Quick Links:

- How to calculate customer acquisition cost?

- CAC in action. With examples.

- 3 Ways to Lower Customer Acquisition Cost.

- Segmenting your customers for better CAC analysis.

- [WATCH] Allowable CAC: Are you spending enough to acquire new customers?

I recently had a client ask how they might capture the cost of customer acquisition. To put it simply, tracking it is certainly the first step, but of course the real objective is how to lower your customer acquisition cost.

What is customer acquisition cost?

Your customer acquisition cost (CAC) is the the total cost to acquire one new customer. It’s a KPI that provides insight for your business operations and should be a focal point for key stakeholders. Think of it this way: CAC is the amount of money you need to invest in order to win one new customer. When coupled with the profit you expect to receive from that customer, you can then decide whether or not it makes sense to continue investing to bring in more customers.

How to calculate your CAC

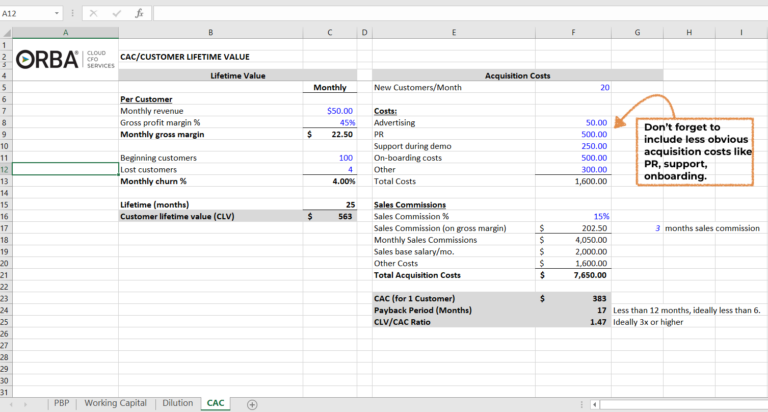

Your CAC is found from taking your total sales and marketing expenses over a given amount of time, (normally a month) and dividing that total by the number of new customers in the same length of time. The customer acquisition cost formula is: CAC = Total Sales and Marketing Expenses (per month) / # of New Customers (per month).

Total Sales and Marketing Expenses (per month) / # of New Customers (per month) = CAC

From the most simplified version of the CAC formula, you and your accounting team can then determine how to best apply it to your business model. By slicing and dicing the data to look at CAC by marketing channel or CAC per customer segment, you can calculate the ancillary payback period and lifetime value metrics as well.

What’s not included in your CAC?

While you might include support during sales demos there are some support costs that should not be included in your customer acquisition costs. These customer support costs do affect your customer monthly profit margin, but should NOT be included in your CAC calculations:

- Account management

- Hosting

- Training on new releases

- Customer service

Customer Acquisition Cost (CAC) in action

Say your marketing and sales campaign cost your company a total of $5,000. You acquired 75 new customers through the campaign. Using the CAC formula above, your CAC would be:

$5,000/75 = $66.67 CAC

Now, if you found a way to spend only $2,500 to acquire the same number of new customers, then your CAC would be cut in half.

$2,500/75 = $33.33 CAC

Now, multiply both CAC examples by 1,000 customers, and you would have spent $66,667 in the first scenario and only $33,333 in the second scenario to get the same number of new customers. If you figure out a way to achieve the second scenario, then you could reinvest even more in your marketing spend and could have brought on 2,000 customers at the same cost as the first scenario.

As you can see, finding a way to lower your customer acquisition cost is a pretty big deal. But, what should your CAC be? That depends on your industry and the revenue you get from a single new customer. For example, real estate brokerage tends to have much larger CAC compared to an industry like online retail. When you consider the sales cycle and effort it takes to help a client buy a new home, compared to convincing an excited, first-time dad to buy a kiddie pool online, it’s no surprise that the CAC would be quite different for those two industries. (Yes, that’s right, I saw an ad one time and purchased a kiddie pool for my kids. Guilty as charged!).

3 Ways to Lower Customer Acquisition Cost

Lower your customer acquisition cost, increase your profit. Sounds simple right?

