Your value proposition is more than simply defining your price structure. It is your brand’s narrative.

An awesome value proposition can mean the difference between a conversion and losing a sale. And that has a direct effect on your bottom line. Below, we’ll cover value proposition structure, and how to create one that you can tie back to your financial strategy.

Value Proposition vs. Mission Statement

First, don’t confuse your value proposition with your mission statement or slogan.

Mission Statement

Defines your objective as an organization

Brand Slogan

A memorable phrase to define brand

Value Proposition

Defines what you offer customers and why they should choose your company

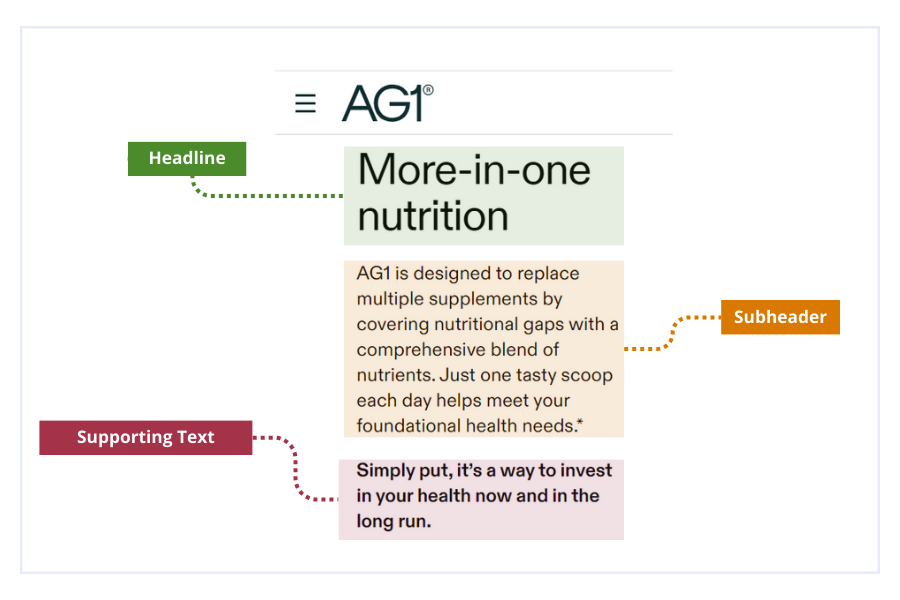

Here’s an example from Athletic Greens AG1:

- Mission Statement: “We are doing our part to bring about a healthier world through nutrition, sustainability, community, and giving back.”

- Slogan: “Own your health, own your day.”

- Value Proposition: “More-in-one nutrition. AG1 is designed to replace multiple supplements by covering nutritional gaps with a comprehensive blend of nutrients. Just one tasty scoop each day helps meet your foundational health needs. Simply put, it’s a way to invest in your health now and in the long run.”

Next, define your value proposition, beginning with the obvious and working your way through to the nuanced.

Value proposition structure

Your value proposition structure should look like some version of this:

Headline

The benefit to your customer or clients.

Sub-headline or paragraph

How you’re solving a problem for your customer

Supporting text

Explain why they should choose your product or service over your competitors. This may be included in your sub-headline/paragraph or you may choose to add extra points.

Here are three easy steps to help you create your value proposition using the above structure.

How to define your value proposition in 3 steps:

1. Be specific

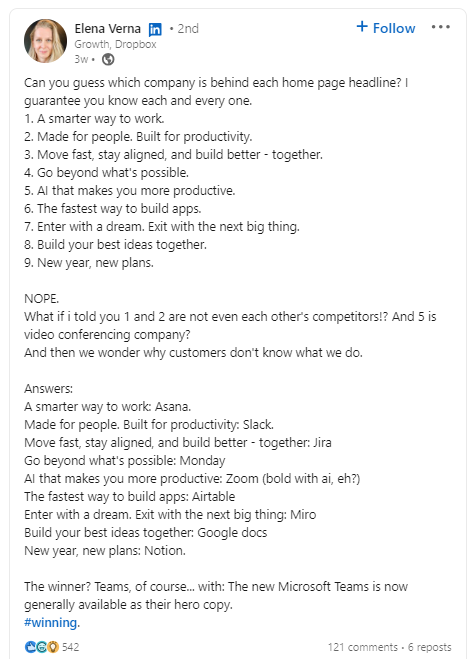

Here’s where you should address the specific benefits your customers will get. Most often, your headline should reference this benefit. Keep it brief. Aim for two to three sentences max. Focus more on being concise and clear than being creative with catchphrases. Remember, your headline should not be your slogan. Vague headlines tell your customers… what?

