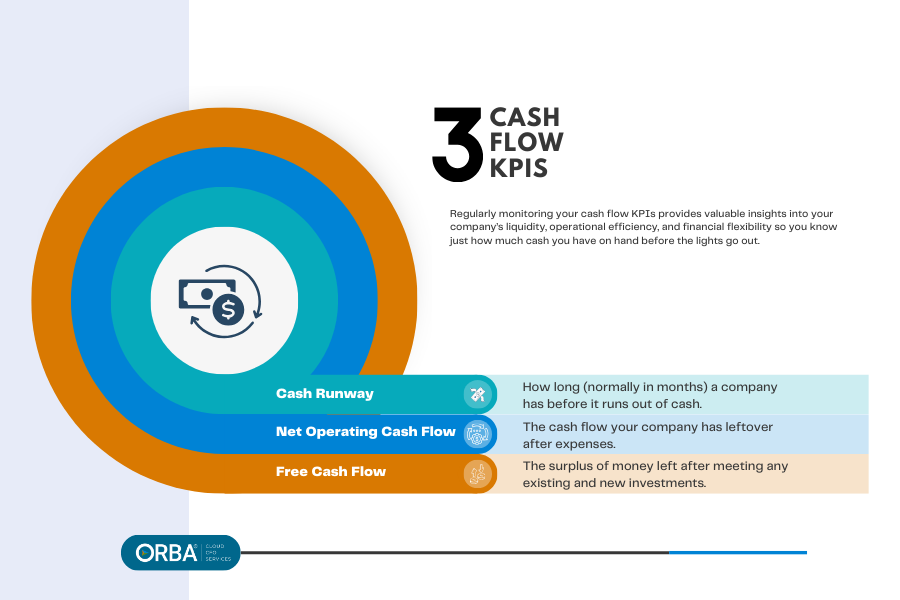

Regularly monitoring your cash flow KPIs provides valuable insights into your company’s liquidity, operational efficiency, and financial flexibility so you know just how much cash you have on hand before the lights go out.

What is Cash Flow?

- Definition: Cash flow is the money coming in and out of your business. Cash received = cash inflows, and cash spent = cash outflows.

- Importance: Cash flow is the root of every business. You need to have a steady stream of capital to keep the door open (or, in the case of an ecommerce business, to keep the site running).

- Types of Cash Flow: operating cash flow, net cash flow, free cash flow

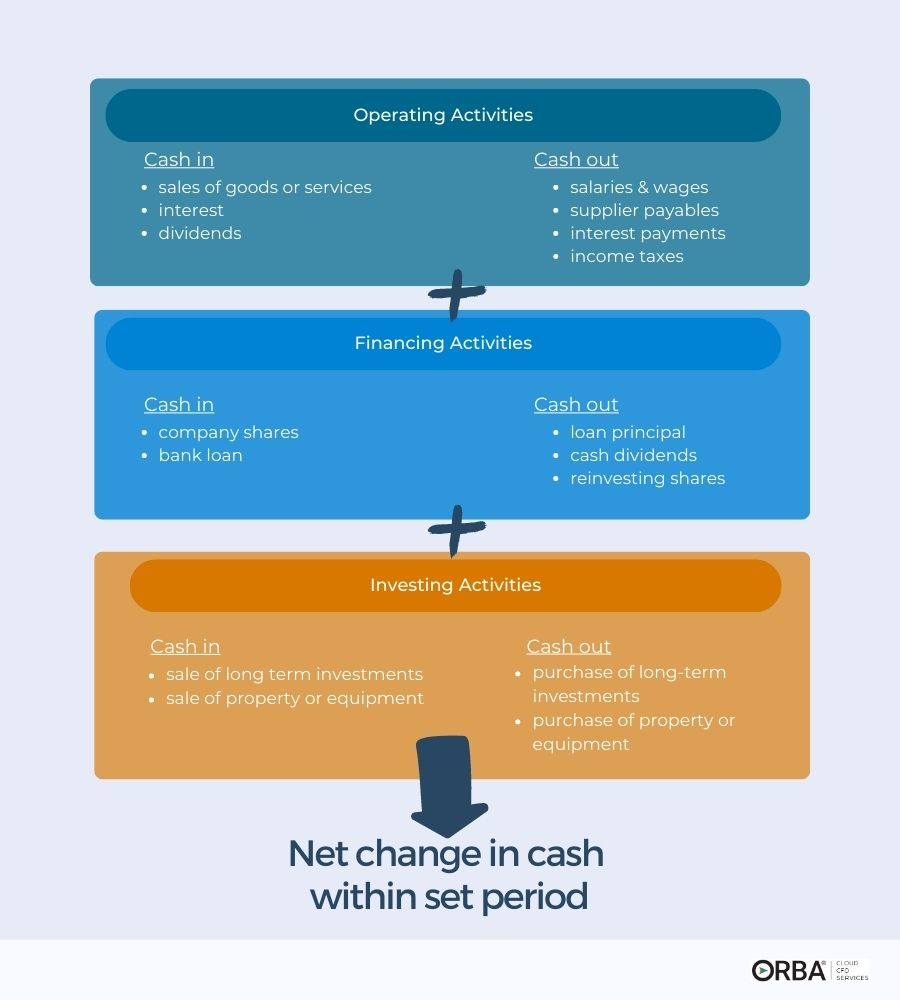

There are three main types of cash flow activities:

