When was the last time you analyzed your unit economics? Also known as the economics of one.

What are unit economics?

If you boil down any business, at the end of the day your financials are the sum of transactions within a period of time. You’re selling something to somebody. Not quite as complex as it sounds, unit economics is the concept of selling one thing. Or, the value each item generates for your business. It is a simplified way to get a grasp on your profitability.

At its core, unit economics refers to the direct revenues and costs associated with a single unit of what you sell. That “unit” could be anything—a single product, a subscription, or even one customer. It’s all about figuring out, “Are we making money every time we sell this?”

A simple way to think about it is this:

Revenue per unit – Cost per unit = Profit per unit

If the end result is positive, congrats, you’re likely on the right track. If it’s negative, well… we’ve got work to do.

But unit economics isn’t just about profitability; it’s about understanding the building blocks of your business and whether it’s sustainable in the long run. Calculating your unit economics will give you a better handle on your gross profit margin (GPM) and break-even point.

You can measure and define “units” like this:

- One unit = one customer: Measured using the LTV/CAC ratio

- One unit = one item sold: Measured using your contribution margin

Contribution margin = (Price per unit – variable cost per unit) / price per unit x 100%

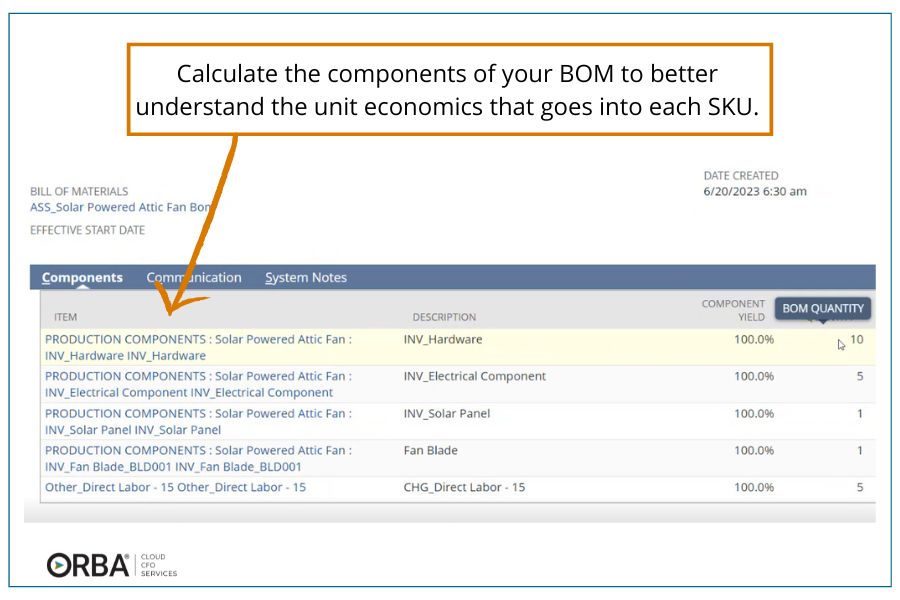

Contribution margin is important to understand to your break even sales point. The easiest thing to calculate in unit economics is the direct materials cost. It becomes more complex, if you have a lot of materials that go into one widget or item that you are manufacturing. Then, you need to also find your bill of materials (BOM). Your BOM is essentially a recipe of raw materials required to build your end-product.

While BOM is more specific to manufacturing, all businesses have unit economics. For example, in our business of outsourced accounting there are no raw materials or products. So, we determine margins by calculating how many hours a manager and associate spend on each client.

If you’re a business that manufactures product, the staffing costs to manufacture is direct labor. I know what you’re thinking. How can I know exactly how much time it takes to make something? Start by taking an hour of your staff’s time, then determine how many items they can make in that time. This gives you an average direct labor cost per unit.

Related Read: What is landed cost?

Unit economics example

For example, let’s look at a very simple transaction:

Say you sell a widget for $100 and it costs you $40 to make it. You then make $60 of profit on every transaction. You have a pretty solid 60% gross profit margin.

Now to examine your unit economics for profitability.

If you sell your widget for $100 but it is costing you $110 to make it, the more you sell, the more money you lose. Less obvious though, is when it costs $80 to make your widget. Theoretically you make $20 every time you sell one widget. But that’s only a 20% profit margin, which is normally not enough to cover overhead expenses or fixed costs like rent, management salaries, etc.

Examining your gross profit margin percentage compared to industry benchmarks will let you know if you have poor unit economics. If you are lower than the benchmark, there is probably an issue that you need to look into.

Ways to improve unit economics

Alright, maybe your numbers look a little less rosy than the example above. Don’t worry—it’s pretty common to need some fine-tuning. Here’s where you can roll up your sleeves and start optimizing like the business genius you are.

- Increase Revenue per Unit

- Raise prices (but only if your customers won’t revolt).

- Upsell or cross-sell. Can you bundle accessories or add premium features?

- Build loyalty—repeat customers spend more over time.

- Lower Costs per Unit

- Negotiate better deals with suppliers (pro tip: vendors love long-term relationships).

- Improve operational efficiency to cut waste.

- Consider economies of scale—bulk production often means lower cost per item.