Granted, the above examples are strictly about headlines, I think Verna still highlights the importance of clarity in defining your value proposition.

2. Identify the pain point you’re solving.

Use the customer experience to really understand your value. Start with your ideal customer profile. Then ask for feedback. While it may not be a ground-breaking idea, if you analyze your customer success KPIs and ask the right questions, the feedback you get is invaluable. Use cohort analysis to narrow down those best customers and get their opinion.

Cohort Analysis looks at groups of customers over time. It’s behavioral analysis to examine slices of customers individually and the metrics related to them- customer churn, lifetime value, CAC, and revenue for example.

Once you’ve identified your most loyal customers, begin by asking them some version of these basic questions:

- What brought you to us in the first place?

- What problem has been solved thanks to our product or service?

- What other products or services did you try first and in which ways did they fail to meet your needs?

- What gave you the confidence to try our product or service?

3. Identify your competitive advantage

Next, start digging into your specialty. Ask yourself more questions.

- Why should a customer choose you over the competition?

- What do you do better?

- What sets you apart from your competitors?

- What can you do that is not being talked about by competitors already?

Working through these lists of questions will get you thinking more like a customer rather that someone who knows the business from the inside out. Avoid using catchy slogans and make sure someone completely new to your brand and company can extract the value of choosing your product or service.

Value proposition examples

A brand value proposition often appears with a headline, catchphrase or slogan followed by a concise proposition that says who you are, what you do and how you do it– ideally how you do it better than your competitors. Let’s break down a few examples of some great value propositions from tools we use:

