The Most Important Questions to Ask Your Controller Right Now

In an inflationary economy, there are plenty of questions and uncertainty for business owners and entrepreneurs. Here are 3 important questions to ask your controller right now.

1). What is the break-even sales point for the business?

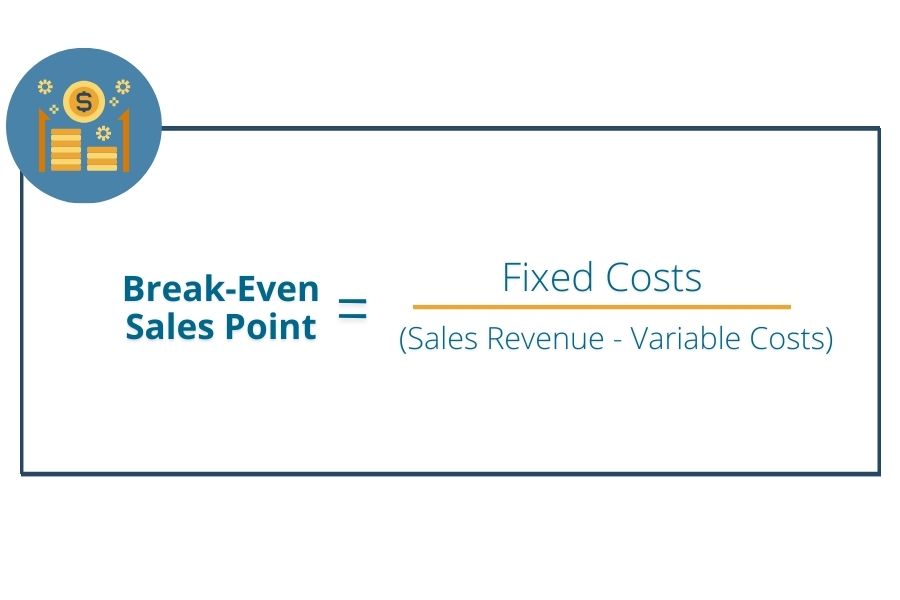

With a number of companies losing money or facing financial hardship, it’s important that your controller be able to tell you what your company’s break-even point is. Profit aside, focus on when you can begin to make money again. Have your controller figure out which expenses you’re on the hook for within your reduced spending. Things like rent, payroll and essential operations. Napkin Finance has a great napkinfographic explaining the break-even point.

The break-even point for a service-based company.

If you’re a service-based company, finding your break-even point is a fairly simple equation. You’ll need to make enough revenue to equal your total expenses. The formula for a service-based business’ break-even point is: total fixed expenses/average total revenue from billable hours or projects = break-even point.

Let’s consider an example where a consulting company has cut fixed expenses down to $500,000 per month. They will need to book on average five projects a month at $100,000, to reach their break-even point.

The break-even point for a consumer products company.

If you sell a product it becomes a little more complicated as you have to consider the margin on what you sell. Using the same amount of expenses as in the example above, if a beauty supply business sells blow dryers for $100 a piece, and it costs them $25 to make each blow dryer, for every one they sell they make a gross profit of $75. To figure out the break-even point they should take the $500,000 overhead spending they’re incurring and then divide it by the $75 to know how many units they need to sell to break even. The formula for a consumer product company’s break-even point is: total fixed expenses/contribution margin= break-even point. The contribution margin is your total sales – variable costs per unit.

Keep track of your liquidity, current and quick ratios and figure out how long it will take to reach your break-even point to ascertain whether you can realistically survive until then.

Related read: What ways can you improve liquidity? In this financial climate you must think outside the box to increase your cash flow. Read more about how your team can get creative with cash.

2). When can I rehire my laid-off employees?

As you move through economic recovery, you will hopefully be covering costs. Piggybacking off the break-even point question, you’ll likely wish to know when you can rehire laid-off employees. One question to ask your controller is how much revenue can be generated by bringing that person back.

When to rehire employees in a service-based business.

Using our consulting agency example above, once they have signed more consulting work at their average rate of $10K per month but their core team is maxed out that should trigger the rehiring process. If they can hire someone back for say $5K per month, it’s a no-brainer. Rehiring the employee yields an additional $5K in profit and can cover the additional workload. They now know they can hire that employee back.