- Focus on Retention

- Customer acquisition is expensive, so aim to keep customers longer. Loyal customers are cost-effective and bring in consistent revenue.

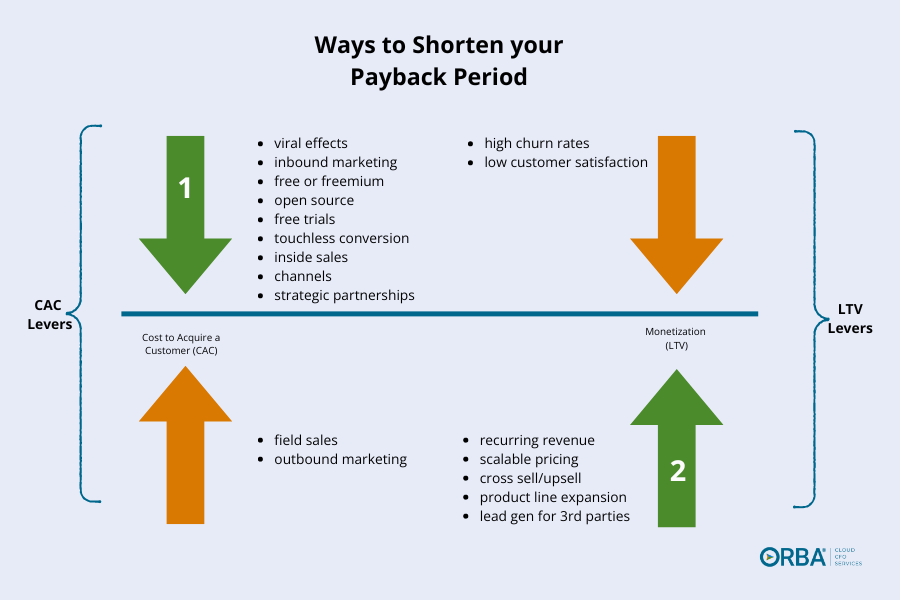

Here are a few levers you can pull to improve unit economics:

CAC/LTV

- pricing

- work on CX to reduce churn and increase LTV

- focus on highest ROI sales & customer channels

Churn Rate: The percentage of customers who cancel their subscription during a specific time. Spoiler—it’s gotta be low.

Shorten Payback Period

- product line expansion

- standardize parts of your sales funnel to shorten sales cycle

- cross-sell & upsell

- prepaid services & subscriptions

Cloud CFO Tip: Don’t make the mistake of across-the-board adjustments like reducing total production or spreading capital equally. Not all products and services deserve the same treatment.

Instead, maximize profitability, anticipate demand and prioritize getting the answers to these 6 questions:

- Which SKUs, services or clients have the highest profit margins?

- Which SKUs, services or clients have the largest sales volumes?

- Which products or services share components and raw materials?

- How do rising costs impact the margin for this product/service?

- Can any of these goods/services share labor costs?

- How much does this SKU/service contribute to the bottom line?

Now you’re armed with the information you need to direct and spend resources along with how much it will affect your bottom line.

Use Automation to Improve your Unit Economics

Additionally, by automating processes related to creating, selling or fulfilling your product. You can do this will tools like Ramp and NetSuite.

Example: If you’re a manufacturer, you may want to consider investing in a barcode scanning system to automatically mark product as picked to fulfill orders more quickly.

What are good unit economics?

Good or positive unit economics means you are generating more revenue than it costs to make one unit of product or provide a service.

Nothing shocking here—”good” unit economics looks different for every business. Generally, the healthier your profit margins, the better. However, there are some industry guidelines you can check against.

For example, in subscription businesses, a popular metric is LTV/CAC (Customer Lifetime Value/Cost of Acquisition). Ideally, your LTV should be three times your CAC. You remember that magic ratio we love dishing about…Why? Because that means the revenue you’ll make from a customer over their lifetime more than justifies the cost of acquiring them.

Meanwhile, e-commerce brands often aim for at least a 30% gross profit margin after factoring in unit economics.

Unit economics in SaaS

Here’s where things get interesting (and nerdy).

For SaaS businesses, a “unit” is typically a subscriber. Your unit economics answer questions like:

- How much does it cost to acquire and retain a new user?

- How much revenue does one subscriber generate over their lifetime?

A few staple metrics you’ll need to crunch:

- Customer Acquisition Cost (CAC): How much are you spending on ads and sales to win over a customer?

- Customer Lifetime Value (LTV): The total revenue you’ll earn from a customer before they churn.

- Churn Rate: The percentage of customers who cancel their subscription during a specific time. Spoiler—it’s gotta be low.

SaaS companies with healthy unit economics often have strong recurring revenue streams, low churn rates, and scalable acquisition strategies. If your LTV significantly outweighs your CAC, you’re golden. If not? Time for a strategy refresh.

The Bottom Line

Unit economics might seem dry, but it’s like having night vision goggles for your business. It shines a light on what’s working, what needs fixing, and whether you’re heading in a profitable direction.

And remember, improving your unit economics isn’t about making massive, overwhelming changes overnight. Even small tweaks—whether it’s renegotiating with a supplier or adjusting your pricing strategy—can have a massive impact over time.

Now, go crunch those numbers! Or better yet, convince someone else (like us!) on your team that they love spreadsheets.