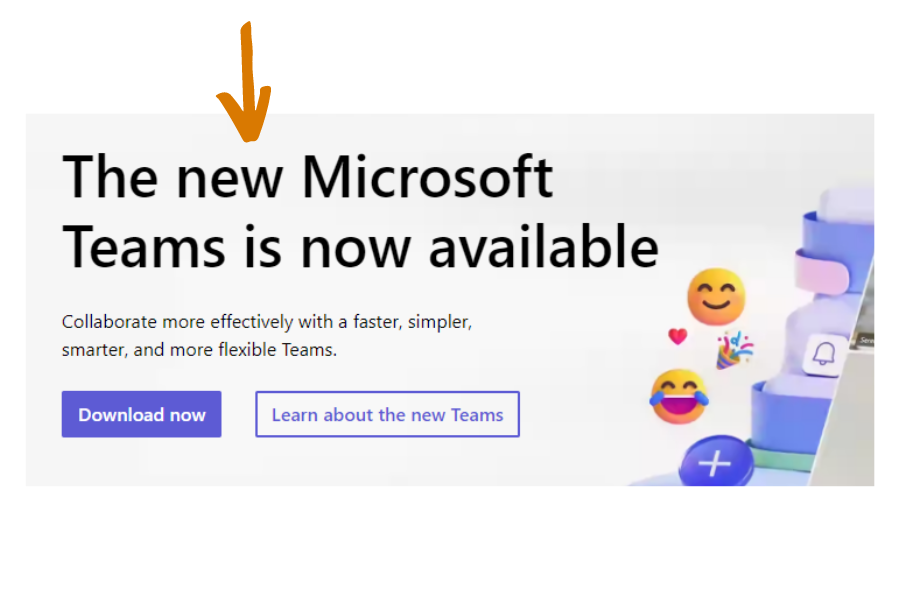

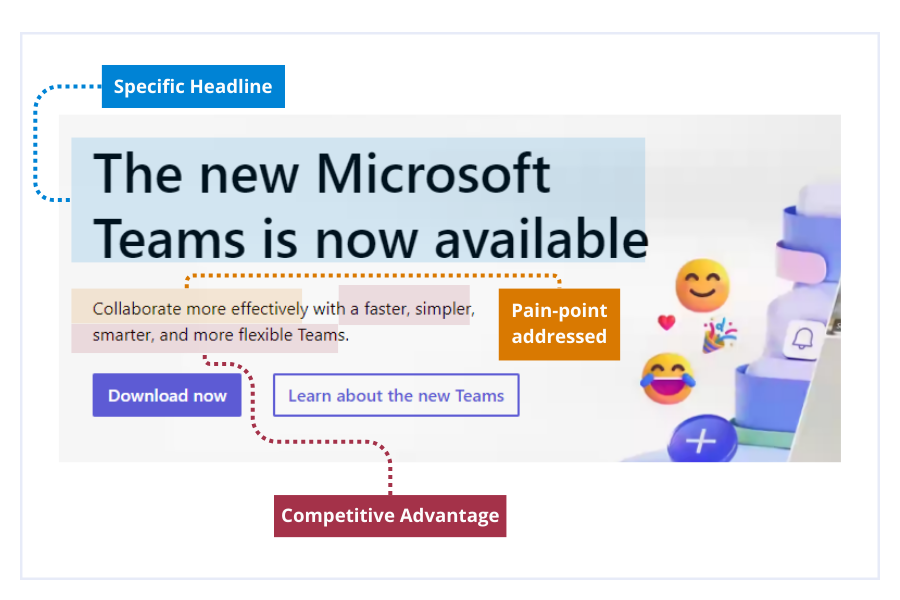

Microsoft Teams: “Collaborate more effectively with a faster, smarter, simpler and more flexible Teams.”

