While recessions are a normal part of the economic cycle, you can’t avoid what is all over the news cycle these days: Inflation, stagflation, recession. It may sound like doomsday has arrived, but business planning for a recession can put you a step ahead of the competition.

Warning Signs of a Recession

A recession may not be inevitable yet, but it’s still smart to look for warning signs of recession:

- record high inflation

- record high fuel prices

- material costs rising sharply

- consumers feeling the brunt of inflation

- decreasing sales

- real estate slowing

Historically, we know that companies that prepared for past recessions came through okay, and a percentage of them even flourished. What set them apart? They got ahead of the game to recession proof their business.

How to prepare your business for a recession: 7 Step Guide

1). Build up your rainy-day fund

While your revenue is still strong, use extra funds to build up your emergency fund. This isn’t the first time we’ve mentioned the importance of a rainy-day fund in uncertain economic climates. Though how you go about it might be very different with interest rates climbing.

Cloud CFO Tip: Ideally you want to amass a fund that covers at least three to six months of operating expenses. That way if you experience a big impact to your revenue you have some breathing room. You can make strategic decisions about expenses and avoid a knee-jerk reaction.

One problem with a line of credit to be mindful of: banks can come in at any time and remove your excess credit. This kind of thing happened all over the place in the Great Recession, “you’re not using that additional $200K? We’re changing your terms and removing it from your line of credit.”

2). Play offense and diversify

I like to think that if you know how to double-down to prepare business for recession, you’re more likely to emerge from it stronger than ever. After the Great Recession we saw the greatest market rally over the following 10 years. So how do you position your company to be one of those that thrive?

Brand according to need

Think need instead of want. Then brand yourself accordingly. In fact, you want your brand to be indicative of your value. So, if you’re in the B2B space for example, and clients are focusing on where to make cuts, you want them to think twice about your company because they know you provide such good value. As I’ve said in the past, paying attention on how to increase LTV is the single most important goal you should be aiming for using your customer analytics.

Cloud CFO Tip: Shift your intention. Start having conversations with potential and existing customers to fulfill a need they have instead of treating each touchpoint as a transaction.

Diversify your revenue streams

Research ways to diversify your revenue streams. For companies selling consumer products, can you pivot to also offer services in order to protect any loss in inventory sales? Are there new subscription models you could introduce for your products? Consider altering your pricing model to become more accessible. Recurring revenue models bring offer predictability for stable growth. Profile your best customers to understand how to increase LTV and reduce churn.

Recurring revenue models show their strength when CFOs balance long-term strategy while iterating for market turbulence.

Todd McElhatton, Zuora

Example 1: One client began renting a larger piece of capital equipment and companies were able to acquire it using operating expenses on a monthly recurring budget rather than taking a large chunk out of CapEx to purchase it. The result? The client’s sales increased.

Example 2: HubSpot adopted a growth strategy to make it more accessible to more companies. Instead of a strictly tiered system from Starter at just $40/month to Professional with the large jump to $800/month, they now offer Hubs and Bundled suites with scalable structures, add-ons and commitment levels. While there are still big jumps in price from Starter to Pro, a client can access more features in a Starter bundle at a lower price if they commit to a year. Smart. Even if those companies are paying less per month, HubSpot can rely on that recurring revenue. What happened? Their subscription revenue increased YoY by 36%.

Play offense with companies that align with yours

Additionally, if you are in a good financial position, more vulnerable companies might be open to be acquired. To make this happen you will need that rainy-day fund mentioned earlier.

Example: Junction, a digital marketing company that excels in the tourism sector recently acquired a tourism marketing elearning platform. This means a more comprehensive marketing certification program plus access to a growing list of clients. Additionally, it offers the post-acquisition gold mine of a prime hiring pool. Talk about a partnership that just makes sense.

Think of employee retention as a competitive market

Finally, one unique factor about the current economic climate is many companies are facing a labor shortage. In this competitive hiring market, get creative with hiring and work on your employee retention strategy. Branch out from the standard ways of hiring and retaining staff:

- Offer hiring and recruiting bonuses.

- Think of Instagram as the new Indeed and take your hiring social.

- Don’t ignore SEO on your Careers pages.

- Use professional development to inherently increase your company value and lower your risk of losing A+ staff.

3). Check-in with your budget

You do have a budget right? If not, our fractional CFO services can help. If there ever was a time to start, now is that time.

To prepare for recession, build budgets that trigger spending changes if your sales decrease by x amount. For example, having tiered forecasts to represent revenue dips of 10, 20 and 30% and what cuts you will need to apply. And if you’re already consistently seeing large budget variances, now is the time to tighten up.

Example: For example, you might have a trigger so that if sales go down by 10%, you know how much you need to cut salaries by in order to maintain your operating margin. Plan ahead so you can quantify when and how much to cut expenses.

Think of these triggers as reverse drivers. Hopefully you won’t need to use them, but if you do, you can feel assured that you have a plan in place for a potential sharp downturn in revenue.

4). Cut expenses strategically

Generally we do not recommend making cuts that aren’t easily reinstated when revenue improves. Layoffs are not easy to reverse. There are many creative ways to cut business expenses including:

- swapping fixed for variable expenses;

- automating tasks to refocus staff on business development;

- and reviewing monthly recurring expenses.

