A touchy subject.

Fraud. It is no one’s favorite subject, especially when it involves your employees.

Put plainly, if your company provides expense reimbursements, then it runs the risk of fraud. Expense report fraud is a touchy, yet important issue to address. Being a company that prides itself on building a transparent culture, we understand why that can be uncomfortable. That being said, one of the many ways to protect yourself from risk is to ensure you have appropriate internal controls in place.

How to identify expense report fraud.

- Look for discrepancies in spending across employees.

- Check for acceptable expenses that have been inflated.

- Double-dipping. Or receipts claimed more than one time.

- Allowable expense limited have been exceeded time and time again.

Ultimately there are a number of ways that an employee might commit expense report fraud, but luckily there are tools that can mitigate your risk by flagging a number of the discrepancies listed above.

Expense report fraud? There’s an app for that.

Below are steps on how to build internal controls around expense reporting with your employees or contractors:

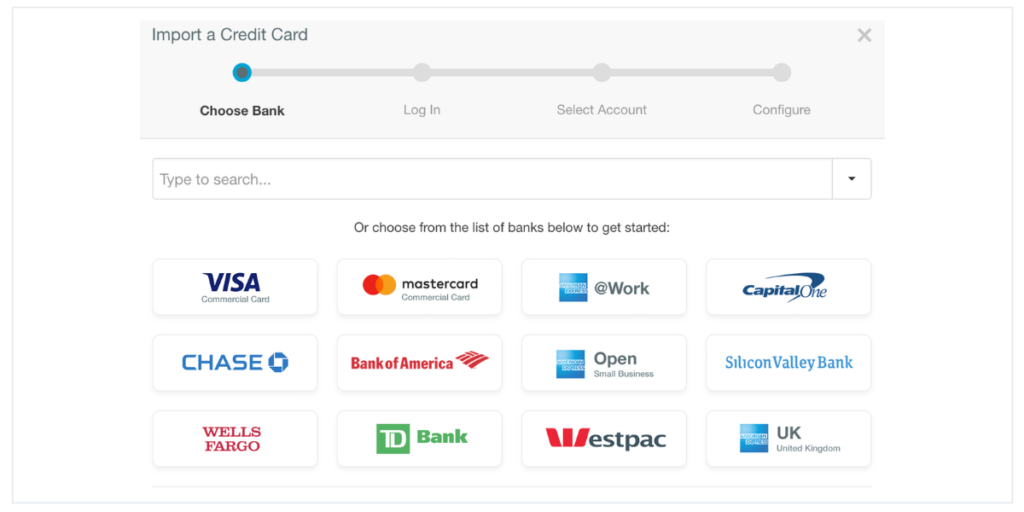

Provide company-issued credit cards.

Once upon a time, providing company-issued credit cards might have been more headache than their worth. However, with new technologies, those days are behind us. Besides other obvious reasons, providing a corporate card allows a company to more closely track employee spending and the exact amounts being charged. It prevents opportunity for personal and business expenditures to be mixed on the same card and, with proper controls in place, will ultimately save you time and worry.

Related Read: “The Business Meal Expense Deduction Lives on Post Tax Cuts and Jobs Act“

Get an Expense Reporting Tool.

It is likely no surprise that a cloud accounting service might suggest using technology to tackle expense report fraud. Ditch the accordion folder for an expense reporting tool. While there are many options to choose from, one good example for streamlining expense reporting is Expensify. The pros of adapting Expensify greatly outweigh its learning curve:

- Expensify will sync with many accounting systems, including QuickBooks Online.

- It offers smart scanning of receipts, allowing users to snap a photo of their bill and then auto-populates the fields. Both increasing efficiency and lowering the risk of lost receipts. Additionally review and audit can happen easily and quickly online.

- The Concierge feature automatically flags altered receipts and ignores duplicate receipts reducing the risk of reimbursing someone twice for the same expense.

- When it syncs with your accounting system, it can automatically code expenses from both receipts and credit card statements to the correct expense account. This is a two-fold time saver for both your company and your employees. No more tracking down employees to code it themselves. No more missing receipts at month-end. No more submitting and coding monthly reports. It has been taken care of on-the-go.

