In the fast-paced world of entrepreneurship, understanding the financial health of your business is paramount. Identifying your target profit margin is a key indicator of that financial health, guiding strategic decisions and ensuring sustainability. In this guide, we’ll explore the essentials of profit margins, decipher the difference between margin and markup, and provide actionable insights to help maximize your business potential.

Understanding Target Profit Margins

Profit margins serve as a compass, helping steer your business towards profitability. But what exactly is a target profit margin?

Simply put, it’s the percentage of revenue that exceeds all expenses. Setting the right target profit margin allows you to determine how much profit you aim to generate from each dollar of sales.

Your revenue may look impressive, but it doesn’t tell the whole story. To truly measure business success, look at profit margins. What’s $11 million in revenue worth if you spent $11 million to get it?

Your target profit margin can vary depending on industry norms, business goals, and market conditions. For instance, retail businesses typically see lower margins compared to service-based industries due to higher overhead costs. Knowing your target profit margin helps you price products correctly, manage costs effectively, and remain competitive.

Understanding your target profit margin is not just about looking at numbers—it’s about analyzing your business strategy. Consider factors such as production costs, competitive pricing, and market demand when determining your target. A thorough understanding of these elements will enable you to set realistic goals that align with your business vision.

What is Net Profit Margin?

Net profit margin is a fundamental metric that provides insight into your business’s overall financial performance. It is calculated by dividing net income by total revenue, then multiplying by 100 to convert it into a percentage. This figure represents the portion of revenue that remains as profit after all expenses are accounted for, including operational, interest, taxes, and other costs.

For entrepreneurs, the net profit margin is a crucial indicator of profitability and efficiency. A higher net profit margin suggests that a business is well-managed, with effective cost control and pricing strategies. Conversely, a lower margin might indicate higher expenses or underpricing.

Understanding your net profit margin allows you to evaluate your company’s financial health and make informed decisions. Regularly monitoring this metric helps identify trends, assess business strategies, and uncover areas for improvement. By closely examining your net profit margin, you can ensure your business remains on a path of growth and success.

How to Calculate Net Profit Margin

Calculating your profit margins should be a straightforward process using the net profit margin formula:

Net Profit Margin = (Net Profit ⁄ Total Revenue) x 100

In this formula, “Net Income” refers to the profit your business earns after all expenses, taxes, and costs have been deducted from the total revenue. “Total Revenue” is the total amount of money generated by your business’s sales or services. By applying this formula, you can quickly assess the profitability of your business operations and make necessary adjustments to improve financial performance.

Remember as you begin to define your target profit margin to consider the variables that may come into play:

Net Profit Margin vs. Gross Profit Margin

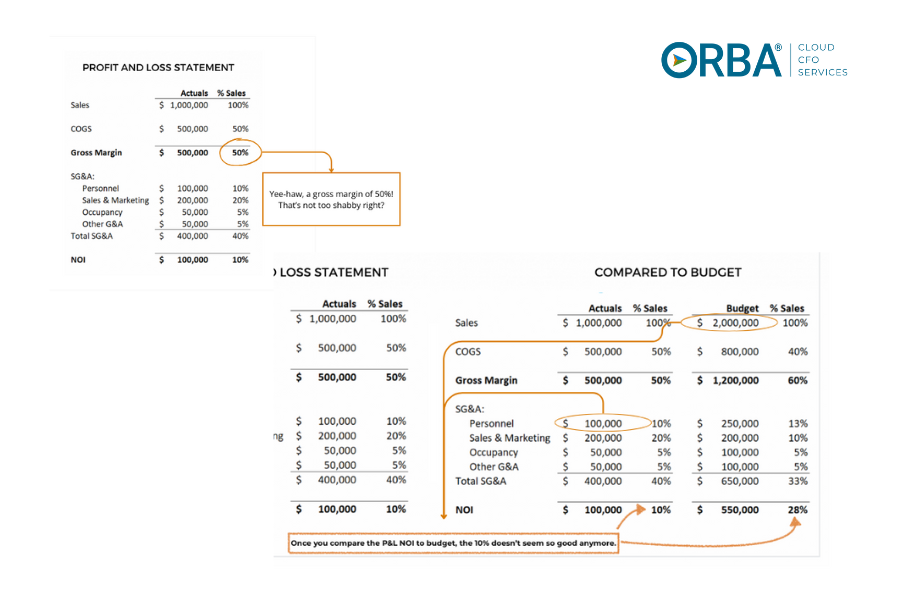

Net profit margin takes a broader view by considering net income, which accounts for all expenses, including operational, interest, taxes, and other miscellaneous costs. Gross profit margin (GPM) measures the profitability of a company’s core activities by calculating the ratio of gross profit to total revenue.

Gross Profit Margin = (Total Revenue – COGS) x100

This margin reflects the efficiency of production and pricing strategies, providing insight into how well a company manages its direct costs.

