We will cover inventory accounting best practices, including inventory tracking, and the key inventory accounting concepts you should know.

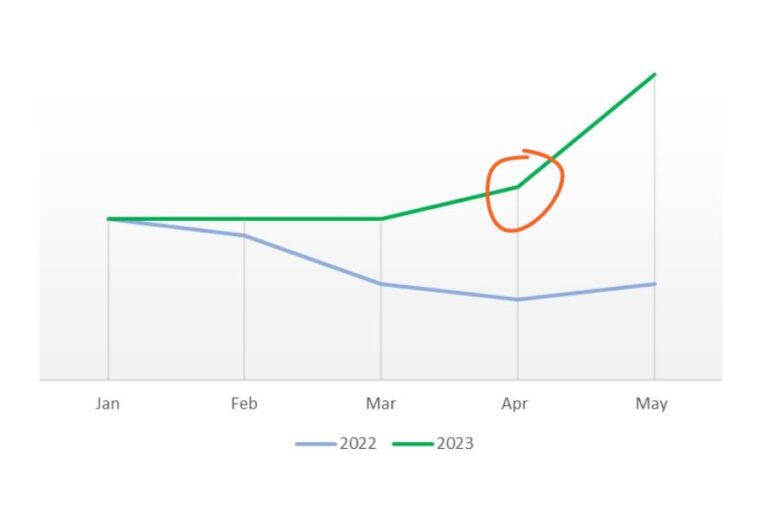

Given ongoing supply chain troubles, skyrocketing prices, and never-ending shipping delays, eCommerce brands have been going through a seriously tough time. Amidst all this uncertainty, there’s one thing you can take charge of – gaining a solid understanding of your financial statements and inventory items. It’s a game-changer for your company’s financial health and cash flow.

What is inventory accounting?

Inventory accounting plays a critical role in portraying the financial well-being of a business, based on its inventory. It can include many factors, including the movement of stock, daily variations in quantity, aging inventory carrying costs and even deadstock.

Generally, from the IRS point-of-view if you hold inventory you must use the accrual method of accounting. With the interest being namely in your Cost of Goods Sold (COGS) and net income. From the IRS:

Items included in inventory.

If you are required to account for inventories, include the following items when accounting for your inventory.

- Merchandise or stock in trade.

- Raw materials.

- Work in process.

- Finished products.

- Supplies that physically become a part of the item intended for sale.

Your inventory’s value is directly linked to the business’s revenue and overall income. In other words, the stock is not income, but the value of your inventory is required for determining income. The IRS elaborates:

Valuing inventory.

You must value your inventory at the beginning and end of each tax year to determine your cost of goods sold. To determine the value of your inventory, you need a method for identifying the items in your inventory and a method for valuing these items.

via IRS

Jump to the difference between the FIFO vs LIFO inventory accounting methods below.

Inventory Accounting: Sold vs. Unsold Inventory

There are a ton of inventory-related supply chain KPIs, but not all are relevant to inventory accounting specifically. We’ll highlight some important ones below. Some inventory accounting KPIs are related to the cost of selling inventory and others (not to be ignored!) are related to the cost of unsold inventory.

Inventory Sales Costs

- COGS

- Landed costs

- Shipping fees

- Packaging

- Fulfillment costs

- Storage

- Merchant processing

COGS vs landed cost, what’s the difference?

Let’s clear up the confusion between these two inventory accounting metrics.

| Inventory Accounting | Role in Supply Chain | |

|---|---|---|

| COGS | Used to calculate true gross profit margin | Focus on procurement & production phase |

| Landed Cost | Used to evaluate true cost of goods at point of sale | Focus on logistics and distribution |

COGS: There are numerous misconceptions surrounding the calculation of COGS.

It is used to evaluate pricing strategies, optimize production and make informed decisions about inventory management and paints a picture of your production efficiency. Although the formula may seem straightforward, accurately capturing sales and matching them with their corresponding costs can be intensive. As you introduce new products to the market, this effort only grows more demanding and complex.

Landed Cost: COGS and landed costs may sound similar, but they’re not exactly twins. COGS is just a fancy term for an expense category on your income statement.

Landed costs cover everything from the moment you create or buy your product to when it finally arrives at your fulfillment center. We’re talking about the price of goods, freight costs, insurance fees, customs duties, taxes, and any other sneaky charges that pop up along the way. It’s like a rollercoaster ride of expenses to reduce your landed costs! It’s important to note that this is not a one-time task; the costs are based on assumptions that are subject to changes over time, such as increased freight expenses, which can affect the accuracy of the landed costs figures. Frequently monitor these assumptions and adjust the landed costs accordingly to account for any fluctuations that may arise.