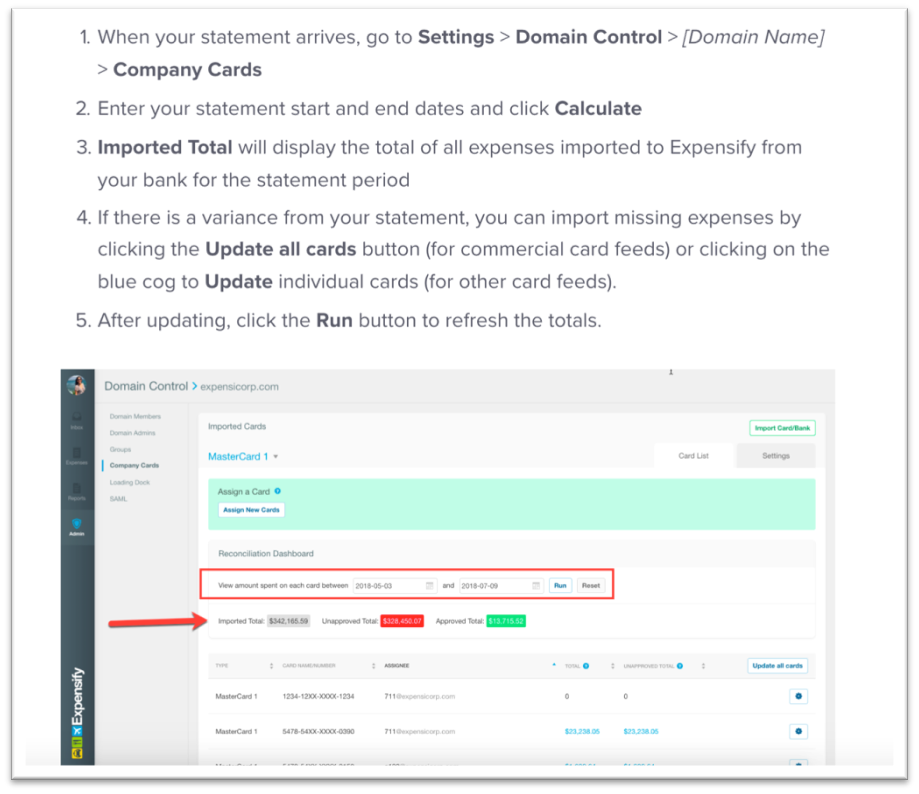

- Finally, by enabling Domain Control (see below), your credit card reconciliations have practically been completed before you even receive your statement.

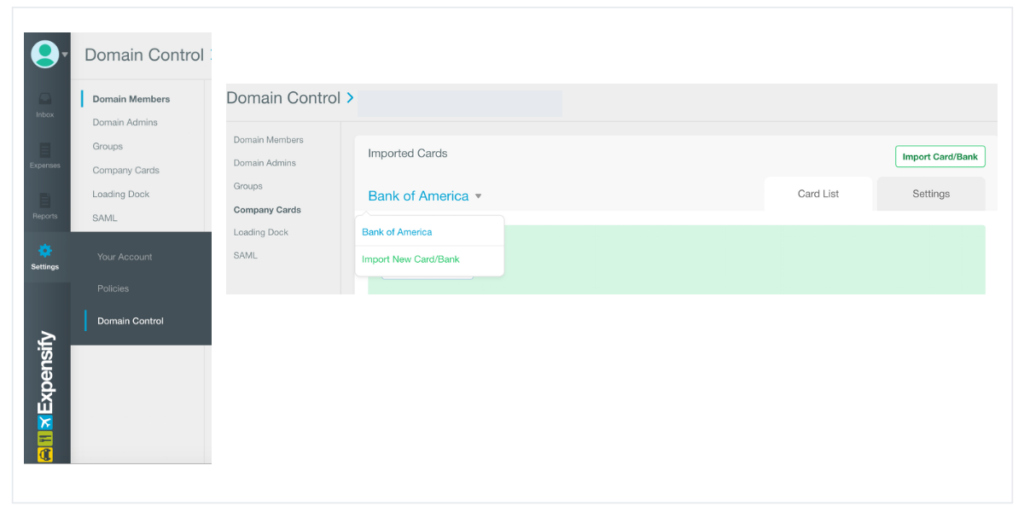

Domain Control is a “centralized company card management” —a beefed-up company card system that ensures that your employees and Expensify users (identified using their emails at your domain name) are following your expense policy workflow.

Advanced reporting, automated workflows and company card monitoring lowers the opportunity for undetected fraudulent activity. Domain Control also allows you to import your commercial cards and connect bank feeds, connecting those feeds to your respective users which streamlines the reconciliation process.

Expensify confirms the statement amount, identifies any outstanding expenses missing from an employee’s statement and processes the reconciliation in a timely manner.

For example, businesses with multiple people reporting expenses will know this situation can happen more easily than you might think. Say your employee happened to upload an expense for reimbursement that had already been charged to the company card (whether intentionally or by mistake). The Concierge feature will flag the duplicate receipt. Your internal controls are already tighter than most company expense workflows. Plus, you have prevented the headache of having to track down the employee to recoup the extra reimbursement.

Create a comprehensive expense policy

While Expensify can help mitigate your risk, it’s important to still have an approver looking over all expenses being reported. Enact a policy that addresses the best practice use of your corporate credit cards and Expensify. Then set policy controls, pre-approvals and compliance monitoring tools to further reduce expense report fraud. Remember to include any exceptions like missing receipts to help prevent any hiccups with your automated workflow.

Related Read: “Is it Time for Your Company to Draft an Expense Policy?“

Implementing these steps helps the approver identify items needing further investigation without having to comb through every item on a report. This also allows the approver to focus more on the overall submission and whether expense levels are reasonable and appropriate.

As a cloud CFO team, we’re not strangers to enlisting tech solutions to improve business operations. Get in touch with us if you’d like to learn more about how to set up your expense policy workflows. While you can never eliminate all chances of expense report fraud, by updating that “trusted” but not-so-trustworthy accordion folder to a 21st century tool, you can certainly limit your risk.

Need help building your internal controls? Our outsourced controller services can help.