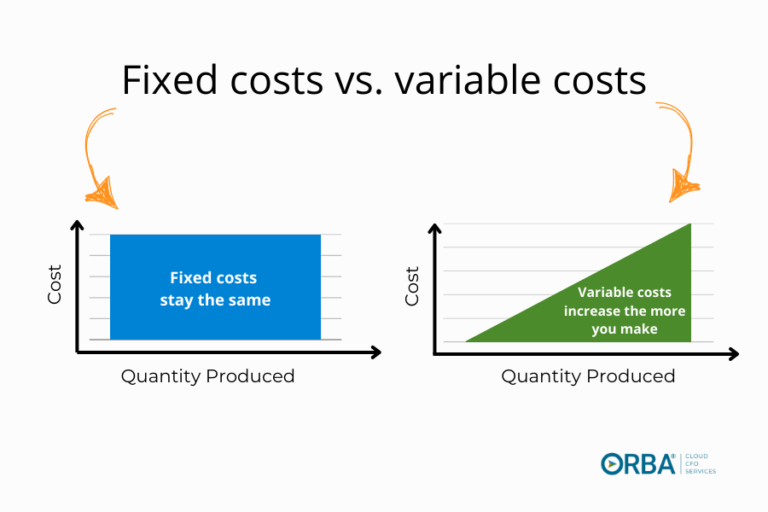

Specifically, the swap for fixed to variable is a good strategy even in normal times, but is especially useful in an unpredictable economy with a looming recession. Having more variable expenses allows you to be nimble. It allows you to quickly cut costs if sales go down more than you predicted.

Cloud CFO Tip: For example, you might wish hire staff to cover 50-75% of your expected workload- or whatever you can consistently maintain. Then utilize contractors to make up the remaining percentage if you get more work, i.e., revenue. Trust me, you’ll sleep better at night.

Contractors are available to hire if needed and you don’t have to worry about letting people go if the work isn’t there. This is one of the benefits of a fractional CFO. You may be giving up some gross profit margin on the incremental work during the higher revenue months when you flex up. But, when you have a bad month, you’re not stuck paying fixed salaries for staff simply because you don’t want to let them go. Read more about how outsourced accounting for small business can help companies facing the Great Resignation.

Another alternative is to pay overtime to your current team instead of hiring subcontractors when you flex up. It’s a win-win, they make more money and you still pay less than you would contracting out. In general, overtime is a useful solution across industries not just those that use contractors.

Plus, companies that avoid layoffs and focus on operational improvements will see the increase in brand value we mentioned above.

5). Optimize inventory management

Plan to reduce inventory costs to increase cash flow. Identify slower-selling, less profitable items and run discounts or promos to move the stale inventory off the shelf. Then hone in on the minimum inventory you need to accommodate your predicted demand. When you’re buying inventory for business as usual, you buy inventory with the expectation you’re going to sell a set amount next month. Let’s say you normally need $1 million of inventory on-hand. But if a recession hits and your sales suddenly get cut in half, you’ve now overspent, and have $500,000 cash tied up in inventory. And cash is really what you need in a recession.

Cloud CFO Tip: If you want a metric to determine if you’re buying too much inventory, you should refer to your planned inventory turnover ratio or sell-through rate.

Reassess how your inventory impacts your cash flow. If sales are down, your COGS will be down because you’re selling fewer items, so you should notice your inventory turn ratio go down as well. This is not what you want going into a recession. Instead, be cautious with your sales forecasts which ultimately drive inventory procurement. To further capture your most profitable items you might turn to GMROI. The GMROI formula is:

GMROI should always be more than one, but there are industry benchmarks you can target to know if your product is competitive. This metric will tell you where to focus your marketing efforts and where you might want to target stale inventory with discounts to move it out of your warehouse in order to free up some cash.

6). Review the interest rates on your debt

You’ve likely heard economists discussing a possible stagflation: when sales and demand are decreasing but interest rates are increasing. In this case, companies with a lot of debt are the most vulnerable. In a recession, if you have variable interest rates on your debt, that could hit you hard right when your sales are decreasing. This is a scenario you want to plan for to prepare your business for recession.

That said, you might have a good deal on some of your older debt. Your recession plan should take into consideration the maturity dates and interest rates compared to current inflation. Holding on to old debt can make sense depending on the current rate.

7). Get financial reporting in order

Your CFO should ensure everything is up to date so that you have your finger on the pulse when it comes to something like a sizable shift in cash flow. Then have your CFO run various modeling for different scenarios and identify which triggers will call for executing your plan for recession. A good CFO should be able to assess your risk tolerance in a volatile market. Just one of the benefits of a fractional CFO. For most companies, the bottom line in a recession remains protecting your cash flow and profit margin.

Recession planning for businesses must include multiple scenarios

Finally, don’t forget to plan for multiple versions of your projected sales. To recession proof your business begin by estimating how much you think your sales might decrease. Next, run an anemic and awesome version of those scenarios. “If sales decrease by x amount, we have a contingency plan to get through it.”

Some questions to consider when business planning for a recession:

- When should you cut back on operating expenses?

- What if the recession lasts longer than forecasted?

- When should you dip into your line of credit to protect it?

- What key drivers are triggers for a shift in spending?

- What KPIs should I track to optimize inventory?

Once you begin to consider the effects of a sharp or even shallow decrease in revenue you can begin to properly prepare business for recession.

Use these 7 steps to prepare your business for recession and you might not only survive but thrive in an otherwise unruly market. Need help with financial modeling? Get in touch to learn more about our outsourced accounting services.