- Cash from operating activities: This is money from customers minus operating expenses. These expenses include salaries and wages, rent, utilities and supplies.

- Investing activities: This includes long-term, or capital investments, like property equipment in a plant and stock or securities.

- Financing cash flow: This funding comes from investors, owners and creditors. It’s classified as debt, equity and dividend transactions on the cash flow statement.

Cash Flow from Operations = Net Income + Non-Cash Items + Changes in Working Capital.

As companies grow, it’s common for them to ignore the balance sheet and focus too much on their P&L, resulting in a greater investment in improving their working capital ratio than needed. Instead they should turn focus to the cash conversion cycle and other cash flow KPIs.

There are a number of measures you could monitor as part of your cash flow analysis but here are three cash flow KPIs every business leader should track: cash runway, net operating cash flow and free cash flow.

Cash Flow KPI #1 – Cash Runway

Cash runway measures how long (normally in months) a company has before it runs out of cash.

Cash runway becomes an especially important cash flow KPI for small businesses and those in the startup phase because they are more likely to need cash in order to scale. It’s vital for your finance team to understand cash runway to:

- Pinpoint cash flow issues early on

- Make better decisions about your short and long term cash plans

- Better communicate with investors and lenders sooner

Cash runway is estimated using your burn rate (e.g., dividing current cash reserves by monthly cash burn rate).

For example, is a company is burning $10,000 every month and has $80,000 to spend, the cash runway would be estimated to be 8 months. If your runway is consistently under a year, we recommend monitoring it every month.

Cloud CFO tip: If your cash runway is longer you could probably check in quarterly.

Cash Flow KPI #2 – Net Operating Cash Flow

Net Operating Cash Flow (NOCF) is the cash flow your company has leftover after expenses. It is an indicator of whether you can generate cash from your operations.

NOCF tells you whether you can pay your vendors, employees and other operational costs. It is essential to forecasting future cash flow and helps your finance team:

- Evaluate your company’s financial health

- Assess core profitability of your business operations

- Make cash decisions

- Highlight future cash flow issues or opportunities

To calculate net operating cash flow subtract your operating expenses (including interest, depreciation and amortization) from your operating revenue (or income).

Cloud CFO tip: you should be checking in with your NOCF on a monthly basis

Cash Flow KPI #3 – Free Cash Flow

Your free cash flow (FCF) is the surplus of money left after meeting any existing and new investments. Looking at FCF along with your balance sheet gives you valuable insights into long-term potential for growth.

While Free Cash Flow is a more volatile measure due to changes in working capital and CapEx spending, it is hard to manipulate when compared to EBITDA or Net Income. Ultimately, metrics like FCF offer a more holistic measure that include D&A and balance these items against your CapEx. Including FCF in your cash flow analysis helps your finance team know how much cash is available for:

- expansion

- paying dividends

- debt repayment

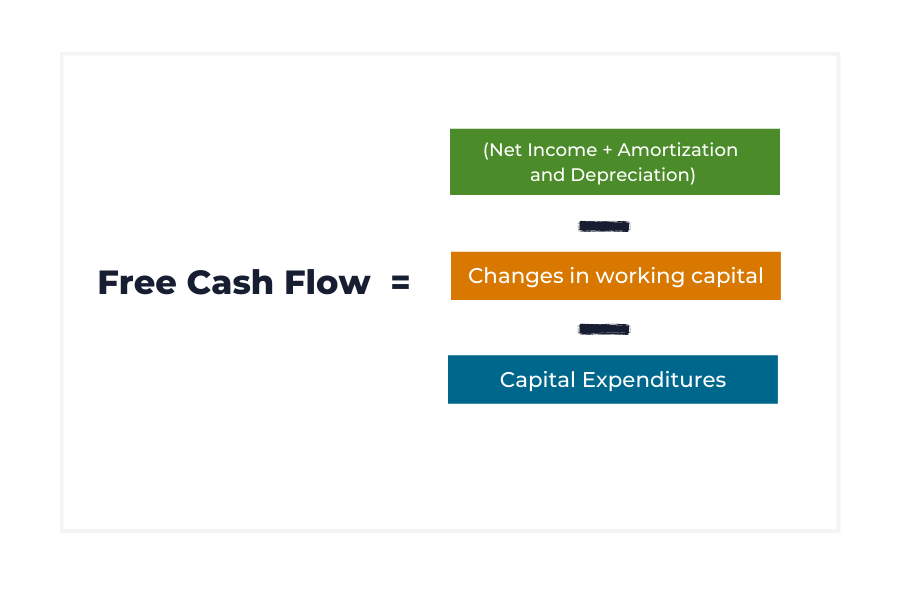

To calculate free cash flow, start with your net income and add back your amortization and depreciation. Subtract your working capital (to do this, subtract your current liabilities from current assets). Then subtract any capital expenditure. You’ve found your free cash flow!