When to rehire employees in a consumer products business.

If you’re maxing out orders, it’s time to rehire. Say our beauty supply business is struggling to fulfill orders with their dialed back team. They should consider that a trigger to rehire laid-off staff. If they pay someone in the warehouse $25 per hour to fulfill orders, 8 hours a day, that’s a payroll cost of $200 per day. If by hiring that person, they can fulfill another 10 orders per day ($750 gross profit) then they’re $550 better off than before bringing that person back.

Related read: a system like NetSuite that offers a live dashboard of KPIs can easily tell you how many orders you’re fulfilling each day to calculate how many orders per person in your warehouse. Read more ways to know whether your product business should make the switch to NetSuite.

3). Which one of my sales channels, services, or products is the most profitable?

In order to get the greatest benefit from a limited team or resources ask your controller which of your sales channels, services and/or products are the most profitable right now.

Service business profitability.

If you’re a service-based business that has cut spending and can’t yet rehire your employees, focus on your most profitable channels and best-selling services to optimize your core crew. Is one of your services easier to sell than others? Concentrate on that channel in the short-term to build back your profitability. If, for example, you use partner channels and can sell more services efficiently with a lower customer acquisition cost (CAC), even if it’s at a lower profit, it’s a good focus of your resources.

Consumer products sales channel profitability.

If your consumer products business sells a million units for $1 per unit or 100,000 units at $10 per unit, they both return one million in gross profit. Focus on whichever one is easier to accomplish with your limited team. Find your sales channel profitability by subtracting your cost of goods sold (COGS) and expenses from that channel’s revenue. The formula for sales channel net profit is: Sales Channel Net Profit = Sales Channel Revenue – Direct COGS – Direct Expenses

In a product-based business, most people assume you always want higher margin sales; however, if you deal with a high volume buyer you can benefit from how efficient they are to work with. Even if it’s technically not your most profitable margin it’s a good focus of your time in the current market. One of our clients had a better margin with smaller retailers but didn’t push a ton of volume. They signed a deal with Walmart, and while they charged a fraction of the price per unit, they sold so much volume and Walmart was so easy to work with, our client essentially doubled their sales overnight.

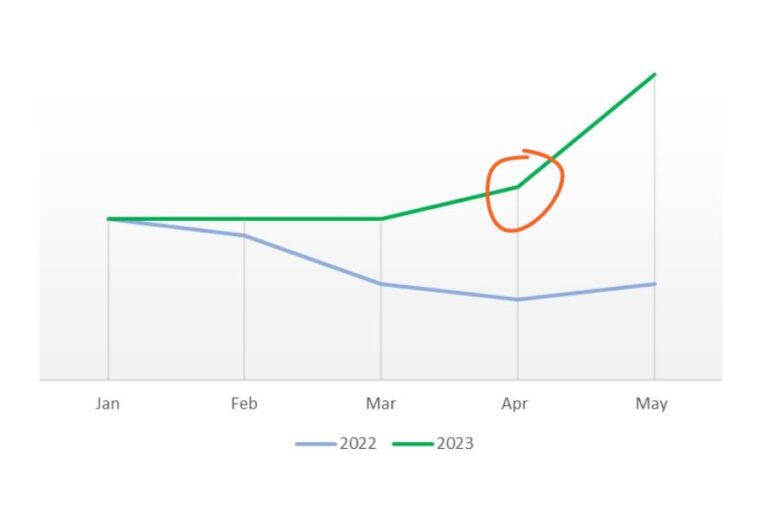

Effective controllers are leveraging financial projections to improve accuracy. By modeling cash flow, break-even point profitability, and other outcomes under varying conditions, business owners are forced to rethink assumptions.

We know businesses have a lot of questions about how to prepare for the post-pandemic road ahead and there isn’t always a clear-cut answer; however, asking your controller these questions will better prepare you for your economic recovery.

How much does an outsourced controller cost?

The short answer: an outsourced controller costs substantially less than an in-house controller. Check out our pricing tiers to learn more about what’s included for out controller-level services starting at $3,000 per month.

Need help? Book a free consultation with us to get started today. Our outsourced controller services include financial reporting, cash flow management and establishing financial controls.