The effect of inventory accounting on reporting and profitability:

Client case example: When one of our clients signed on with our NetSuite accounting services they were still tracking purchases and shipping through an Excel spreadsheet. This skewed their monthly inventory accounting in respects to their gross margin. Our Senior Accounting Manager, set up landed cost tracking for them in NetSuite to calculate duty and freight against container weights. The result? Improved and accurate margin reporting. Plus, by tracking landed costs using NetSuite, our manager eliminated the wasted time spent tracking costs in Excel.

Client case example #2: Tracking landed costs really helped a manufacturing client know when to raise prices. Additionally, highlighted which customers to focus on compared to customers with specific fulfillment requirements that were driving up costs.

Unsold inventory costs

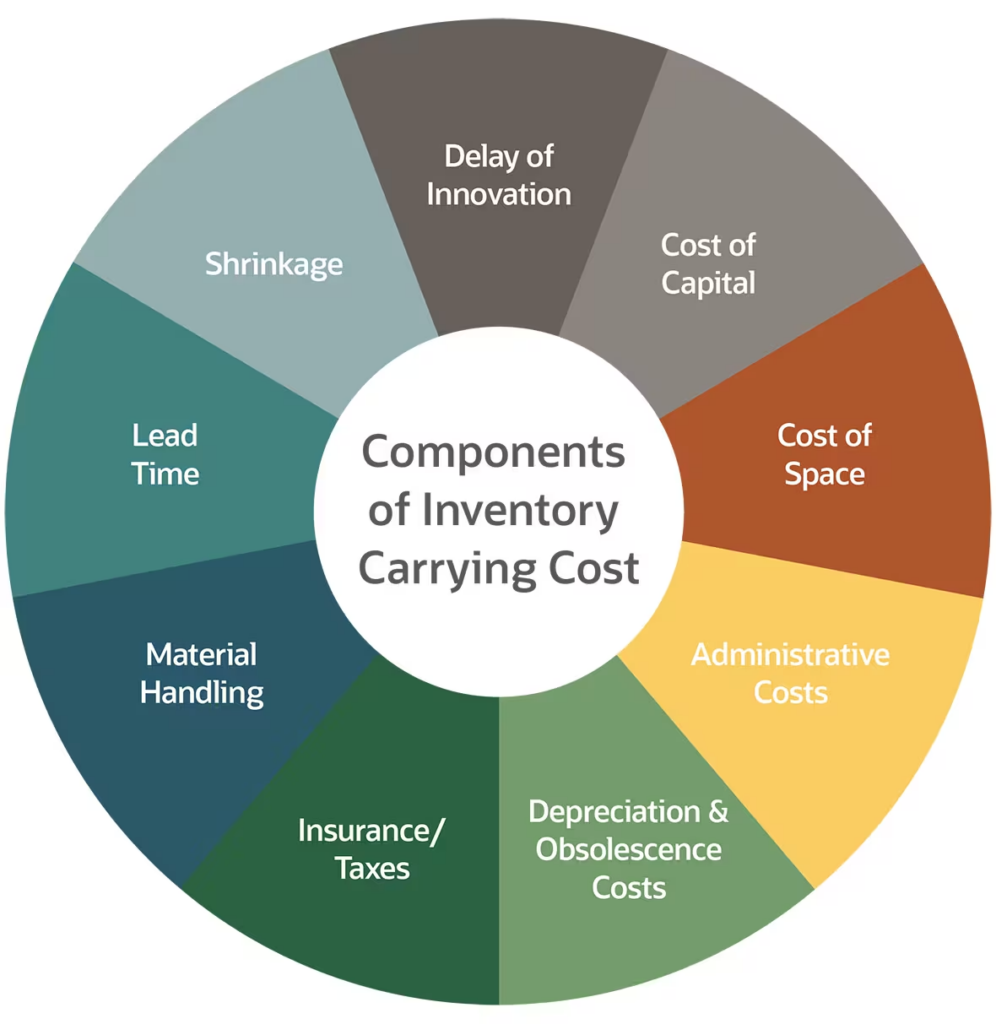

Managing inventory can be a real headache for companies, but it’s crucial to crunch the numbers and determine the true cost of holding that inventory, as well as the value of those products.

Carrying costs of dead stock: The carrying costs of dead stock have a significant impact on your cash flow. If you have a large amount of money tied up in inventory, this leaves less cash available for other essential operating expenses. Moreover, it leads to higher carrying costs and occupies valuable warehouse space. If you measure your days inventory outstanding (DIO) regularly you will notice the average length of time it takes you to sell your inventory. If your DIO is too long this results in increased expenses for inventory management, such as employee wages, and raises insurance costs. Consider bundling dead stock to reduce your inventory costs.

Lost sales due to stockout: One of the most prevalent challenges faced by our ecommerce clients is the loss of sales due to stockouts caused by disruptions to their supply chain. To accurately measure the financial impact of such losses, utilize the below formula.

Having the right ERP can make the difference here. Business-Software.com rated NetSuite the top ERP for inventory needs. By hiring the right NetSuite accountant you get spot-on financial statements.