Microsoft Teams

- Specific benefit: helps you collaborate

- Pain-point: time-saver, faster teamwork and collaboration

- Competitive advantage: smarter and simpler

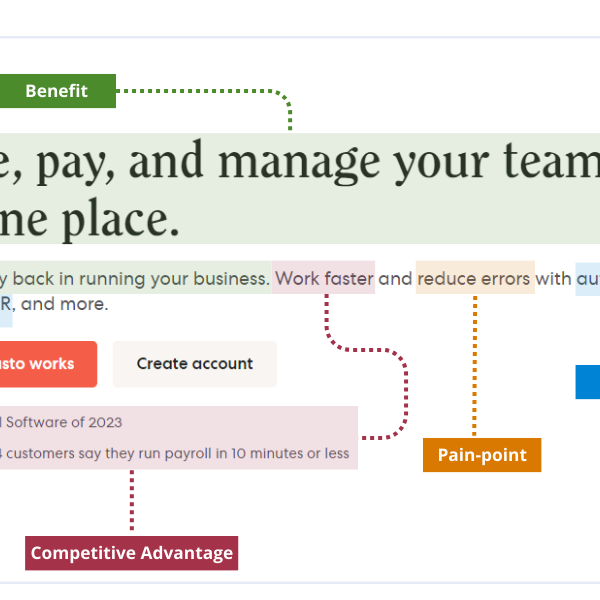

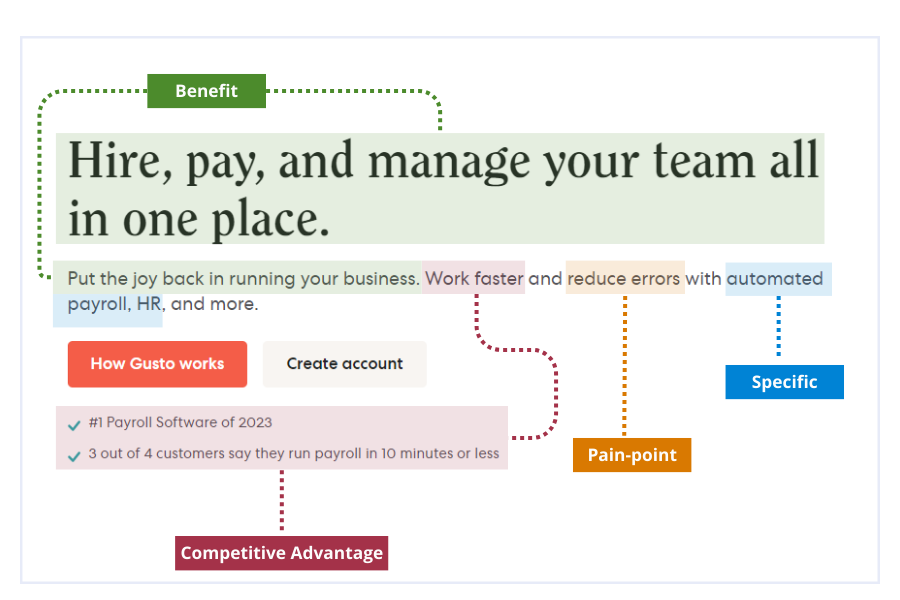

Gusto: “Put the joy back in running your business. Work faster and reduce errors with automated payroll, HR and more.”

Gusto

- Specific benefit: payroll and HR tools to manage team in one place and bring joy back to running your biz

- Pain-point: reduce errors and speed up payroll

- Competitive advantage: join existing users with faster payroll

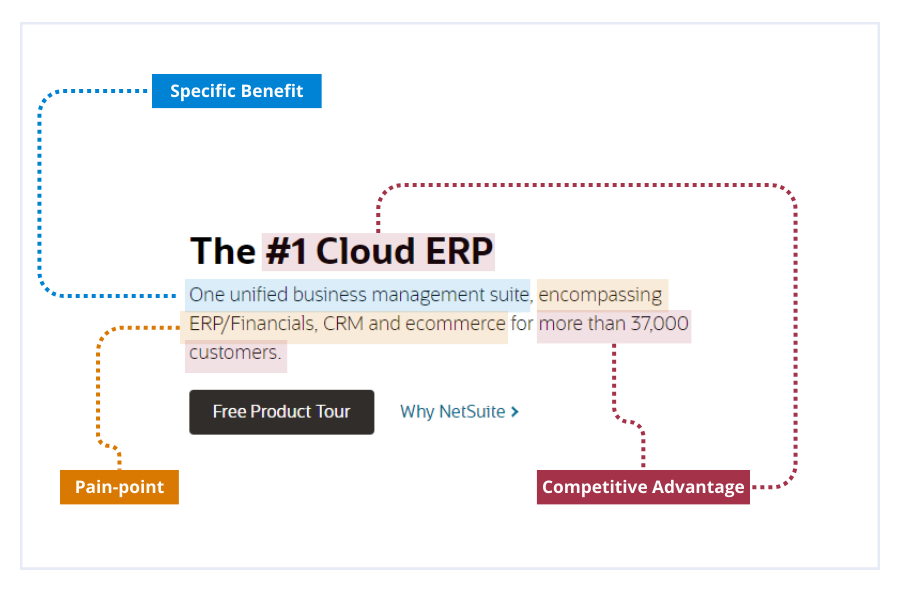

NetSuite: “One unified business management suite, encompassing ERP/Financials, CRM and ecommerce for more than 37,000 customers.”

NetSuite

- Specific benefit: unified business management suite

- Pain-point: ERP, inventory, financials and CRM can be disjointed or spread across multiple platforms