1). Optimize Your Website.

In today’s market, you can’t overlook the importance of your website. Make sure your site is easy to navigate for the audience that you have now carefully targeted using the steps above. While cutting expenses is key to lowering your CAC, make sure to spend the money and invest in optimizing your site for conversions:

- Review form fields for concise, ease of use

- Implement A/B tests on your landing pages to make sure your call-to-action is working

- Ensure your site is mobile friendly, so you don’t lose transactions. Think about how often you yourself visit a company’s site on your phone before making a purchase.

How important is social media marketing to lower your customer acquisition cost

Social media marketing is a powerful tool you can use to cut marketing expenses and lower your CAC.

Good to know: new research from Simplicity DX suggest social revenue is underreported by a massive 245% because consumers have lowered trust in buying direct through social. So, expect consumers to want to discover your brand on social but then to head to your site to actually convert.

As a result, ensure you’re getting the most out of your paid ad campaigns by investing in conversion rate optimization. Increasing total customers = lowering CAC.

2). Improve Your Sales Funnel to Reduce CAC Salaries.

This can mean anything from becoming more efficient at building leads, personalizing your messaging through the selling process or finetuning your pitch. Shortening your sales cycle automatically lowers your CAC by letting a salesperson focus on more leads at once. This spreads that person’s salary out over more customers eventually acquired. Quick tips to shorten your sales cycle:

- Use automated CRM tools to cultivate leads and create tailored campaigns.

- Be transparent about pricing. This will cut down the amount of time you spend explaining pricing or packages to potential customers.

- Know your prospects’ goals and/or customers’ expectations.

3). Use Data to Define your Best Customer and How to Market to Them

Focus your customer acquisition strategy to be the most efficient marketing machine possible. Know your target market and build your strategy accordingly. If you are diffusing your marketing budget and salaries out over a poorly defined target audience, you could be wasting valuable dollars on selling to someone who might not actually be a potential customer.

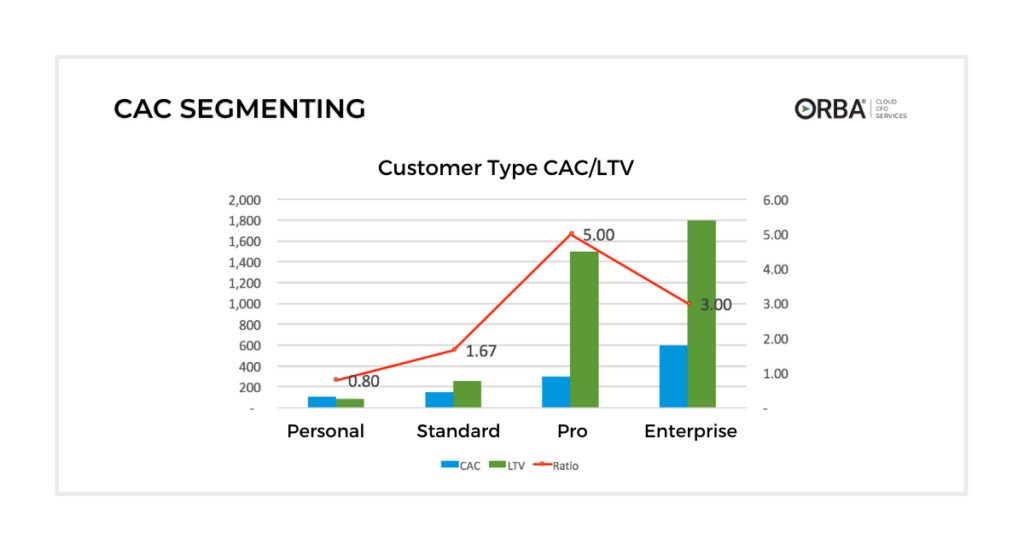

Using the Magic Ratio to Lower CAC

Calculating your CAC and LTV by segments can help you identify the best bang for your buck. For example:

- Customer types

- Sales channel

- Customer location

Take your LTV divided by your CAC and you have got your “magic ratio”. Aim for a ratio of three (3:1) or greater to see optimal growth. So in other words, for every $1 you spend on acquiring a customer you want to aim for earning $3 back. And because these metrics factor in all your key variables like gross margin for example, this applies across industries.

