I feel pretty safe saying that most, if not all, entrepreneurs know they need a business budget. Where business owners often get hung up is on just how comprehensive that budget needs to be. We frequently get asked this exact question by clients: “How detailed does my business budget need to be?” And it’s another one of those “it depends,” kind of answers.

Aim Small, Miss Small: Include Details in Your Business Budget from the Start

That being said, the easy preliminary answer when you’re creating your business budget is to be as detailed as possible because you are laying the groundwork for the upcoming year. A favorite quote of mine is, “aim small, miss small.” (The Patriot fans will recognize this one).

The idea is by including details from the start you’re more likely to be successful in achieving your budget throughout the year. The basic steps to build a business budget include:

Related Read: Budgeting and Forecasting: A Business Owner’s Guide

5 Steps to Build a Business Budget

- Choose the type: surplus, perhaps balanced if you’re a non-profit, zero-based, value proposition based etc.

- Total income: Estimate sales, forecasting revenue and totalling up your income. Be sure to build in any related advertising and marketing costs you will need to help achieve these sales goals. And avoid making these mistakes with your financial projections.

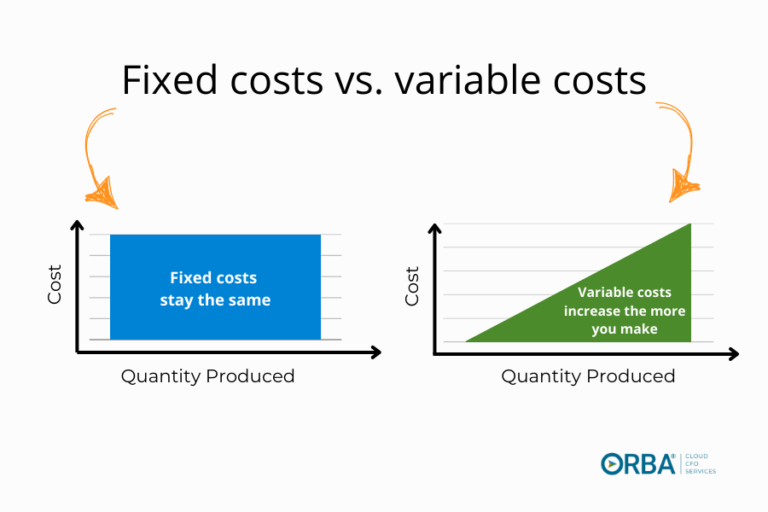

- List out your fixed costs: (e.g. rent), and semi-fixed costs of salaries. Most of your operating expenses will likely be in these two categories.

- Include variable expenses: (e.g. cost of goods sold). Also connect your expenses to your revenue using your growth ratios. For example, if you know you need to hire a new customer support person for every 10 customers you sign, then make sure your payroll costs increase along with any projected revenue increases.

- Plan for big spends and cash flow: Look ahead to any capital or one-time expenditures you need to make in the upcoming year. Don’t forget about the ever-important balance sheet, to help budget for future CapEx and inventory that dramatically affect your cash flow.

Now forget about those details

Ok not really. The detailed budgeting process still holds value. But you want to focus less on specific dollar amounts and more on growth drivers for your business. Too much detail can encumber the budget.

Don’t spend time drilling down items like postage and office supplies.

Do be detailed when budgeting for growth drivers and break them down to the smallest key metric (e.g. 150 customers each month or 3,000 widgets sold).

Manager, Carolyn Koonce, recommends that clients “DO get detailed in their biggest drivers, which are usually income, COGS [cost of goods sold], and personnel expenses. Budget salary by person rather than a flat percentage across all positions. Think about if any positions will need to be added in throughout the year to sustain the growth you’re predicting. Then stay high-level on the less impactful things. Instead of listing out each supply need per department, include a general 10% increase and move on!”

A Business Budget Should be More Than Just Dollars and Cents

Build your budget around a few key metrics to fuel business growth instead of budgeting down to the cent. Think gross profit, net promoter score/customer loyalty, or sales channel profitability. What kind of budget do you need in place to help those metrics skyrocket? If your financial goals are for growth, then you want to strategize your spending accordingly.

Say, for example, you’re a retail business trying to increase profitability. You want to optimize the sales channels that will fuel your most profitable growth. Then budget according to those marketing and sales needs, even if it means tightening spending in another department.

If you are a tech or SaaS company looking to reduce your cash burn, you may want to build a budget with plans to improve your liquidity. Then simultaneously focus on increasing your monthly recurring revenue. In this case, your budget may need to focus on ways to accelerate your collections of accounts receivable (e.g. give a discount for customers to pay a full year upfront), along with the additional marketing training needed for upselling.

Related read: If you’re in the consumer products industry don’t miss this guest post for Brightpearl by founder and director, Chris Arndt on the 8 KPI’s a Retailer Should Know (along with tips on how to improve them).

