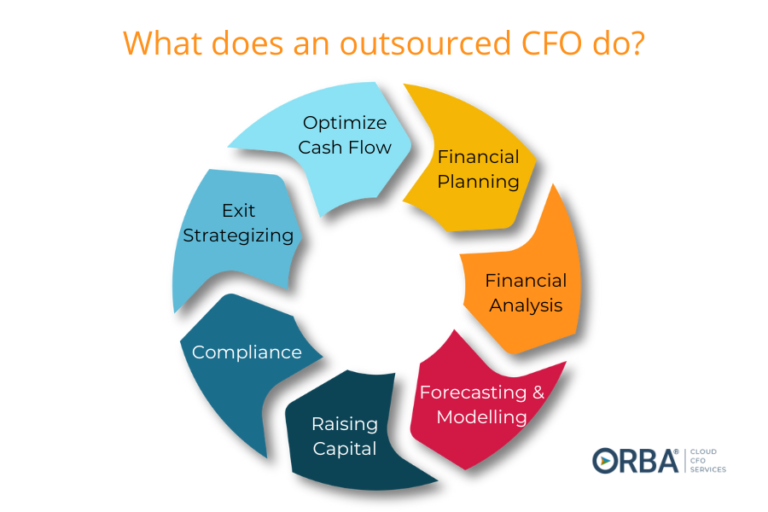

Our Cloud CFO team gets a lot of face time with high-growth companies that are experiencing the frustrations of outgrowing QuickBooks. There are lots of benefits to ERP systems but these are the top 3 reasons we recommend the switch to NetSuite.

Check out our NetSuite Pricing

The top 3 reasons to switch to NetSuite:

1). The more you grow, the more you need your systems to play nicely together.

NetSuite is designed to grow with you. Once you make the switch to NetSuite, you shouldn’t ever have to worry about outgrowing it the way you might have outgrown QuickBooks. If you’re using 3 or more of these systems:

- Accounting system (QBO, Xero, etc.)

- CRM system

- Inventory management system

- PO system,

it’s likely y time to make the switch. Reduce the time spent syncing these systems. Entering redundant data, performing reconciliations and fixing sync errors can mean falling behind on reporting. And let’s be clear, you’re not doing your company any favors by working with stale financials.

Solution: From simple to complex, NetSuite solves these problems with its numerous integrations and seamless syncing. For example, switching to NetSuite allows you to sync third-party applications like e-commerce integrations, EDI, Warehouse Management Systems (WMS) and cloud-based payables.

Related Read: 8 Benefits of ERP Systems

2).You get real-time insight into your numbers priming you for growth.

Speaking of stale, it’s the classic accounting pitfall: concentrating your attention on backward-looking financials. Think of your growing company like a race car; if you don’t have real-time insight, then you’re essentially trying to race a car while looking in your rear-view mirror.

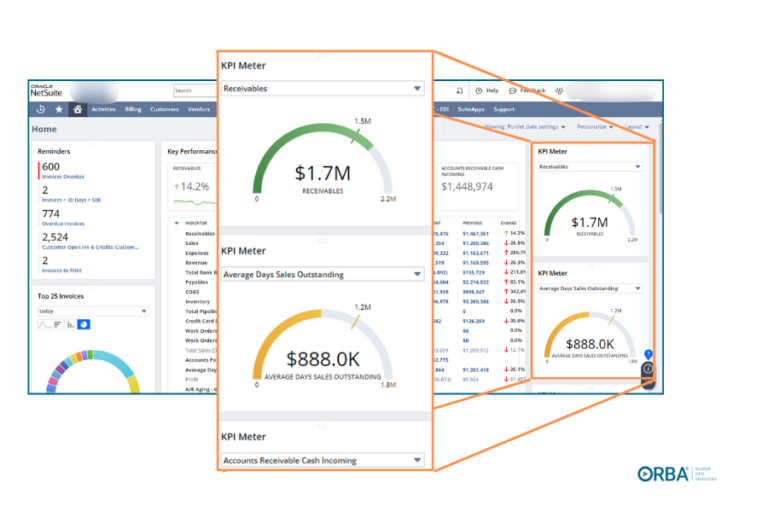

Solution: NetSuite was the first ERP system built entirely in the cloud*. From its beginnings, it was designed to offer users customized dashboards with live data updated by the second to meet their needs. This gives you the opportunity to make informed business decisions without waiting on your controller to get you financial reports.

*An added bonus of the cloud-based system: curbing the time your IT team spends on patching servers and installing and troubleshooting software.

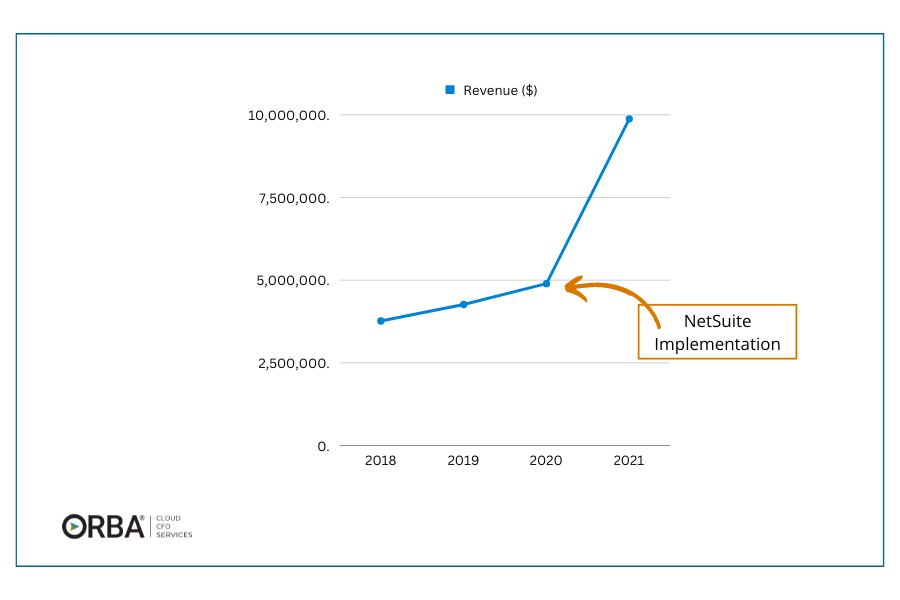

For example, when we recommended one of our clients switch to NetSuite, we implemented the ERP in under 3 months and reduced monthly close time by 67%. The results? Warehouse operations were streamlined. Their revenue increased by 120%. These are the kind of results you can expect using an ERP and by hiring a NetSuite accountant.

3). You’re a product-based business and/or you manage your own warehouse.

Finally, if you run an inventory-heavy company or have ecommerce accounting needs and manage your own warehouse, your business has the most to gain from making the switch to NetSuite. NetSuite streamlines your inventory management and order fulfillment like no other ERP on the market.

Related Read: Young Nails NetSuite Case Study

Solution: We’ve seen how NetSuite can help manufacturing businesses firsthand. In our Young Nails and NetSuite case study we dig into how the cloud ERP not only provides the professional nail manufacturing business with the real-time financials they require; but how, thanks to NetSuite’s omnichannel ecommerce solutions, Young Nails is better able to manage their inventory, forecast manufacturing demand and access the data they need to drive growth.

Have you outgrown QuickBooks?

One of the most common questions clients have is how to streamline their operations with a new solution. While it’s an, “it depends” sort of answer, rapidly growing companies seem to face a few common struggles before upgrading to an ERP. We’ve noticed there are three big signs to look for to know if it’s the right time to switch to NetSuite:

- Your reconciliations are becoming unmanageable: Are you concerned your current solution is unable to scale with your company’s growth? If everything from bill payments, to expense reporting and data entry is eating up your time– or your accounting team’s time– that’s a red flag you may need NetSuite vs. QuickBooks.

- You need better forecasting but still rely on Excel: If you’re a rapidly growing company, often your accounting solution can’t seem to generate the reports that are essential to your business. It’s common to see companies relying on Excel. This becomes more complicated as you grow. After a while, it requires the skills of something close to an Excel guru– see the above point about your accounting team’s precious time. Working only with backward-looking financials is a tell-tale sign you should switch to a more robust system like an ERP.

Client case example: one of our clients was looking for a more centralized solution to track products and services that their clients purchased. They were still using Excel to track everything. They thought NetSuite would be too robust and expensive for their needs. As a BPO partner we were able to secure the licensing for about 90% less than they thought they might have to pay!

- You’re your own manufacturer, have a ton of inventory and/or have more sales channels to manage: I can’t stress this enough: if you’re in the manufacturing business or have large amounts of inventory from multiple sources, QuickBooks just doesn’t cut it. An ERP like NetSuite can optimize your processes in so many ways. Same goes for an ecommerce business with increasing sales channels and revenue streams.

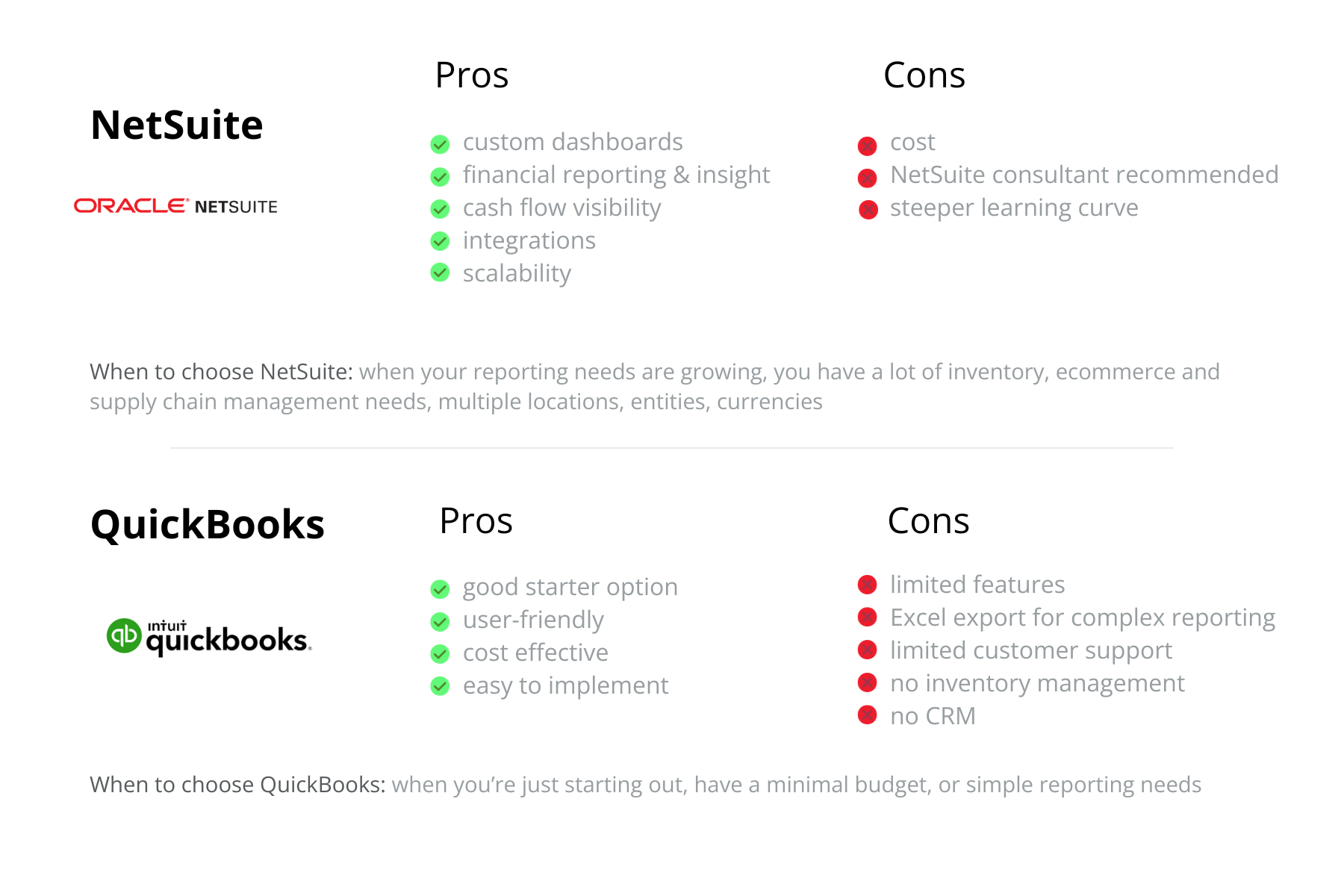

FAQ: Which is better, NetSuite or QuickBooks?

NetSuite is more robust, with way more capabilities for integrations and reporting. QuickBooks is cheaper and easier to use. That said, many of our SMB clients especially those that classify as CPG companies will see vast improvements in reporting, inventory management and ultimately increased revenue that make the NetSuite investment worth it.

Finding the right NetSuite accounting team

NetSuite can seem like a hefty investment but NetSuite-specific accountants can offer multiple benefits and cost-savings. Plus, we boast a smooth transition and go-live process to get you set up on NetSuite.

Get in touch to learn more about how we can help our accounting for NetSuite clients.