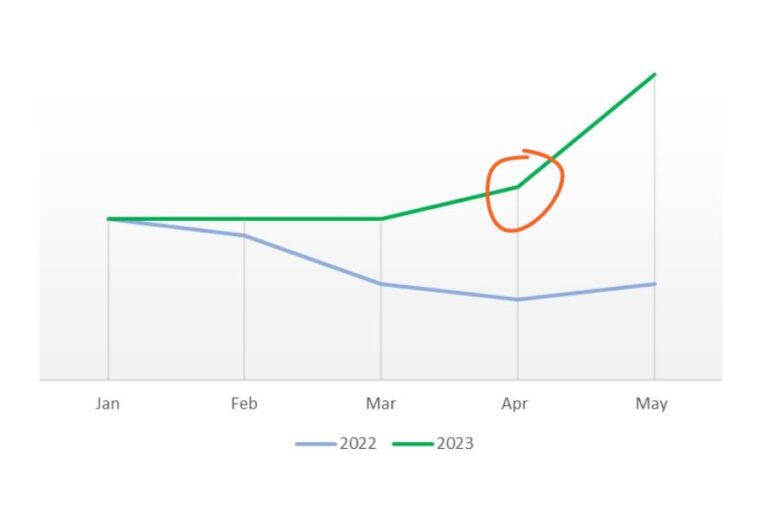

For example, in this case study on our outsourced controller services, improved and reliable reporting offer Logical Media Group a lens into profitability and a true GPM. CEO, O’Neill elaborates, “we use this data to make decisions moving forward. There are things I’m losing sleep over, and my books aren’t one of them. I feel like we’re safe and in control.”

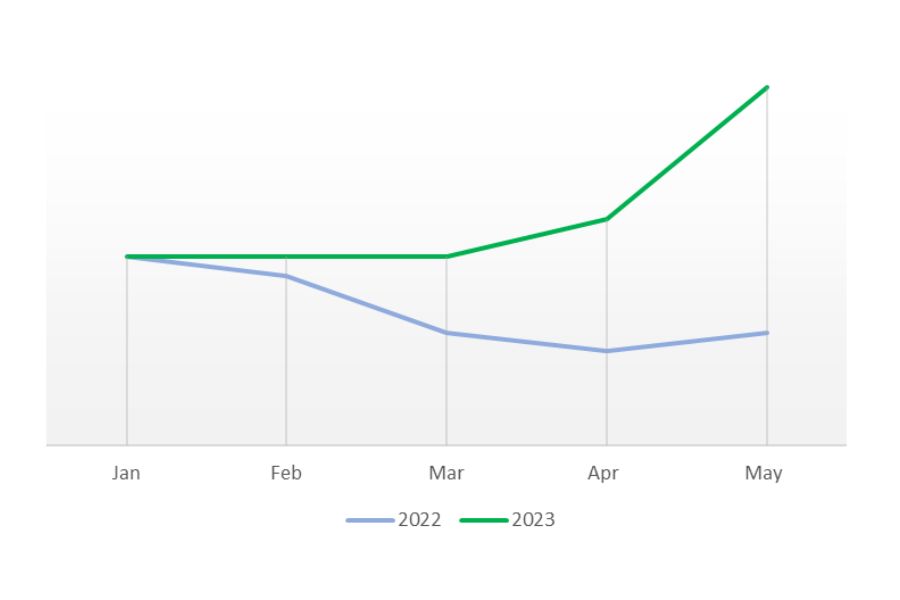

Figure 2. From 2022 to 2023 YTD, Logical Media Group experienced a positive Gross Profit Margin (GPM) trend with excellent forecasts to continue a stable profit pattern through 2023.

Add in their solid GPM compared to industry peers, and Logical is trending toward a sustainable profit-pattern entering into Q3 of 2023. “It’s financial management of our organization that is imperative to its success,” says O’Neill.

While the gross profit margin offers a glance at the core business efficiency, the net profit margin provides more a comprehensive picture of the company’s overall profitability and cost management. You can take a closer look at the example below:

Both margins are useful for assessing different aspects of a business’s financial performance. High gross profit margins suggest that a company is effective at generating revenue from its products or services with low direct costs, whereas high net profit margins indicate strong control over operational and indirect expenses. Evaluating these margins enables businesses to pinpoint strengths and weaknesses.

Margin vs. Markup

Margin and markup are often used interchangeably, but they are distinct concepts which should not be confused. Understanding the difference between the two is crucial for setting the right prices and achieving desired profit levels.

Margin refers to the percentage of sales revenue that turns into profit. On the other hand, markup is the percentage added to the cost price of a product to determine its selling price. Markup is based on cost, while margin is based on sales price.

Using the wrong calculation can lead to pricing errors, affecting profitability. A common mistake is underestimating costs when using markup, leading to lower margins. By clearly understanding both concepts, you can establish pricing strategies that align with your financial goals.