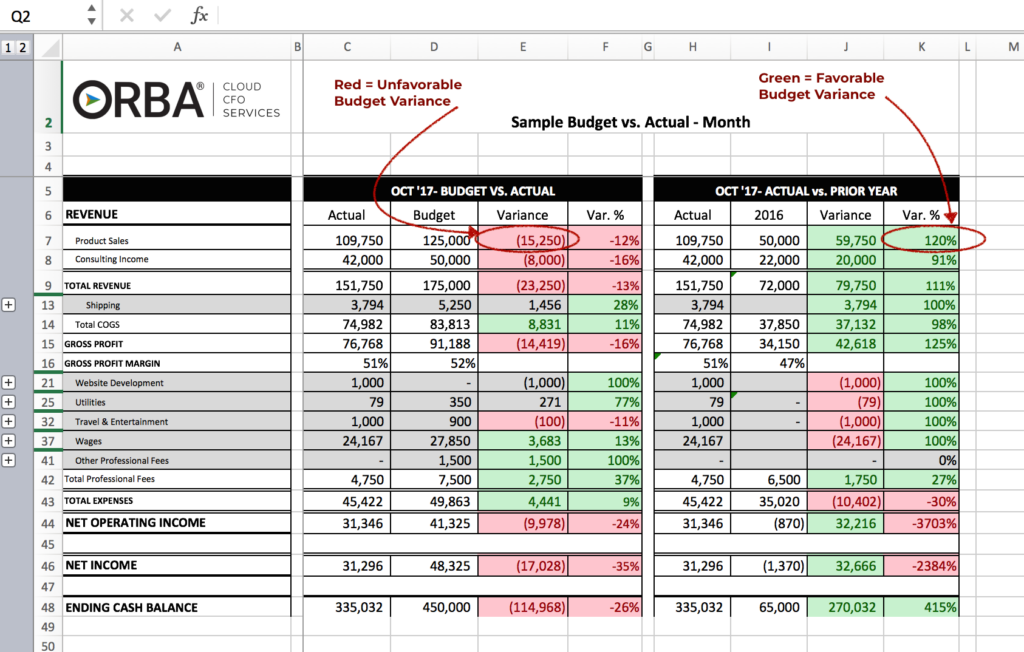

Your financial plan should drive the focus when comparing your actual cash flow to your budget. Carolyn suggests that your actual-to-budget be high-level and then when you’re performing budget variance analysis you can drill down to details when needed.

Call on your team to build a business budet

The budgeting process should start from the bottom up. I like to say top-down goals with bottom-up drivers. Push down the accountability, involve your team in the process, and you create better buy-in and ultimately better results.

If you allow for dynamic allocation of resources to better support your strategic plan and avoid freezing flexibility within your business budget, you’re likely to see a higher level of service within each department. For example, how many times have you seen a manager spend the remaining two-thirds of their budget in the last quarter of the year knowing that next year’s budget will be based on the current year’s spending? Instead of holding your team to such specific spending restrictions, adapt according to both need and cash flow and you’re more likely to see responsible spending.

Carolyn specifies that one of the most important aspects is to include the sales team in building the sales budget, “this is the case for all of the major departments, but the sales one is what I see missed most. You want the people who will control whether or not you hit your targets to be able to say whether or not the goals are realistic and/or to add input on what needs to happen to get you there. Moreover, you want them to have buy-in; they’re more likely to hit the targets if they had a say in setting them.”

“Your sales team is more likely to hit the targets, if they had a say in setting them.”

Review, Revise and Adapt your Business Budget

We recommend that our clients maintain an adaptive budget so they are able to adjust to market changes, variable expenses, unexpected costs or in the best-case scenario, increased revenue and unforeseen profits. And review it regularly. Using a flexible business budget allows your financial team to help guide appropriate spending versus sticking to a budget that may be out of date before the first quarter even ends.

Review your actuals to budget and your full-year forecast versus the prior month’s forecast. This forces you to examine why your actuals are different than your budget and/or previous forecasts. Examine any accurate assumptions and any inaccuracies in forecasted revenue or profit margins and revise accordingly. Perhaps you need to shorten a sales cycle using a free trial. Or focus on reducing a higher churn rate than expected by automating the onboarding process for new customers or by improving customer service.

Whichever way you choose to review and revise your budget, remember to focus on only the most important growth drivers to keeps it manageable. Carolyn instructs to, “budget to whatever level of detail [you] can report on regularly – at minimum monthly. Building out a super complex model that you can’t sustainably measure against is somewhat useless.”

Budgeting Gone Bad

As we discussed in our roundtable discussion on Budgeting & Forecasting for High Growth Companies, the three most common things we see interfering with a successful budget are:

- Too much detail.

- Not involving the team and relevant departments.

- Revenue plugs- or unsupported numbers used to build the budget that weren’t later revised.

The final consensus: a detailed business budget is never a bad thing as long as you remain open to adapting your spending as required; remember that your financial planning should involve your team; and ensure your budget reflects your growth drivers and goals.

ORBA Cloud CFO offers outsourced accounting services for all your business budget needs. Our unique cross-industry experience means we offer specialized solutions for: