Not everyone loves numbers and spreadsheets as much as us folks at ORBA! And, it is not easy communicating financial performance for investors. Many accounting firms put out entire White Papers on this subject, so keep in mind there is plenty of detail I could go into here. In the interest of your precious time, however, I’ll try and keep this brief.

Inc. recently published an article titled, Seven Horrifying Mistakes Founders Make in Their Pitches, and that got me thinking about what the best approach is, specifically when trying to find investors.

Financial Performance: 5 Things to Communicate to Investors

1). Be Innovative

First, your financials should tell a compelling story. I am not suggesting you walk in beginning with, “once upon a time…,” but the narrative you tell with your finances will be what, in the end, seals the deal. What I actually mean by telling a story, is capturing your financial reports in an innovative way. Do not simply print off your financial statements.

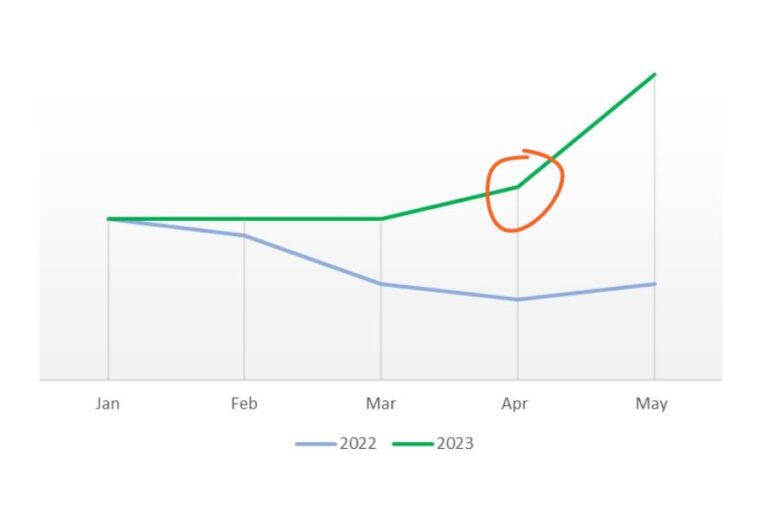

Investors are relatively open-minded about the format of financial reports. So, while it is important to be clear and concise, you can be a little flexible to best show how your finances fit your business model and strategic plan. Take into account what your investors want to know. For instance, if you are a consumer products company, you could use a stacked line graph to highlight your expanding gross profit margin as you have scaled your business. Include your break-even sales analysis and free cash flow. Innovative illustrations like this will set you apart from other businesses also competing for your investors’ time and money.

2). Define Your Financial Performance Objectives

Consider what you are trying to accomplish and clearly outline your objectives. You definitely want the Key Performance Indicators (KPIs) you show investors to shed the best light on your company. However, there is another reason why investors like to see a few well-designed KPIs. If you are able to show investors that you boil down your complex business into just three KPIs that everyone focuses on, then this shows:

- You understand how daily operations are directly tied to the financial performance of the company; and

- You are able to focus your team on only the most important things and not waste resources “chasing squirrels.”

3). Transparency Will Get You Everywhere

Be open about the promises you are making and the plans to deliver on them. Have you been meeting your forecasts thus far, and, if so, how will you continue to do so? As you know, you cannot fake your free cash flow (FCF); and, ideally, it should be positive. It also may be understandable if your FCF is in the red if you are at a stage in growth where you are reinvesting.

A five-year Profit and Loss (P&L) should be based on the market risks and assumptions. Explain the risks and use your financial statements to show how you handled, or are planning on handling, those risks. Nobody is perfect, and investors do not necessarily expect perfection, either. Instead of trying to hide mistakes, own up to them and explain how you will avoid them in the future. Being proactive and transparent will actually help you to gain credibility.

“I like over communicators who err on the side of transparency and candor.” -Mark Suster, Venture Capitalist

3). Clarity is Key

Next, be sure your balance sheet, income statement and statement of cash flows tie together nicely. It should be clear and easy for your potential investors to follow. Consider adding in commentary notes to any key financial changes so your investors can clearly follow each statement and the context of the numbers they are looking at. If you can anticipate their questions and answer them before they even ask them, then you make it clear that you understand your financials and what they care about.

Linking the commentary right into the financial pages by topic area could benefit you more than simply having indexed notes at the end of each line item. If you are using technology-driven reporting, there are a number of ways you could do this without cluttering up your package.

4). Mind your audience

Lastly, consider your audience. Your narrative should not be universal. Depending on the VC’s and potential stakeholders you are pitching to, you will want to adjust your reports, KPIs and style to fit the audience along with their likelihood to fund a company like yours. Remember what type of investment they are looking to make and communicate accordingly.

Perhaps you want more detailed notes for one group of investors and a shorter package for another. Also, be open to feedback. If an investor sees potential in your company, they might very well have some ideas for better communicating financial performance for other investors, as well. They would know after all!

Be timely, be specific, be ready to answer questions. Now, sell!