Inventory Accounting: FIFO vs. LIFO

To effectively manage inventory, it is important to assign a value to each inventory item. The two most commonly used accounting methods for this purpose are FIFO and LIFO.

FIFO Inventory Method: In the first in, first out (FIFO) cost method, the assumption is that the oldest inventory items are sold first.

LIFO Inventory Method: On the other hand, the last in, first out method (LIFO) dictates that the newest items are sold first.

It’s important to note that the choice of inventory valuation method has a direct impact on your COGS, sales, and ultimately, profits. FIFO would be suggested for items that have a shelf life, or to liquidate old product. LIFO would be used for items that do not have a shelf life or if companies want to utilize current costs on items and hold items for discount.

Onboarding manager, Joshua Trezek elaborates,” FIFO is often used when your inventory will depreciate quickly or with perishable food. You want to get your oldest inventory sold first. This is the most common method used. LIFO is used when your costs quickly rise (think of COVID), so you want to sell your last in inventory in order to put smaller profit margins on your books.” This is beneficial come tax-time since you’re claiming higher COGS.

Looking for work as an accountant? Find remote accounting jobs on Jooble

FIFO and LIFO produce a different cost per unit sold, and the difference impacts both your balance sheet (inventory account) and the income statement (cost of goods sold). See the table below for more on the effects of FIFO versus LIFO on your inventory accounting when prices are rising.

The average cost is a third accounting method that calculates inventory cost as the total cost of inventory divided by total units purchased. Most businesses in the U.S. use either FIFO or LIFO, while some sole proprietors may opt to use average cost.

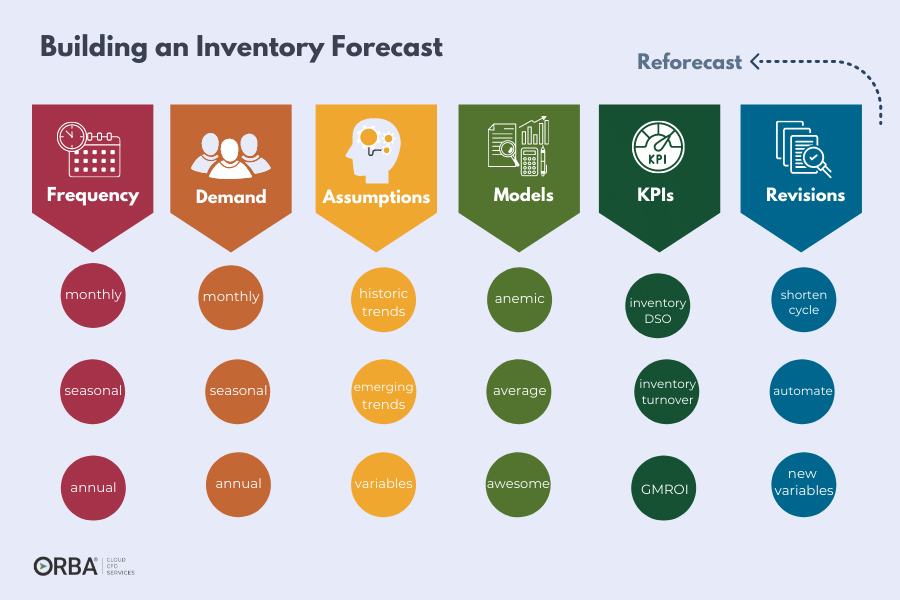

How to forecast inventory

Besides tracking inventory, from a financial-preparedness and operational perspective, you will want to run inventory forecasting reports on a regular basis. Consider these factors to get a better inventory forecast:

- Frequency: Set forecast period (monthly, seasonally or annually)

- Review Demand: Look at historical demand by period

- Assumptions: Include variables and emerging trends

- Models: Run multiple scenarios (the 3 A’s: anemic, average, awesome!)

- KPIs: track relevant inventory KPIs

- Revise: Do you need to shorten your cycle? Automate? Include new variables?

- Reforecast

How to simplify your inventory accounting

As you can see, there’s a lot to factor into inventory accounting. It’s easy to make mistakes. This is where inventory management software, and ERP systems like NetSuite, combined with NetSuite accounting services can make a big difference to your bottom line.

Benefits of using inventory management software:

- More visibility around inventory you are moving across all of your different sales channels

- Know how much inventory remains on hand and across your fulfillment centers

- Increase working capital and get out of a cash crunch since you’ll always know how much sales and inventory you have at any given time

- Easier inventory planning during seasonal spikes

- More efficient inventory management practices

- A faster fulfillment process for a better customer experience

- Streamlined financial reporting during tax season (and year-round!)

The Bottom Line

Once your eCommerce or manufacturing company grows past $2 million in revenue, it’s probably time to consider how to beef up your inventory accounting as it can have a direct impact on your net profit and customer experience. Get in touch to learn more about our CFO-level NetSuite accounting services.