Free Cash Flow = Net Income + Depreciation & Amortization +/- Non-Cash Income And Expenses +/- Changes In Net Working Capital – Capital Expenditures

If a business can pay for operations and growth, this indicates to investors that it has a solid foundation. A large FCF is a good sign that a growing company will also have growing earnings in the near future.

Cloud CFO tip: Compare your FCF over different periods.

- Trend analysis: look at how FCF changes from month to month

- Ratio Analysis: compare FCF against total sales.

This analysis helps you understand not just your current state of cash flow but also its trend direction and volume.

Bonus KPI: Cash Conversion Cycle

The cash conversion cycle measures how quickly your company turns inventory into cash. It calculates your inventory into cash within a set time period.

If you operate in ecommerce, manufacturing or consumer goods, you may find the cash conversion cycle (CCC) is a more useful measure of liquidity than the working capital ratio. An unsustainable CCC is a red flag that you may be seeing issues with liquidity and should signal a need for improvements to your working capital.

The cash conversion cycle formula is:

Cash Conversion Cycle (CCC) = DIO + DSO – DPO

Generally, the lower your CCC, the better. A lower cash conversion cycle is an indicator of a faster inventory-to-cash process. Meaning your working capital is tied up for a shorter amount of time and your business has greater liquidity, a.k.a, better cash flow.

How to Use Cash Flow Analysis to Make Informed Decisions

Monitoring these cash flow KPIS is can be a proactive financial strategy for a number of scenarios and stakeholders:

- Business executives and CFOs can use FCF to monitor company health and guide plans for business expansion or reinvestment.

- Creditors and lenders use FCF to ascertain how much debt your company can take on.

- Investors and shareholders use this to understand how much cash your company can generate and how much is available to distribute.

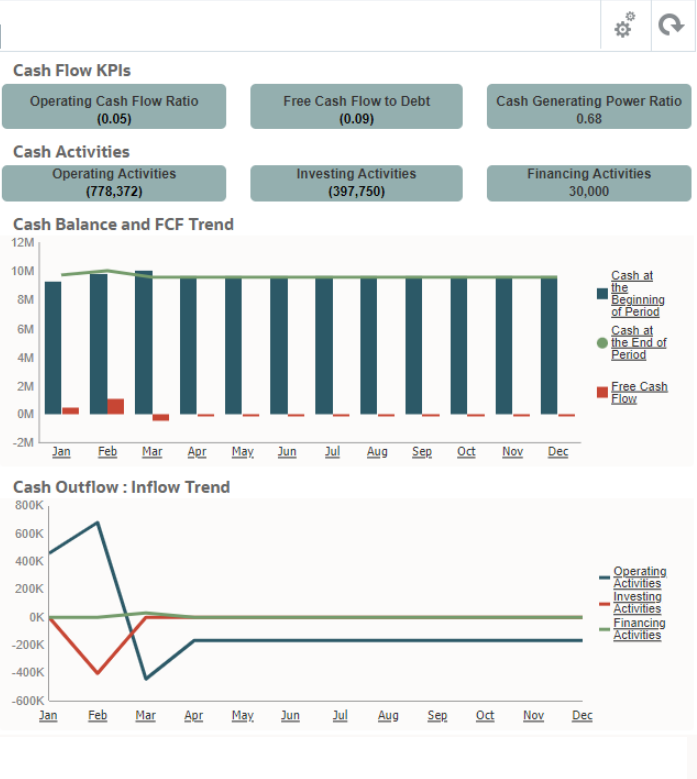

To promote cash management throughout an organization, companies can establish cash-related KPIs and set clear targets for each of them. Monitoring the KPIs with a dashboard refreshed each month should be the responsibility of the CFO.

McKinsey & Co

The Bottom Line

- Cash flow analysis is vital to keeping your doors open and cash flow in the black

- Track these three cash flow KPIS on a monthly/quarterly basis: cash runway, net operating cash flow, free cash flow

- Use these cash flow KPIs to prepare for business expansion, product launch, debt planning and paying dividends to shareholders.

Get in touch for a free consultation to discuss how our fractional CFOs can help you set up a regular cash flow analysis!