- Competitive advantage: in the cloud, huge customer base

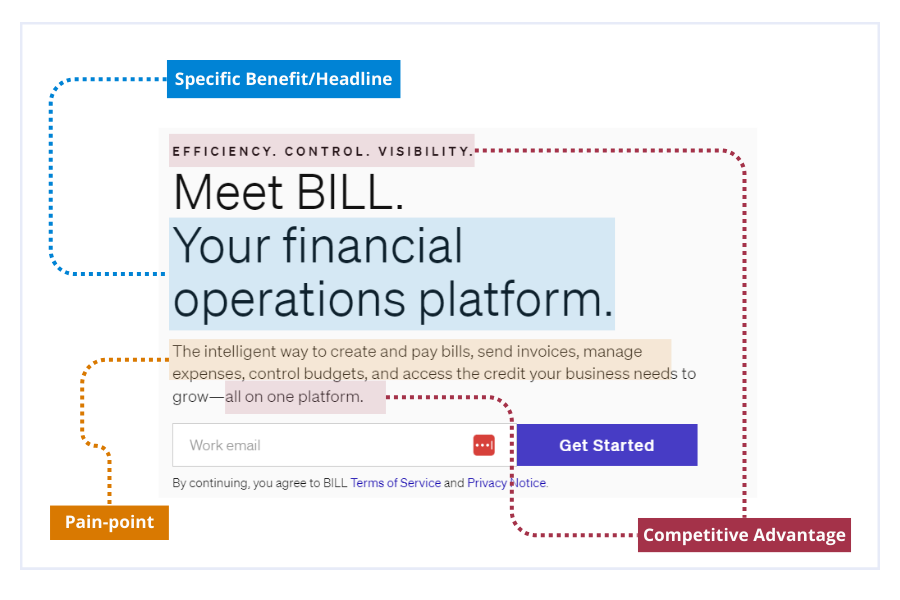

BILL: “The intelligent way to create and pay bills, send invoices, manage expenses, control budgets, and access the credit your business needs to grow—all in one platform.

BILL

- Specific benefit: financial operations platform

- Pain-point: create and pay bills, send invoices, manage expenses, control budgets and access credit

- Competitive advantage: efficient, control, visibility all in one platform

As you can see, while the order of the three aspects listed above may change, generally the structure looks the same. Try listing out your specific benefits, solutions to pain-points and your competitive advantage and playing around plugging them into the examples above.

How to tie your value proposition to your financial strategy.

Now that you’ve defined your value proposition, let’s map it back to your financial strategy.

Let’s begin with your price. Setting the right price can be a task all on its own but once you do, it will reveal your market position. Is your business white glove concierge or economy?

Related Read: How to write a price increase letter

If you consider your business to be white glove concierge, for example, you’re going to offer more, at a higher price point, but for fewer customers. Or, in accounting terms, you generally will have higher margins with lower revenue.

On the other end of the spectrum, if you offer more standard or economical pricing, you will likely have lower margins: Your business offers a little bit for lots of people and with a lot of revenue.

Your customer value proposition and who you’re targeting differ greatly in each of the cases above and should tie into your entire financial strategy.

For example, value proposition becomes essential to financial strategy for SaaS companies that operate within a freemium model. How you upsell your product will depend on the kind of value you want to offer within your free subscription. We cover how using creative upselling can increase cash flow for ecommerce businesses in this post.

Figuring out the right amount to offer within your free version is a delicate balance: you want to offer just enough that your potential customers can experience the value you’re selling but not so much that may never convert or upgrade to paying customers.

Value-proposition budgeting

If you’re exploring budgeting and forecasting you may run into something called value proposition budgeting. Value proposition budgeting, also referred to as priority-based budgeting, is a comprehensive approach that involves justifying the value of each expense item. The primary objective is to determine where a business should allocate funds to achieve a positive return.

To maximize your income start by defining the best services or products. When you’re using value-proposition budgeting, business owners should ask themselves these crucial questions:

- Why is this specific amount included in the budget?

- What is the rationale behind this expense?

- Does the item generate value for customers, staff, or other stakeholders?

- Does the value outweigh its cost?

- How do we measure success?

Ways to use your value proposition

Besides web copy and elevator pitches, there are a few other ways to put your value proposition to work now that you’ve tied it to your finances:

- Create a fact sheet for your sales team to draw on.

- Model an infographic around your value proposition to use it for all kinds of marketing and sales opportunities.

- Use it as a stepping stone to build a referral program using your existing customer base.

- Run it as a self-check. Structure feedback and surveys around your value proposition to make sure that you continue to offer the value that you promise.

Need some extra insight to tease apart how your value proposition is tied to your financial strategy? Get in touch to see how our outsourced CFO services and dashboard analytics can provide you with the real-time insight that you’re looking for.