Cloud CFO Tip: One of the reasons I love these metrics is because you can work them backwards as well. Once you know your LTV you can divide that by three and you then know how much you can afford to spend on acquiring customers.

Let’s dig in further. Say your average CAC is $150 and your average LTV is $400. Your magic ratio would be 2.67, pretty close to three. Not bad.

LTV/CAC = Ratio

$400/$150 = 2.67

But how do you know which customers you should target? The overall average is a vanity metric and not that helpful. Instead, segment your customers and get the ratio for each segment to understand more about your best customer. Take this example of a SaaS company and the different account tiers they offer:

The blue bar is CAC, the green the LTV and the red is the magic ratio. While some might assume you should focus marketing and sales on personal accounts because it costs less to acquire each customer, the 0.8 ratio for personal subscriptions will grow this company broke! So where should the company invest its precious cash?

As always, the data only tells part of the story. Perhaps investing in Enterprise with a 3.0 ratio could work if the company has the right team and structure in place. But in this case, I would likely recommend focusing on Pro accounts and growing to a healthy level before tackling Enterprise customers. In a webinar with Kathy Steele from Red Caffeine, she further highlights this point, “we all get caught up in our bigger clients, and it’s really tough to make sure that we’re making the right decisions about what segments of the business we should be going after.”

Remember: Knowing that my lifetime value is $100K without knowing what I’m spending on them? Useless. Knowing that I spend $10K to acquire a customer without knowing their lifetime value? Also useless. Understanding how LTV and CAC work together as levers in your business is what’s the most helpful.

[Watch]: Allowable CAC

Equally important is understanding your allowable CAC. You don’t want to be missing out on an opportunity to lower your customer acquisition cost by not spending enough either.

Related Watch: Are you spending enough to acquire new customers? Use your allowable CAC to find out for sure.

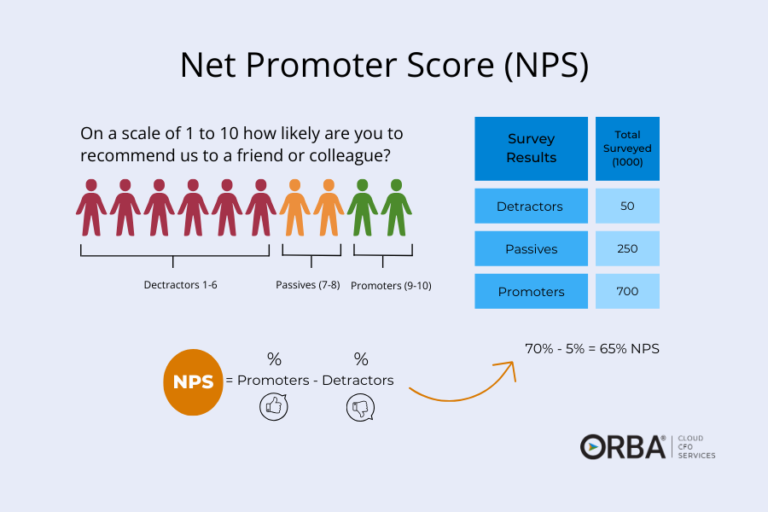

Referral programs to lower customer acquisition cost

Not only can you focus customer engagement data to learn more about their personas and create economical targeted ads, but you can have your customers do the selling for you. A good word-of-mouth (WOM) strategy is one of the best (and cheapest) acquisition tools you can implement. A couple of ways to strengthen your WOM strategy:

- Set up loyalty and referral programs.

- Incentivize brand ambassadors.

Related read: Increase LTV with these 5 Referral Programs (with examples)

Remember, lowering your CAC does not happen overnight and it pays to continue to track it. Impress your investors as your customers become more profitable and less costly to your business.

Need more help understanding the effects of CAC on your bottom line? Get in touch to book your free consultation.