To illustrate, if a product costs $50 and you apply a 50% markup, the selling price would be $75. However, the margin on this sale would be 33.3%, calculated as profit ($25) divided by sales price ($75). Knowing these calculations ensures accurate pricing that contributes to a healthy profit margin.

What is a Good Target Profit Margin?

Although there’s no magic number, a good profit margin will typically fall between 5% and 10%.

It’s not as simple as saying 5% is low and 20% is high. Generally if you’ve got around a 10% profit margin that is pretty sustainable. But the cookie-cutter approach isn’t the best way to set goals for your business profitability.

Determining the right target profit margin is vital for any business aiming to thrive in a competitive landscape. But what should your target be? The answer depends on various factors, including industry standards, business model, and long-term objectives.

Start by researching industry benchmarks to understand typical margins within your sector. Use our target profit margin table below, or check out the comprehensive list for Profit Margin by Sector in the U.S. This provides a baseline for setting realistic goals. Additionally, consider your unique business circumstances—such as startup costs, growth potential, and customer base—when establishing your target.

Regularly reviewing and adjusting your target profit margin is essential as your business evolves. Economic shifts, market dynamics, and operational changes may necessitate revisions to your targets. By staying adaptable and informed, you can establish a profit margin that supports both short-term cash needs and long-term profitability goals.

This table gives a list of typical target profit margins by industry. Keep in mind that these figures can vary widely based on specific business models, geographic regions, and market conditions. It’s important to consider these factors alongside industry benchmarks when setting your own target profit margins.

| Industry | Typical Target Profit Margin (%) |

|---|---|

| Retail | 2% – 6% |

| Restaurants & Dining | 3% – 5% |

| Professional Services | 15% – 25% |

| Manufacturing | 10% – 15% |

| Technology | 10% – 20% |

| Healthcare | 15% – 20% |

| Real Estate | 20% – 30% |

| Finance & Insurance | 15% – 20% |

| Agriculture | 2% – 5% |

| Construction | 5% – 10% |

Beyond industry benchmarks, assess your business expenses and desired income. Factor in fixed vs. variable costs, ensuring your target margin covers these while providing a reasonable profit.

Fixed Costs:

These expenses remain relatively stable from month-over-month:

- Rent

- Salaries

Cloud CFO Tip: for any fixed costs, also apply a set percentage to prepare your business for inflation.

Variable Costs:

Identify and categorize your variable expenses, such as marketing costs, inventory purchases, and office supplies. Be thorough in capturing all potential expenditures. Smart business owners (and their outsourced accounting team) will categorize expenses into some version of the following:

- General & Admin

- Research & Development

- Sales and Marketing

- Operations

- Cost of Goods, etc.

Cloud CFO Tip: Remember, variable costs are hugely important when you’re looking at unit economics, which is a good indicator of profitability.

Strategies to Increase Your Profit Margin

Once you’ve set a target profit margin, the next step is to work towards achieving it. Fortunately, there are several strategies to boost your profit margins and enhance overall profitability:

- Optimize Pricing: Regularly review and adjust your pricing strategy to reflect changes in market demand and costs. Implementing dynamic pricing models can help you capture the maximum value for your products or services.

- Cost Management: Identify areas where you can reduce costs without compromising quality. Streamlining operations, renegotiating supplier contracts, and minimizing waste contribute to improved margins.

- Enhance Product Value: Differentiate your products by focusing on quality, unique features, or exceptional customer service. Offering added value justifies higher pricing and improves profit margins.

- Implement Automation: For example, 91% of businesses that introduce AR automation, experience increased cash flow and growth.

These strategies require careful planning and execution. Track your progress regularly and be open to experimentation. By prioritizing actions that align with your business strengths and opportunities, you’ll create a sustainable path towards increased profit margins.

Measuring Profit Margin with EBITDA

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a powerful financial metric for assessing operating performance. It provides insight into profit generation from core operations, excluding non-operational expenses.

For small business owners and entrepreneurs, EBITDA offers a clearer picture of business profitability. By excluding interest, taxes, depreciation, and amortization, it highlights the efficiency of your business model. Comparing EBITDA with net profit margin gives you a comprehensive view of financial health.

Using EBITDA to measure profit margin allows you to focus on operational improvements. It’s particularly useful for evaluating businesses with high investment or interest costs, as it removes these variables from the equation. That said it’s not without its pitfalls. Dive into those more and use or EBITDA calculator to find yours.

The Bottom Line

Understanding and achieving the right profit margin is crucial for any business aiming for sustainable growth and success. By grasping key concepts such as net profit margin, margin vs. markup, and employing strategies to increase profitability, entrepreneurs can position their businesses for long-term success.

Remember, your target profit margin should align with industry standards, business goals, and financial needs. Regularly monitor your margins, adjust strategies as needed, and leverage metrics like EBITDA to ensure your business thrives.

For small business owners and entrepreneurs looking to optimize their profit margins, this guide provides a comprehensive starting point. By applying the insights and strategies shared here, you’ll be well-equipped to achieve your financial goals and drive your business forward.